Table of Contents

- Executive Summary: Key Takeaways and 2025 Snapshot

- Market Size and Growth Forecast (2025–2029)

- Emerging Technologies Transforming Quartz X-ray Reflectometry

- Top Applications: Semiconductor, Optoelectronics, and Nanotechnology

- Competitive Landscape: Leading Manufacturers and Innovators

- Advanced Instrumentation and Automation Trends

- Key Challenges: Technical, Regulatory, and Supply Chain Issues

- Regional Analysis: North America, Europe, APAC, and Beyond

- Sustainability and Green Lab Initiatives in X-ray Metrology

- Future Outlook: Strategic Opportunities and Disruptive Innovations

- Sources & References

Executive Summary: Key Takeaways and 2025 Snapshot

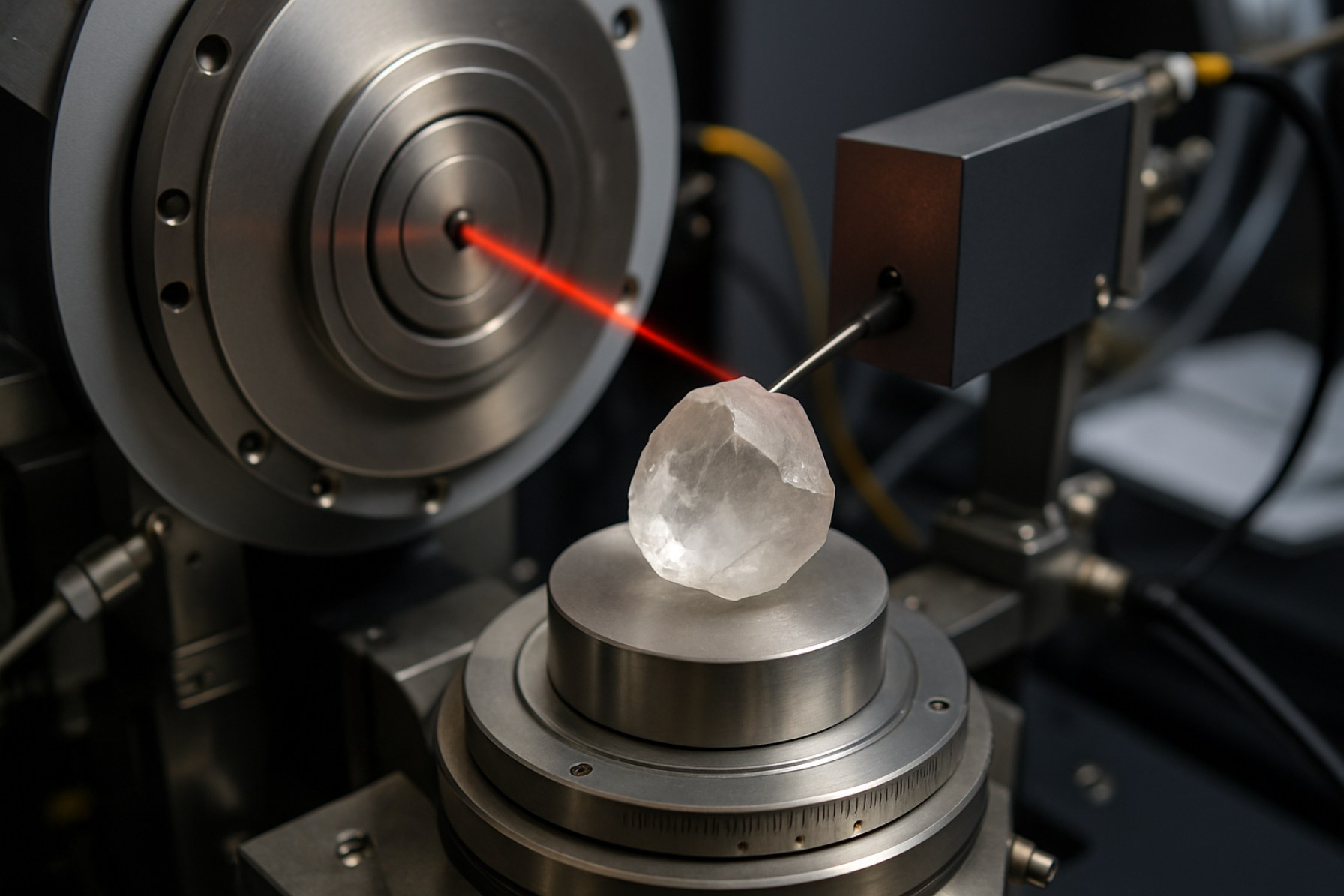

Exquisite Quartz X-ray Reflectometry (QXRR) is emerging as a pivotal analytical technique for material characterization, thin film analysis, and surface science, with 2025 marking a period of accelerated innovation and adoption. Quartz, valued for its superior crystallinity and thermal stability, has enabled the refinement of X-ray reflectometry (XRR) systems, driving new standards in measurement resolution and reproducibility for the semiconductor, optoelectronics, and advanced coatings sectors.

In 2025, leading instrument manufacturers and metrology solution providers are actively expanding their portfolios to feature QXRR systems with enhanced automation, data analytics, and integration capabilities. Key players such as Bruker and Rigaku have introduced next-generation XRR platforms leveraging precision quartz optics, enabling sub-nanometer thickness resolution and interface roughness detection critical for nanoscale devices. These advancements address the growing needs of semiconductor fabs and research labs seeking reliable, non-destructive evaluation of ultra-thin films and multilayer stacks.

QXRR’s relevance is further underscored by the increasing complexity of device architectures, such as those in 3D NAND, logic transistors, and photonic devices. As companies strive for tighter process control and defect mitigation, demand for real-time, in-line QXRR metrology is rising. In response, system integrators and tool makers are collaborating with quartz component specialists like Heraeus to optimize X-ray optics and sample handling modules, thus ensuring robust, reproducible results across high-throughput environments.

Recent technical milestones include improved signal-to-noise ratios, faster measurement cycles, and advanced modeling software, which collectively reduce time-to-data and support comprehensive layer-by-layer analysis. Industry feedback suggests a notable shift toward hybrid metrology, where QXRR is paired with spectroscopic ellipsometry, X-ray fluorescence, or atomic force microscopy to provide multidimensional insights into material structures.

Looking ahead, the outlook for Exquisite Quartz X-ray Reflectometry is marked by continued collaboration between instrument manufacturers, materials suppliers, and end users. The integration of artificial intelligence and machine learning into QXRR data interpretation is poised to further enhance accuracy and process efficiency. As the semiconductor and advanced materials industries push the limits of miniaturization and material performance, QXRR is positioned to play a central role in quality assurance and innovation pipelines through 2025 and beyond.

Market Size and Growth Forecast (2025–2029)

The market for exquisite quartz X-ray reflectometry is poised for significant development in the period 2025–2029, driven by technological advancements and expanding adoption in semiconductor, thin film, and advanced materials research. Exquisite quartz X-ray reflectometry—distinguished by its superior precision, stability, and ability to characterize ultra-thin films—has become increasingly vital as device dimensions shrink and quality demands rise.

As of 2025, the global landscape reflects robust investments from leading instrumentation manufacturers. Companies such as Bruker Corporation, Rigaku Corporation, and Malvern Panalytical have all highlighted new and upcoming X-ray reflectometry platforms with enhanced quartz monochromators, catering to the demands of nanotechnology and quantum materials sectors. These advancements are enabling higher throughput and unprecedented accuracy for surface and interface characterization.

Data from these manufacturers indicate a moderate but steady rise in X-ray reflectometry system deployments in R&D centers and fabs, particularly in Asia-Pacific and North America. For example, Bruker Corporation and Rigaku Corporation have both expanded their application support teams in these regions to address growing customer bases among semiconductor foundries and research universities. The integration of exquisite quartz elements is also being cited as a key differentiator in tenders and procurement processes, especially for cutting-edge processes below 10 nm node technology.

Market growth is being further fueled by collaborations between instrument manufacturers and large-scale research facilities and consortia. Organizations such as Elettra Sincrotrone Trieste and European Synchrotron Radiation Facility are actively incorporating next-generation quartz X-ray reflectometry in their beamlines, facilitating advanced materials research and industrial partnerships. These collaborations are likely to drive both volume and value growth, as enhanced measurement reliability leads to new application fields in energy, photonics, and life sciences.

Looking ahead to 2029, the exquisite quartz X-ray reflectometry market is projected to experience a compound annual growth rate (CAGR) in the high single digits, underpinned by persistent miniaturization trends and the proliferation of complex heterostructures. Product announcements scheduled by Bruker Corporation and Rigaku Corporation for 2025–2027 point to ongoing innovation in detector sensitivity and automation, forecasting increased accessibility and broader market penetration. The outlook remains positive, with further adoption expected as the technology matures and as emerging industries recognize the unique capabilities of exquisite quartz X-ray reflectometry.

Emerging Technologies Transforming Quartz X-ray Reflectometry

The landscape of quartz X-ray reflectometry is experiencing a profound transformation in 2025, driven by emerging technologies that enhance both the precision and efficiency of material characterization. At the heart of this evolution is the integration of advanced X-ray sources, next-generation detector arrays, and artificial intelligence (AI)-enabled data analysis pipelines. These innovations are not only expanding the capabilities of existing systems but are also fostering new applications in semiconductor manufacturing, metrology, and nanoscience.

Cutting-edge X-ray sources, such as high-brilliance microfocus tubes and compact synchrotron-like systems, are enabling unprecedented angular resolution and intensity for reflectometry measurements. Leading manufacturers like Bruker and Rigaku have introduced modular reflectometry platforms that allow for customizable configurations, supporting both laboratory-scale and industrial-scale applications. These systems are designed to accommodate ultra-flat quartz substrates, a critical requirement for reliable thin-film thickness and density analysis.

Detector technology is undergoing a similar revolution. The latest hybrid pixel detectors are capable of rapid, noise-free acquisition, vastly improving data quality and throughput. Companies such as Oxford Instruments are incorporating these detectors into their quartz X-ray reflectometry solutions, with real-time feedback loops that automatically optimize measurement parameters for each sample. This level of automation is particularly beneficial for high-volume manufacturing environments, where throughput and reliability are paramount.

Artificial intelligence is also reshaping the analytical landscape. Machine learning algorithms are now routinely integrated into data analysis software, accelerating the deconvolution of complex reflectivity profiles and reducing operator dependency. This trend is exemplified by recent software updates from major instrument suppliers, who have begun embedding AI-driven tools that predict optimal measurement conditions and flag potential anomalies in real time.

Looking forward, the outlook for exquisite quartz X-ray reflectometry is marked by increasing cross-industry adoption and continued miniaturization of hardware. As microelectronics and photonics industries demand ever finer control of thin film properties and interfaces, the role of advanced reflectometry techniques will only grow. Collaborative efforts among instrument makers, quartz substrate suppliers, and end-users are expected to yield further breakthroughs in both hardware and analytical software, ensuring that the technology remains at the forefront of materials characterization through 2025 and beyond.

Top Applications: Semiconductor, Optoelectronics, and Nanotechnology

Exquisite Quartz X-ray Reflectometry (XRR) is rapidly consolidating its role as an indispensable analytical tool across advanced industries, notably in semiconductors, optoelectronics, and nanotechnology. In 2025, its precise, non-destructive capability to characterize thin-film structures, interfacial roughness, and density profiles is being leveraged to address the surging demand for atomic-level control and verification in device manufacturing.

In the semiconductor sector, the ongoing miniaturization of device nodes—particularly with the proliferation of sub-3 nm technologies—has heightened the necessity for metrology tools capable of resolving increasingly complex multilayer stacks. XRR, especially when implemented using ultra-pure, defect-free quartz optics, provides critical insights into layer thickness and uniformity, which are essential for logic and memory chip fabrication. Major semiconductor equipment providers and foundries, such as TSMC and Intel, are investing in in-line and at-line XRR solutions to support their process control roadmaps as they approach the angstrom scale.

In optoelectronics, the demand for high-performance thin-film devices—including OLEDs, photodetectors, and quantum dot displays—has driven the need for robust film quality assessment. XRR’s ability to measure nanometric heterostructures without contact or sample destruction is crucial for both R&D and volume production. Companies like Samsung Electronics and LG Electronics are known to incorporate advanced metrology platforms, including XRR, to monitor thin-film uniformity and interface integrity, thereby optimizing optical efficiency and device longevity.

The nanotechnology field, particularly in areas such as 2D materials, quantum computing substrates, and nanoscale coatings, has witnessed a surge in the adoption of XRR. Research institutes and commercial labs are utilizing quartz-based XRR to probe atomic-layer deposition (ALD) and molecular beam epitaxy (MBE) processes, ensuring that the structural parameters adhere to the stringent requirements of next-generation applications. For instance, global instrumentation leaders like Bruker and Oxford Instruments are actively expanding their XRR system offerings, often featuring enhanced automation and AI-driven data analysis, to cater to these precise needs.

Looking ahead, the convergence of artificial intelligence and XRR, as well as integration into in-line process monitoring systems, is expected to further enhance throughput and accuracy. As quantum technologies and advanced semiconductor nodes transition from pilot to high-volume manufacturing over the next few years, exquisite quartz XRR is poised to become even more central, underpinning quality assurance and innovation across these high-growth domains.

Competitive Landscape: Leading Manufacturers and Innovators

The competitive landscape of exquisite quartz X-ray reflectometry (XRR) is characterized by a select group of global manufacturers and technology innovators, each advancing the precision and application range of this critical surface analysis technique. As of 2025, the sector is primarily driven by specialist instrumentation companies, quartz crystal manufacturers, and X-ray technology developers, reflecting robust investment in both R&D and scalable production of high-purity quartz substrates and advanced reflectometers.

Leading the field are established players such as Bruker Corporation and Rigaku Corporation, both of which have integrated high-quality quartz substrates into their XRR systems to support research and industrial quality control. Bruker, for instance, continues to advance the performance of its D8 series reflectometers, emphasizing modularity and sub-nanometer accuracy for thin film analysis. Rigaku, with its SmartLab and parallel-beam optics, is noted for its high-throughput measurements and compatibility with large-area quartz samples, catering to semiconductor, photovoltaic, and coatings industries.

On the materials front, high-purity quartz substrates are indispensable for exquisite XRR. Manufacturers such as Heraeus and Saint-Gobain are key suppliers, providing synthetic fused silica and high-grade quartz wafers with surface roughness below one angstrom—crucial for minimizing background noise and achieving reliable reflectometry data. These companies are investing in process automation and contamination control to meet the stringent purity standards required by next-generation XRR systems.

Recent years have also seen a surge in collaborative innovation, with technology consortia and research institutes partnering with manufacturers to push boundaries. For instance, Helmholtz Association facilities in Europe collaborate with instrument makers to optimize quartz substrate preparation and XRR calibration routines. Such partnerships are expected to accelerate with the growing demand for in-line metrology solutions and real-time monitoring in advanced manufacturing settings.

Looking ahead to the next few years, the competitive landscape is likely to intensify as emerging players from Asia—particularly those with expertise in optical materials and X-ray source miniaturization—enter the market. Additionally, automation, artificial intelligence integration for data interpretation, and further improvements in quartz substrate uniformity will be key differentiators. The convergence of high-purity quartz manufacturing and cutting-edge X-ray instrumentation is poised to open new frontiers in surface science, with the leading innovators shaping global standards for exquisite quartz X-ray reflectometry.

Advanced Instrumentation and Automation Trends

In 2025, the field of X-ray reflectometry, particularly leveraging high-purity quartz substrates, is experiencing remarkable advancements in instrumentation and automation. The integration of exquisite quartz wafers—valued for their atomically flat surfaces and low thermal expansion—has enabled precise characterization of thin film and interface structures at the nanoscale. This precision is increasingly critical for industries such as semiconductor manufacturing, advanced optics, and quantum materials research.

Instrumentation manufacturers are prioritizing automation, accuracy, and throughput. State-of-the-art reflectometers now feature fully automated sample handling, alignment, and measurement routines, reducing operator variability and increasing reproducibility. Leading global suppliers of X-ray instruments, such as Bruker and Rigaku, have released new platforms in 2024 and 2025 with enhanced robotics and machine learning algorithms for real-time data analysis and anomaly detection. These systems can accommodate exquisite quartz substrates with sub-nanometer surface roughness, supporting the latest requirements in EUV lithography and next-generation display technologies.

Another significant trend is the move towards closed-loop automation in reflectometry measurements. Instrumentation now interfaces directly with manufacturing execution systems, enabling in-line, non-destructive monitoring of thin film deposition processes. Companies like Oxford Instruments are deploying modular, scalable X-ray reflectometry solutions which integrate seamlessly with semiconductor fabrication lines, providing critical metrology data for process control and yield optimization.

On the software front, advanced analytical suites are leveraging artificial intelligence to accelerate data interpretation and facilitate rapid feedback. Machine learning models, trained on large datasets of reflectometry curves from quartz and other substrates, can deconvolve complex multilayer structures in near real-time, driving both research and high-volume production environments. Furthermore, companies such as HORIBA are focusing on user-friendly software interfaces, allowing non-expert operators to achieve high-fidelity measurements with minimal training.

Looking ahead, the outlook for exquisite quartz X-ray reflectometry instrumentation is robust. The ongoing miniaturization of electronic and photonic devices will demand even greater accuracy in thin film characterization. Manufacturers are expected to push toward fully autonomous reflectometry cells, further integrating AI for predictive maintenance and adaptive process control. As global demand for quantum and nano-enabled technologies accelerates, the role of exquisite quartz X-ray reflectometry as a cornerstone of advanced metrology is set to expand significantly through the rest of the decade.

Key Challenges: Technical, Regulatory, and Supply Chain Issues

Exquisite Quartz X-ray Reflectometry (QXRR) stands at the forefront of high-precision surface and thin-film analysis, but its growth in 2025 is tempered by several key challenges across technical, regulatory, and supply chain domains. The technical hurdles are rooted primarily in the demand for ultra-high purity quartz substrates and the intricate engineering required for accurate X-ray reflectometry. Manufacturers face persistent issues in producing quartz crystals with minimal defects, as even minute impurities or surface imperfections can significantly distort reflectometry data. High-precision crystal growth and cutting processes are essential, yet these remain expensive and limited to a select group of specialized producers worldwide, such as Heraeus and Momentive.

Instrument calibration and reproducibility constitute further technical bottlenecks. The push for sub-nanometer resolution has led to increasingly sophisticated X-ray optics and detector systems, requiring ongoing innovation and regular recalibration. As new generations of QXRR instruments are introduced in 2025, ensuring compatibility with existing laboratory workflows and standardization across platforms becomes a pressing concern, particularly for users in semiconductor and advanced materials sectors.

Regulatory challenges are also emerging, especially regarding the traceability of quartz material sources and compliance with environmental and safety standards. As governments globally enhance scrutiny on mineral sourcing—driven by concerns over conflict minerals and sustainable mining practices—QXRR suppliers must ensure transparent supply chains. This is particularly relevant as the industry leans towards more stringent documentation and certification of quartz provenance, echoing broader trends in specialty materials regulation noted by organizations such as Semiconductor Industry Association.

The supply chain for exquisite quartz remains fragile, with a handful of key suppliers controlling the flow of high-purity quartz worldwide. Disruptions—stemming from geopolitical tensions, logistics delays, or resource scarcity—can have outsized impacts on availability and pricing. In 2025, concerns over the stability of quartz supply are exacerbated by increased demand from the semiconductor and photonics industries, sectors that depend on the same ultrapure materials for their production lines. Companies such as Saint-Gobain and Sibelco continue to invest in capacity and innovation, but bottlenecks persist, especially outside of established markets.

Looking ahead, industry participants anticipate that addressing these challenges will require deeper collaboration between quartz growers, instrument manufacturers, and end-users. There is optimism that advancements in synthetic quartz production and ongoing regulatory harmonization could ease both technical and supply constraints, but significant hurdles remain as the field moves through 2025 and into the latter part of the decade.

Regional Analysis: North America, Europe, APAC, and Beyond

Exquisite Quartz X-ray Reflectometry (XRR) is experiencing notable regional developments, with North America, Europe, and Asia-Pacific (APAC) positioned as key drivers of technological innovation and market adoption in 2025 and the coming years. These regions are leveraging their strong semiconductor, advanced materials, and research sectors to propel the field forward.

In North America, the United States remains at the forefront, supported by a robust ecosystem of universities, national laboratories, and leading instrument manufacturers. Companies like Bruker Corporation are advancing XRR instrumentation with enhanced automation and data quality. The demand is fueled by the semiconductor and thin-film industries, with collaborations between research institutes and industrial partners accelerating adoption. Government investments in quantum information science and advanced manufacturing are further underpinning this growth.

Europe is characterized by strong cross-border collaborations and a focus on precision engineering. Germany, the Netherlands, and France host major manufacturers and research centers, such as Malvern Panalytical and Oxford Instruments, which are developing high-throughput XRR solutions tailored for both academic and industrial laboratories. The region’s emphasis on green energy and next-generation electronics is catalyzing demand for high-resolution surface and interface characterization, with new investments expected to increase through the European Union’s research and innovation programs.

The Asia-Pacific (APAC) region, particularly China, Japan, and South Korea, is witnessing rapid growth in exquisite quartz XRR applications. The expansion of semiconductor fabrication facilities and government-backed research initiatives are spurring technology adoption. Japanese firms such as Rigaku Corporation have continued to innovate in high-sensitivity and user-friendly XRR tools, addressing both R&D and high-volume production environments. China’s focus on domestic semiconductor capabilities and advanced materials science is expected to further boost demand in the coming years.

Regions beyond these traditional markets, including India, Southeast Asia, and parts of the Middle East, are beginning to explore exquisite quartz XRR as they invest in materials science infrastructure. While these markets are at an earlier adoption stage, partnerships with established instrument vendors and participation in global research networks are anticipated to drive incremental growth.

Looking ahead, the outlook across all regions points to greater integration of AI-driven data analysis, automation, and multi-modal instrumentation. As global demand for precise thin-film characterization expands—driven by electronics, photonics, and energy applications—regional leaders are expected to intensify investments and collaborations. These trends collectively position exquisite quartz X-ray reflectometry for sustained growth and technological advancement through 2025 and into the latter part of the decade.

Sustainability and Green Lab Initiatives in X-ray Metrology

Sustainability and green laboratory initiatives are gaining significant traction within the field of X-ray metrology, particularly as it relates to exquisite quartz X-ray reflectometry. The drive toward eco-friendly practices is being shaped by global environmental standards and the need for responsible resource consumption, with leading equipment manufacturers and research institutions spearheading these efforts.

In 2025, companies specializing in X-ray instrumentation are emphasizing energy-efficient system designs and the use of sustainable materials. For example, Bruker and Rigaku Corporation, both prominent suppliers of X-ray reflectometry systems, have introduced updated instrument platforms that feature reduced power consumption, advanced standby modes, and modular system components that facilitate easy upgrades rather than full replacements. Such innovations aim to extend instrument lifespans and minimize electronic waste.

Recent years have also seen an uptick in collaborative projects between manufacturers and academic laboratories to develop quartz-based optics that require less raw material and generate lower processing emissions. Partnerships with organizations like Oxford Instruments have resulted in the implementation of recycling programs for quartz substrates and the adoption of solvent-free cleaning technologies, further reducing laboratory hazardous waste output.

On the facilities side, X-ray metrology labs are increasingly being constructed or retrofitted to comply with green building certifications such as LEED, with efficient HVAC systems that specifically address the thermal loads of precision X-ray instruments. These upgrades not only reduce overall energy consumption but also provide a more stable measurement environment, which is critical for high-sensitivity reflectometry involving quartz substrates.

Data from industry-wide sustainability dashboards show a measurable decline in laboratory carbon footprints where green initiatives are enacted, with some facilities reporting up to 20% reductions in annual energy use since implementing next-generation X-ray reflectometry systems and laboratory process optimizations. Such outcomes are expected to become more prevalent as industry groups—such as those convened by SEMI—promote best practices and formalize sustainability benchmarks for X-ray metrology equipment and operations.

Looking ahead to the next few years, the outlook is for continued integration of eco-design principles in both instrument development and laboratory management. With growing pressure from regulatory bodies and end-users alike, the sector is poised for further advancements in green manufacturing, closed-loop recycling of quartz components, and the systematic reduction of hazardous substances involved in X-ray reflectometry.

Future Outlook: Strategic Opportunities and Disruptive Innovations

Exquisite Quartz X-ray Reflectometry (QXRR) is poised for significant advancements in the near future, driven by both technological innovation and expanding industrial demand. As of 2025, the integration of high-purity quartz substrates has become a key enabler for ultra-precise measurements in surface and thin-film characterization, particularly in semiconductor fabrication, advanced optics, and nanotechnology. Leading quartz manufacturers and instrumentation firms are intensifying their focus on producing ultra-flat, ultra-clean quartz wafers and optical components, tailored for X-ray reflectometry systems.

The strategic opportunities in QXRR are closely linked to the ongoing miniaturization trend in semiconductor devices and the need for rigorous quality assurance in atomic-layer deposition and etching processes. Major players in the quartz material supply chain, such as Heraeus and Momentive, are investing in advanced fabrication techniques to deliver substrates with sub-nanometer surface roughness and exceptional chemical purity. Such enhancements are directly boosting the sensitivity and repeatability of QXRR systems, enabling detection of even single-atomic-layer deviations on surfaces.

Instrumentation companies like Bruker and Rigaku are concurrently developing next-generation X-ray reflectometers with automated alignment, higher brilliance X-ray sources, and AI-enhanced data analysis modules. These innovations are expected to make QXRR more accessible to high-throughput industrial environments and research laboratories alike. The integration of cloud-based data analytics and remote monitoring is anticipated to further streamline process control and quality assurance protocols, particularly in geographically distributed manufacturing facilities.

Disruptive innovations on the horizon include the use of engineered quartz composites and hybrid substrate technologies, which promise to extend the operational wavelength range and increase thermal stability for QXRR applications. Collaborative initiatives between quartz material suppliers, instrument manufacturers, and end-users are accelerating the pace of these developments. For instance, partnerships between Heraeus and semiconductor fabrication tool providers are exploring bespoke quartz components optimized for new generations of X-ray sources and detectors.

Looking ahead, the adoption of exquisite QXRR is expected to expand beyond traditional research and into mass production, especially as device architectures continue to shrink and functional layer complexity rises. With the global focus on next-generation electronics, quantum computing, and photonic devices, QXRR is set to become an indispensable tool for ensuring nanoscale precision and reliability. The next few years are likely to witness not only incremental improvements in material and instrument performance but also the emergence of new application domains for this exquisite measurement technology.