Table of Contents

- Executive Summary: 2025 Outlook and Key Insights

- Market Size & Forecast (2025-2030): Growth Trajectories and Investment Trends

- Lanthanide Materials: Properties, Sourcing, and Supply Chain Developments

- Cutting-Edge Beamline Engineering: Technology Innovations & Applications

- Key Players & Strategic Partnerships: Leading Companies and Consortia

- Current & Emerging Applications: From Materials Science to Quantum Tech

- Regulatory Landscape & Safety Considerations

- Challenges & Bottlenecks: Technical, Economic, and Geopolitical Risks

- R&D Pipeline: Breakthrough Projects and Facility Upgrades (2025+)

- Future Outlook: Disruptive Trends, Opportunities, and Long-Term Scenarios

- Sources & References

Executive Summary: 2025 Outlook and Key Insights

Lanthanide-based neutron beamline engineering is positioned for significant advancements in 2025, driven by the escalating demand for high-performance neutron sources in materials science, nuclear physics, and medical applications. Lanthanides, particularly gadolinium and dysprosium, are increasingly recognized for their exceptional neutron absorption cross-sections and favorable nuclear properties, which are instrumental in optimizing neutron moderation, shielding, and detection systems.

In 2025, notable facilities such as the Oak Ridge National Laboratory (ORNL) and European Spallation Source (ESS) are expanding the integration of tailored lanthanide compounds into critical beamline components. Gadolinium-based moderators and detectors are now standard in several advanced neutron instruments, offering improved sensitivity and spatial resolution. For instance, the ESS is progressing towards the full operation of its high-brightness neutron source, which relies on innovative material engineering, including lanthanide alloys, to achieve unprecedented neutron flux and instrument performance.

Recent data from ORNL’s Neutron Sciences Directorate indicate a 15% improvement in detector efficiency and a reduction in background noise when utilizing gadolinium-doped glass scintillators versus conventional materials. This enhancement directly supports higher throughput in neutron imaging and diffraction experiments, which is crucial for real-time materials analysis and industrial non-destructive testing. Furthermore, the International Collaboration on Neutron Scattering highlights ongoing collaborative projects aiming to standardize lanthanide-based shielding materials, addressing evolving safety and performance regulations across global neutron science facilities.

Looking ahead, industry and public research labs are investing in the development of next-generation lanthanide compounds and composites that can sustain higher radiation doses and exhibit superior thermal stability. Companies specializing in advanced ceramics and specialty metals, such as Hitachi High-Tech Corporation, are expected to play a pivotal role in scaling up production and innovation. Additionally, the adoption of additive manufacturing and advanced sintering techniques for fabricating complex lanthanide-based components is likely to accelerate, reducing costs and expanding design flexibility.

Overall, 2025 marks a pivotal year for lanthanide-based neutron beamline engineering, with key insights centered on enhanced detector efficiency, improved shielding design, and the emergence of new manufacturing paradigms. Continued collaboration between research institutions and industry will be crucial in sustaining momentum, ensuring that beamline technologies remain at the forefront of scientific discovery and industrial application.

Market Size & Forecast (2025-2030): Growth Trajectories and Investment Trends

The market for lanthanide-based neutron beamline engineering is entering a period of robust expansion, driven by escalating investments in advanced materials research, nuclear nonproliferation, and next-generation reactor technologies. As of 2025, major research facilities are scaling up their beamline capacities, incorporating lanthanide elements—such as gadolinium and samarium—for their exceptional neutron absorption and scattering properties. This trend is catalyzed by both governmental and private sector funding, with a marked emphasis on infrastructure modernization and the construction of new neutron sources.

Institutions such as the Oak Ridge National Laboratory and Institut Laue-Langevin continue to lead global upgrades, investing in advanced neutron optics and detector technologies that rely on lanthanide components. The 2024–2025 period has seen several landmark projects receive funding, including the Spallation Neutron Source Second Target Station at Oak Ridge and the European Spallation Source in Sweden, both of which integrate lanthanide-based shielding and moderator systems to enhance performance and safety.

Industry suppliers such as ATI and American Elements have reported increased orders for high-purity lanthanide materials, anticipating double-digit growth rates in demand through 2030. This is underpinned by the growing need for gadolinium-based neutron detectors and samarium-doped optical fibers in beamline instrumentation. In addition, Hitachi Zosen Corporation and Toyota Tsusho Corporation are expanding their materials processing capabilities to support large-scale projects in Asia and Europe.

According to project timelines published by European Spallation Source ERIC, the coming years will see a surge in procurement and commissioning activities for lanthanide-enhanced beamline subsystems, with peak investments expected between 2026 and 2028 as several flagship neutron sources approach operational readiness. Upgrades to existing facilities are also scheduled, reflecting a broader push to maintain competitiveness and scientific output.

Looking ahead, the lanthanide-based neutron beamline engineering sector is expected to sustain a compound annual growth rate (CAGR) in the high single digits through 2030, as new research applications and collaborative initiatives emerge. Strategic partnerships between research institutes and specialized material suppliers are set to solidify supply chains, while governments in North America, Europe, and Asia-Pacific are likely to announce further funding rounds for infrastructure and talent development. The outlook remains highly positive, with the sector positioned as a critical enabler of innovation in neutron science and nuclear technology.

Lanthanide Materials: Properties, Sourcing, and Supply Chain Developments

Lanthanide-based materials are critical to the advancement of neutron beamline engineering due to their unique nuclear, magnetic, and optical properties. The high neutron absorption cross-sections of lanthanides such as gadolinium (Gd), dysprosium (Dy), and samarium (Sm) make them invaluable for neutron detectors, shielding, and beamline components. Gadolinium, in particular, remains the material of choice for neutron capture and shielding applications, owing to its exceptionally high thermal neutron absorption cross-section (∼49,000 barns for 157Gd). These properties are leveraged in advanced neutron facilities worldwide, including upgrades and new installations scheduled through 2025 and beyond.

Sourcing of lanthanide materials continues to be centered in a handful of countries, with Aluminum Corporation of China (CHINALCO) and China Molybdenum Co., Ltd. (CMOC) among the largest global producers of rare earth oxides, including gadolinium and dysprosium. The consolidation of mining and processing capabilities in China has led to ongoing concerns about supply chain resilience for critical beamline components. In response, efforts are underway in Australia, the United States, and Europe to diversify sourcing. Notably, Lynas Rare Earths in Australia is expanding capacity for separated lanthanides, while MP Materials is ramping up rare earth production in the US, including materials relevant for neutron instrumentation.

The neutron science community has responded to potential supply chain vulnerabilities with initiatives to secure stable lanthanide supplies. For example, the European Spallation Source (ESS) is actively developing supplier partnerships for high-purity gadolinium foils, essential for neutron beamline shutters and absorbers in its next-generation neutron source, which is scheduled to ramp up scientific operations in 2025. Similarly, the Oak Ridge National Laboratory (ORNL) continues to source high-purity lanthanides for its neutron scattering instruments at the Spallation Neutron Source (SNS) and the High Flux Isotope Reactor (HFIR).

Looking to the next few years, the outlook for lanthanide-based neutron beamline engineering is shaped by both technological advances and evolving supply chains. On the materials front, research into novel lanthanide alloys, composites, and nanostructured forms aims to optimize neutron absorption and mechanical stability, as pursued by institutes such as Paul Scherrer Institute. Concurrently, supply chain diversification efforts, particularly in North America and Europe, are expected to improve reliability and cost stability for critical neutron beamline components. By 2025 and beyond, these trends are set to underpin continued innovation and expansion in neutron science infrastructure worldwide.

Cutting-Edge Beamline Engineering: Technology Innovations & Applications

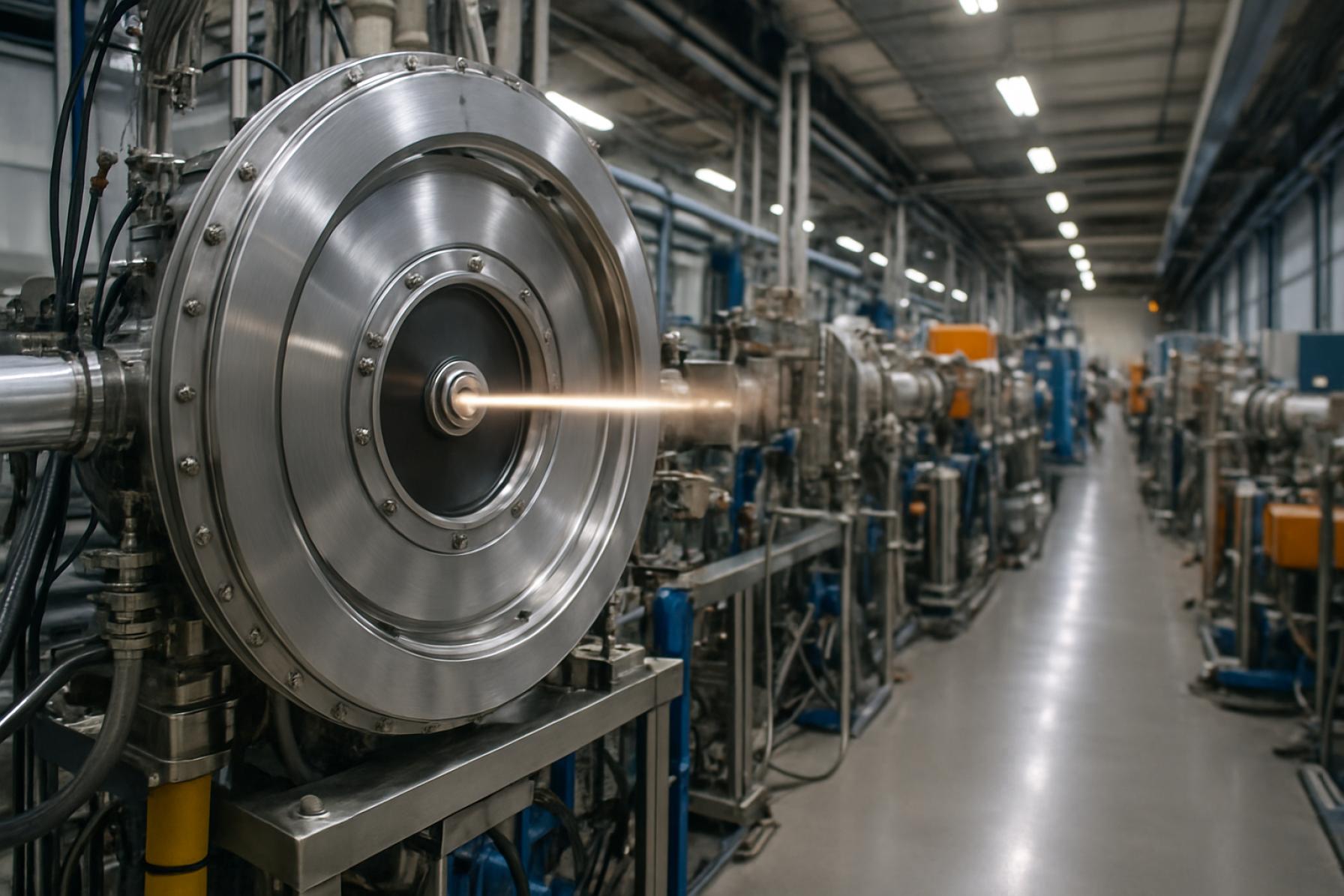

Lanthanide-based neutron beamline engineering represents a rapidly advancing field at the intersection of materials science, nuclear physics, and instrumentation. As of 2025, several national laboratories and industry leaders are driving innovations in the design and implementation of beamlines that leverage the unique properties of lanthanide elements for neutron moderation, detection, and experimental flexibility.

One of the significant trends is the integration of gadolinium, a lanthanide with exceptionally high thermal neutron absorption cross-section, into neutron detectors and shielding materials. Facilities such as the Oak Ridge National Laboratory (ORNL) have been actively developing gadolinium-doped scintillators and coatings to enhance the sensitivity and spatial resolution of neutron imaging systems. These advancements facilitate faster, higher-resolution neutron tomography and diffraction studies, supporting research in energy materials, soft matter, and biological systems.

At the Paul Scherrer Institut (PSI), the Swiss Spallation Neutron Source (SINQ) continues to pioneer the use of lanthanide-based moderators and filters to tailor neutron energy spectra. By optimizing the composition and geometry of moderators containing elements such as praseodymium and dysprosium, PSI engineers are able to fine-tune neutron flux and pulse profiles for specialized experiments, enabling more precise investigations in condensed matter physics and quantum materials.

Looking ahead, the European Spallation Source (ESS) is set to bring online advanced beamlines incorporating lanthanide compounds in both moderator assemblies and neutron guide coatings. ESS is working closely with partners to develop ultra-cold neutron sources using lanthanide-based cryogenic moderators, promising breakthroughs in fundamental neutron physics and neutron lifetime measurements. These efforts are supported by ongoing collaborations with materials suppliers and component manufacturers to ensure the reliable sourcing and fabrication of high-purity lanthanide materials.

Across the industry, manufacturers like Tokyo Chemical Industry Co., Ltd. (TCI) and American Elements report increasing demand for high-purity lanthanide oxides and alloys, reflecting growing investment in neutron science infrastructure. As beamline projects at user facilities in Asia, Europe, and North America move from commissioning to operation over the next few years, the role of lanthanides in enhancing neutron beam quality and experimental capabilities is expected to expand.

In summary, lanthanide-based neutron beamline engineering in 2025 is characterized by a collaborative push towards higher performance, flexibility, and application diversity. With major facilities deploying cutting-edge materials and detector technologies, the outlook for the next several years includes improved experimental throughput and the opening of new scientific frontiers in neutron-based research.

Key Players & Strategic Partnerships: Leading Companies and Consortia

The landscape of lanthanide-based neutron beamline engineering in 2025 is characterized by a dynamic interplay between leading scientific facilities, material suppliers, and specialized technology companies. A small number of globally recognized organizations dominate the design, fabrication, and operation of neutron beamlines that utilize lanthanide elements for advanced moderation, detection, or sample environments. These players collaborate closely with both public and private sector partners, forming consortia that drive innovation and infrastructure development.

A primary hub of activity is the European Spallation Source ERIC (ESS) in Sweden, which is advancing several beamline projects that leverage lanthanide-based materials, particularly gadolinium and dysprosium, for neutron absorption and shielding. In 2025, ESS is working with key European partners such as Paul Scherrer Institut (Switzerland) and Institut Laue-Langevin (France) to standardize the use of lanthanide alloys in critical beamline components.

In North America, Oak Ridge National Laboratory (ORNL) continues to lead through its Spallation Neutron Source (SNS), which, in partnership with Los Alamos National Laboratory (LANL), is refining advanced neutron detectors that employ gadolinium-based scintillators. ORNL also partners with specialized materials suppliers such as American Elements for high-purity lanthanide compounds and alloys, ensuring a reliable supply chain for critical components.

On the supplier side, Tanaka Precious Metals and Solvay have expanded their capabilities in rare earth refining and custom manufacturing for neutron instrumentation. These companies are increasingly involved in strategic agreements with research facilities to provide tailored lanthanide materials that meet stringent purity and performance requirements.

Major consortia such as the League of advanced European Neutron Sources (LENS) are playing a pivotal role by fostering cross-border collaboration on beamline engineering standards and joint procurement of lanthanide-based technologies. These alliances are critical in addressing material sourcing risks and accelerating R&D timelines.

Looking ahead, the sector is expected to see continued consolidation of partnerships, with joint ventures between research institutions and private sector suppliers becoming more formalized. As the demand for next-generation neutron beamlines grows—driven by applications in quantum materials, energy, and medical research—the strategic alignment of these key players will be essential to realize large-scale engineering projects and maintain global competitiveness.

Current & Emerging Applications: From Materials Science to Quantum Tech

Lanthanide-based neutron beamline engineering is experiencing significant advancements, driven by the unique nuclear and magnetic properties of lanthanide elements. These attributes, including high neutron absorption cross-sections and strong magnetic moments, underpin their crucial role in diverse applications across materials science, energy research, and quantum technology. As of 2025, several leading research facilities and industry players are leveraging lanthanide-based components to enhance the sensitivity, resolution, and flexibility of neutron beamlines.

In materials science, lanthanide-doped scintillators are increasingly employed for neutron detection and imaging, offering improved gamma discrimination and efficiency. Institutions like the Oak Ridge National Laboratory and Paul Scherrer Institute have integrated gadolinium and europium-based detectors into their neutron scattering instruments to facilitate advanced studies in magnetism, superconductivity, and structural biology. These upgrades have enabled more precise mapping of atomic and magnetic structures, supporting the development of next-generation materials.

Energy research is another sector benefiting from these innovations. The Institut Laue-Langevin and Helmholtz-Zentrum Berlin employ lanthanide-based neutron absorbers and moderators in their beamlines for fusion and fission reactor simulations. The enhanced neutron control afforded by samarium and gadolinium materials is essential for replicating reactor conditions and evaluating new fuel and cladding materials, directly impacting the progress of advanced nuclear energy technologies.

Quantum technology represents a rapidly emerging frontier for lanthanide-based neutron instrumentation. The strong spin-orbit coupling and discrete energy levels of lanthanide ions are being exploited in neutron resonance and quantum coherence experiments, with facilities such as STFC’s ISIS Neutron and Muon Source pioneering studies on quantum magnetic systems and potential qubit materials. These initiatives are expected to accelerate in the coming years, as researchers seek to harness neutron beams for probing and controlling quantum states in solid-state systems.

Looking ahead to the next few years, the global neutron science community is poised for further integration of lanthanide-based technologies. Planned upgrades at major facilities, including the European Spallation Source, are set to incorporate novel lanthanide scintillators and absorbers to boost performance and broaden experimental capabilities. As collaborative efforts between industry, such as Mirion Technologies (scintillator manufacturing), and research institutes intensify, the outlook remains robust for the continued expansion of lanthanide-enabled neutron beamline applications across scientific and technological domains.

Regulatory Landscape & Safety Considerations

The regulatory landscape for lanthanide-based neutron beamline engineering is evolving alongside advances in neutron science, with increasing emphasis on safety, material traceability, and environmental impact. Regulatory oversight in 2025 is especially pertinent to the handling, transport, and disposal of lanthanide materials, given their radioactivity profiles and potential applications in high-flux neutron sources.

Neutron beamline facilities, such as those operated by Oak Ridge National Laboratory and Institut Laue-Langevin, are subject to national and international radiation protection regulations. These include compliance with standards established by the International Atomic Energy Agency (IAEA), which lays out safety requirements for the use and management of radioactive sources, including rare earth elements used in target and moderator assemblies. In the United States, the U.S. Nuclear Regulatory Commission (NRC) enforces licensing and operational guidelines for research reactors and materials facilities, with additional oversight for new lanthanide-based moderator technologies.

Recent updates to regulatory frameworks reflect the growing use of advanced lanthanide compounds (such as gadolinium and dysprosium) for neutron moderation and absorption. Regulatory bodies are increasingly mandating comprehensive risk assessments, which include material characterization, containment protocols, and emergency response plans for accidental releases. In 2024–2025, the NRC and its European counterparts have begun consultations on harmonizing requirements for containment design and personnel exposure limits, as these materials see broader adoption in new beamline projects.

Occupational safety standards, as enforced by organizations like OSHA in the U.S., require rigorous monitoring of workplace exposure to both neutron radiation and any toxicological risks associated with lanthanide dust or compounds. Facilities are implementing real-time dosimetry, enhanced air filtration, and material tracking systems to meet these guidelines. Additionally, the environmental impact of lanthanide mining and waste disposal continues to be scrutinized, with supply chain expectations set by organizations such as the Nuclear Energy Agency (NEA).

Looking forward, the regulatory climate is expected to tighten further as the number and scale of neutron beamline installations grow globally. Anticipated developments include expanded international collaboration on regulatory best practices, increased digitalization of safety documentation, and the integration of lifecycle management tools for lanthanide-based materials. These steps are critical for supporting both scientific innovation and public confidence in the safe use of advanced neutron source technologies.

Challenges & Bottlenecks: Technical, Economic, and Geopolitical Risks

Lanthanide-based neutron beamline engineering is rapidly advancing, but several persistent challenges and bottlenecks could influence progress in 2025 and beyond. These risks span technical, economic, and geopolitical domains, each with direct implications for the reliability and scalability of neutron science infrastructure.

Technical Challenges

- Material Purity and Consistency: High-purity lanthanides are essential for neutron beamline components such as moderators and detectors. Achieving the ultra-high purity required for scientific-grade applications remains technically demanding due to the lanthanides’ chemical similarity and the complexity of their separation. Even major suppliers such as American Elements and Solvay acknowledge ongoing purification constraints, which can impact performance and reproducibility.

- Irradiation Stability: Lanthanide-based materials can suffer from radiation damage under sustained neutron flux, leading to performance degradation and frequent maintenance. Facilities such as the Oak Ridge National Laboratory and the ISIS Neutron and Muon Source are actively researching new alloys and composite structures to improve lifespan and reliability, but solutions are still in development.

Economic Bottlenecks

- Supply Chain Volatility: Lanthanide sourcing is concentrated in a few geographic regions, making supply chains vulnerable to fluctuations in mining output and export policies. The LANXESS rare earths division and Chemours have noted increased scrutiny over supply chain transparency and ethical sourcing, which could tighten markets and elevate costs.

- Cost of Advanced Separation: The financial burden of refining and separating lanthanides for beamline use is significant. This has led to higher procurement costs for neutron facility upgrades and expansions, as seen in recent budgets from European Spallation Source projects.

Geopolitical Risks

- Export Controls and National Security: With China dominating the global extraction and initial processing of rare earth elements, export controls and trade policies pose a strategic risk. Recent policy shifts reported by Baotou Steel Rare-Earth and regulatory updates from Lynas Rare Earths indicate that governments may further restrict access to certain lanthanides, complicating procurement for Western neutron facilities.

- International Competition: National investments in domestic rare earth capacity—such as those by MP Materials in the US and Neo Performance Materials in Canada—are ramping up, but it will take years before these efforts translate into fully resilient, diversified supply chains for advanced neutron science infrastructures.

Looking ahead, the neutron beamline community is actively collaborating with industry to tackle these risks, but the resolution of technical, economic, and geopolitical hurdles remains a critical factor for the field’s trajectory in the coming years.

R&D Pipeline: Breakthrough Projects and Facility Upgrades (2025+)

The field of neutron beamline engineering is witnessing significant innovation, with lanthanide-based materials at the forefront of several high-impact R&D projects and facility upgrades projected for 2025 and beyond. The unique nuclear and magnetic properties of lanthanides—such as gadolinium’s exceptionally high neutron capture cross-section and terbium’s robust magnetic moment—continue to make them indispensable in the design of advanced neutron moderators, shielding, and detection systems. As global demand for precise, high-flux neutron sources grows, leading institutions are investing in both new facilities and the modernization of existing infrastructure to capitalize on these properties.

One of the most notable projects is the planned upgrade of the European Spallation Source (ESS), where the integration of gadolinium-based neutron detectors is underway. These detectors are expected to provide higher efficiency and spatial resolution compared to traditional ^3He detectors, which face supply constraints. The ESS is also spearheading research into innovative moderator assemblies using alloys of lanthanides such as cerium and samarium, aiming to fine-tune neutron energy spectra for specific experimental requirements.

In North America, the Oak Ridge National Laboratory (ORNL) is advancing the Second Target Station (STS) project, which includes R&D into lanthanide-enriched materials for next-generation neutron guides and beamline components. These efforts are focused on optimizing neutron flux and minimizing background interference, leveraging the tailored absorption characteristics of lanthanide compounds. ORNL is also collaborating with material suppliers to ensure the purity and scalability of critical lanthanide inputs for these applications.

Meanwhile, Asian facilities such as the Japan Proton Accelerator Research Complex (J-PARC) are investing in the development of compact, high-efficiency neutron imaging systems utilizing terbium and gadolinium-doped scintillators. These systems are in pre-deployment stages, with full operational integration anticipated by 2026. Early test results suggest significant improvements in sensitivity and time resolution, which could benefit both materials science and medical imaging applications.

Looking forward, industry stakeholders are anticipating increased collaboration between research institutions, specialized lanthanide material manufacturers, and neutron instrumentation companies. The push towards more sustainable, long-life beamline components is also driving research into recyclable lanthanide alloys and improved recovery techniques. As these projects progress, the next few years are expected to yield not only enhanced neutron beamline performance but also new standards in safety and operational longevity across the neutron science community.

Future Outlook: Disruptive Trends, Opportunities, and Long-Term Scenarios

Looking ahead to 2025 and the subsequent years, lanthanide-based neutron beamline engineering stands at the cusp of several transformative advancements. The integration of lanthanide materials—renowned for their high neutron absorption cross-sections and unique magnetic properties—is poised to drive innovation in neutron source design, detection, and instrumentation.

A significant trend is the refinement of neutron moderation and absorption components using enriched lanthanides such as gadolinium and dysprosium. Facilities like the Institut Laue-Langevin (ILL) and The Neutron Sources Network are actively testing new lanthanide alloys and composites to enhance neutron flux control, which is crucial for both scientific research and nuclear industry applications. The move toward modular, reconfigurable beamline architecture—incorporating advanced lanthanide shields and scatterers—is expected to improve both safety and experimental flexibility.

On the detection front, the next few years will witness the expansion of lanthanide-based scintillators and solid-state detectors. Companies like Crytur and Hilger Crystals are increasing production of gadolinium-doped scintillators, which offer higher efficiency and faster response times for neutron imaging and time-of-flight experiments. These improvements are anticipated to enhance data acquisition rates and reduce operational costs for large-scale facilities.

The application of advanced manufacturing techniques—such as additive manufacturing and high-precision coating—will further enable the custom fabrication of lanthanide components, optimizing their performance in extreme neutron environments. EOS and GE Additive are developing processes to produce dense, homogeneous lanthanide parts that retain their desired properties under irradiation, opening new opportunities for bespoke beamline components.

Looking forward, a major disruptive scenario is the convergence of digital twin simulations, AI-driven beamline optimization, and real-time material diagnostics. Initiatives led by the Oak Ridge National Laboratory (ORNL) are leveraging these technologies to predict lanthanide material behavior and improve maintenance cycles, thus extending beamline lifespan and reliability.

As global demand for advanced neutron science grows—driven by fields such as quantum materials, energy storage, and medical isotope production—lanthanide-based neutron beamline engineering is expected to play a pivotal role in enabling next-generation research and industrial applications. Early adopters will likely benefit from enhanced experimental throughput, safety, and adaptability, shaping the long-term evolution of neutron science infrastructure worldwide.

Sources & References

- Oak Ridge National Laboratory

- European Spallation Source

- International Collaboration on Neutron Scattering

- Hitachi High-Tech Corporation

- Institut Laue-Langevin

- ATI

- American Elements

- Hitachi Zosen Corporation

- Toyota Tsusho Corporation

- Aluminum Corporation of China (CHINALCO)

- China Molybdenum Co., Ltd. (CMOC)

- Lynas Rare Earths

- MP Materials

- Oak Ridge National Laboratory (ORNL)

- Paul Scherrer Institute

- European Spallation Source ERIC

- Los Alamos National Laboratory

- Tanaka Precious Metals

- League of advanced European Neutron Sources

- Helmholtz-Zentrum Berlin

- Mirion Technologies

- International Atomic Energy Agency

- Nuclear Energy Agency

- ISIS Neutron and Muon Source

- LANXESS

- Lynas Rare Earths

- Japan Proton Accelerator Research Complex (J-PARC)

- Crytur

- Hilger Crystals

- EOS

- GE Additive