Table of Contents

- Executive Summary: Transformative Drivers in Microfluidic Cell Manipulation

- Market Size, Growth Forecasts, and Revenue Projections Through 2030

- Key Players and Recent Innovations (e.g., fluidigm.com, dolomite-microfluidics.com, emdmillipore.com)

- Emerging Technologies: Single-Cell Analysis, Sorting, and Isolation Trends

- Applications in Drug Discovery, Diagnostics, and Regenerative Medicine

- Integration with AI and Lab-on-a-Chip Systems: Next-Gen Workflows

- Regulatory Landscape and Standardization Efforts (e.g., ieee.org, iso.org)

- Regional Opportunities: North America, Europe, Asia-Pacific Insights

- Challenges: Scalability, Reproducibility, and Commercialization Hurdles

- Future Outlook: Strategic Roadmap and Investment Hotspots for 2025–2030

- Sources & References

Executive Summary: Transformative Drivers in Microfluidic Cell Manipulation

Microfluidic cell manipulation technologies are poised for significant expansion in 2025 and the ensuing years, driven by advancements in device miniaturization, automation, and integration with analytical platforms. The core transformative forces in this field include rising demand for precision in single-cell analysis, scalable manufacturing methods, and the integration of artificial intelligence (AI) for data-rich experimentation. These drivers are accelerating adoption across biomedical research, diagnostics, and therapeutic development.

Recent years have witnessed a surge in the development and commercialization of sophisticated microfluidic platforms capable of isolating, sorting, and characterizing individual cells with unprecedented throughput and accuracy. For example, companies such as Dolomite Microfluidics and Fluxion Biosciences continue to launch systems supporting highly multiplexed cell manipulation and analysis, tailored for oncology, immunology, and stem cell research applications. These systems leverage advances in droplet-based and digital microfluidics, delivering precise control over cellular microenvironments while reducing reagent consumption and operational complexity.

Key events shaping the sector in 2025 include expanded partnerships between device manufacturers and leading pharmaceutical or biotechnological firms to co-develop custom platforms for cell therapy manufacturing and characterization. This trend is exemplified by collaborations with industry leaders such as Sartorius, who are actively integrating microfluidic solutions into scalable automated workflows for cell analysis. Concurrently, the use of AI and machine learning algorithms—coupled with real-time imaging and sensor data—enables increasingly detailed phenotypic and functional screening of rare cell populations, a capability being rapidly incorporated by technology providers.

The sector is also witnessing a push toward regulatory harmonization and standardization, with organizations like the Pistoia Alliance advocating for interoperable device formats and data standards, facilitating wider adoption in clinical and industrial settings. Additionally, ongoing advances in material science, including the use of biocompatible polymers and 3D printing, are reducing costs and expanding the range of manipulatable cell types.

Looking forward, microfluidic cell manipulation technologies are expected to play a central role in enabling next-generation cell-based assays, diagnostics, and personalized therapies. The integration of automation, AI, and scalable manufacturing processes will further democratize access to these powerful tools, positioning them as essential components in the evolving landscape of precision medicine and cellular therapeutics.

Market Size, Growth Forecasts, and Revenue Projections Through 2030

The global market for microfluidic cell manipulation technologies is experiencing robust growth in 2025, driven by expanding applications in single-cell analysis, cell sorting, diagnostics, personalized medicine, and drug discovery. As of 2025, industry leaders and innovators are accelerating investment in integrated microfluidic platforms, leveraging advancements in automation, miniaturization, and high-throughput capabilities. The surge in demand for precise cellular manipulation is further fueled by the increasing adoption of cell-based assays in pharmaceutical R&D, the rising prevalence of chronic diseases, and the need for scalable solutions in regenerative medicine.

Market data from leading sector participants indicates that the microfluidics industry is projected to maintain a compound annual growth rate (CAGR) in the high single to low double digits through 2030. This dynamic environment is supported by ongoing product launches and strategic expansions by companies specializing in microfluidic components, consumables, and integrated systems. For example, Dolomite Microfluidics continues to introduce versatile platforms for cell encapsulation and droplet-based manipulation, addressing the needs of both research and industrial customers. Similarly, Standard BioTools (formerly Fluidigm Corporation) and BioRep Technologies are actively developing high-throughput microfluidic devices for single-cell genomics and cell culture applications.

The revenue potential for microfluidic cell manipulation technologies is further highlighted by the growing deployment of commercial automated cell processing instruments. Miltenyi Biotec and Berthold Technologies are enhancing portfolios with systems that combine microfluidic cell sorting with downstream molecular analysis, enabling scalable workflows for clinical and translational research. These developments are positioning microfluidics as a foundational technology in precision medicine and cell therapy manufacturing, with the global market forecasted to reach multi-billion-dollar valuations by 2030.

Looking ahead, sustained growth in microfluidic cell manipulation will be supported by increased funding for life sciences research, expanding regulatory approvals for microfluidics-based diagnostic tools, and the integration of artificial intelligence for real-time data analysis and process control. The competitive landscape is expected to intensify as established players and startups alike seek to capture market share in North America, Europe, and Asia-Pacific. Overall, the sector is on track for significant expansion, with revenue projections through 2030 reflecting continued technological innovation and broadening end-user adoption.

Key Players and Recent Innovations (e.g., fluidigm.com, dolomite-microfluidics.com, emdmillipore.com)

The microfluidic cell manipulation sector has witnessed accelerating innovation and strategic expansion among key players as of 2025. Companies are focusing on high-precision single-cell handling, scalable platforms, and integration with analytics—driven by growing demand in cell therapy, diagnostics, and drug discovery. Notably, Standard BioTools Inc. (formerly Fluidigm) remains at the forefront, advancing its microfluidic platforms for single-cell genomics and proteomics. Their CyTOF and Biomark systems have seen expanded adoption in pharmaceutical research, supported by improvements in throughput and automation. In early 2025, Standard BioTools announced further enhancements to its microfluidics-enabled single-cell analysis suite, emphasizing robust, multi-omics compatibility for translational medicine applications.

Another significant contributor is Dolomite Microfluidics, which has broadened its portfolio of microfluidic chips and modular systems catering to cell encapsulation, sorting, and droplet-based assays. In the past year, Dolomite introduced new droplet generators and cartridge-based platforms, streamlining workflows for high-throughput single-cell analysis and cell therapy manufacturing. Their collaborations with academic and industrial partners have yielded solutions tailored for gentle, viable cell processing—critical for stem cell and immunotherapy applications.

On the consumables and reagent side, EMD Millipore (part of Merck KGaA) continues to supply essential microfluidic chips, membranes, and reagents supporting a wide array of cell manipulation protocols. In 2024–2025, EMD Millipore launched new lines of microfluidic-ready reagents for cell separation and multiplexed analysis, targeting the needs of both research and clinical laboratories.

Industry-wide, the trend is toward integration: merging microfluidic manipulation with real-time analytics, machine learning, and connectivity. Several players, including Standard BioTools Inc. and Dolomite Microfluidics, have announced R&D initiatives aiming to combine microfluidics with AI-driven data analysis and remote system monitoring—expected to mature over the next two to three years.

Looking ahead, the market is set for continued growth as microfluidic cell manipulation becomes more standardized in clinical and industrial workflows. The sector’s leading companies are investing heavily in platform scalability, chip robustness, and regulatory readiness, positioning their technologies for expanding roles in personalized medicine, cell-based screening, and biomanufacturing by 2026 and beyond.

Emerging Technologies: Single-Cell Analysis, Sorting, and Isolation Trends

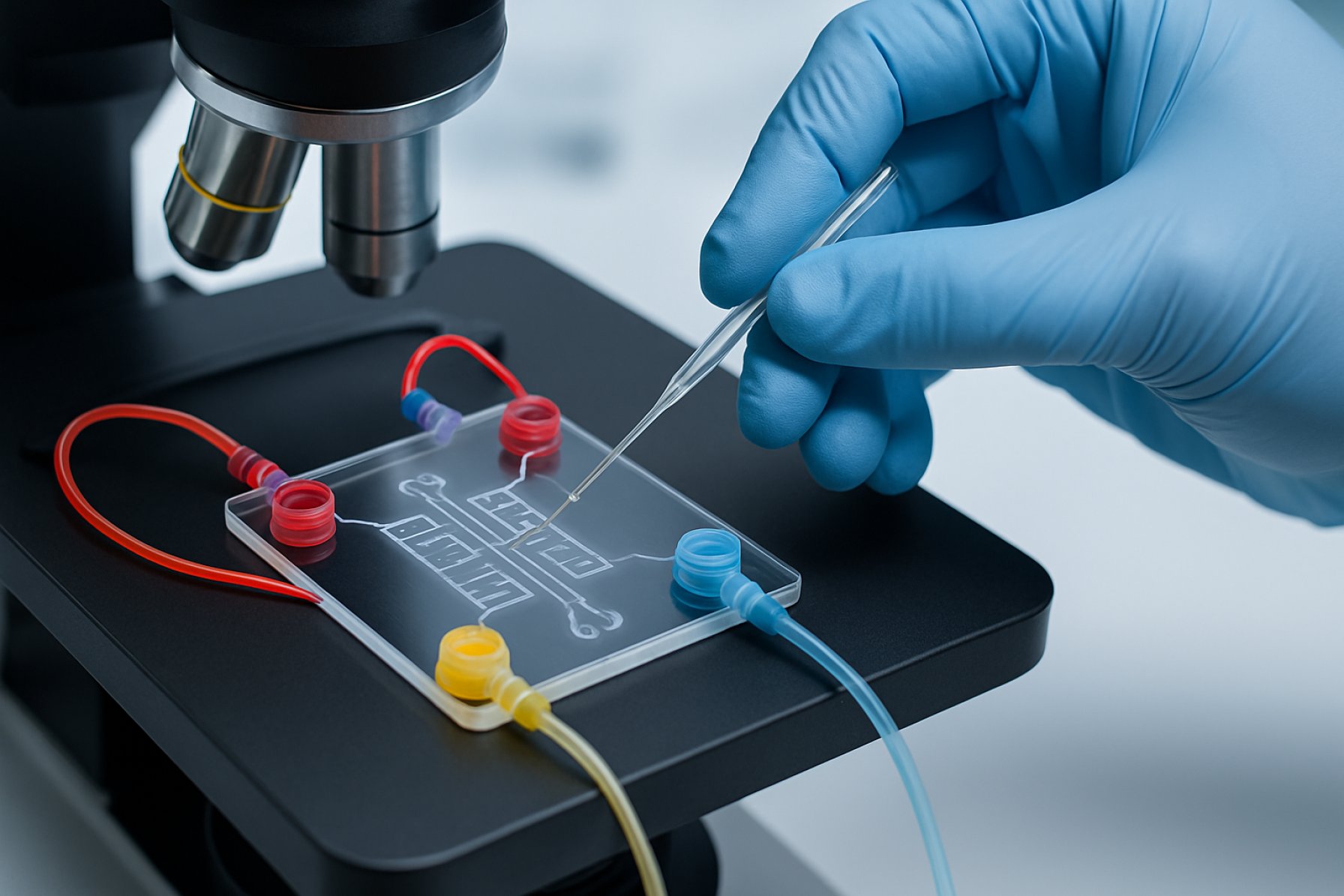

Microfluidic cell manipulation technologies are experiencing rapid advancements in 2025, transforming single-cell analysis, sorting, and isolation. These platforms leverage miniaturized fluidic channels to precisely handle and process individual cells, enabling high-throughput and highly sensitive biological assays. Recent years have seen a surge in commercial development, with leading manufacturers refining droplet-based, valve-enabled, and digital microfluidic systems to address emerging research and clinical demands.

Key players such as Standard BioTools (formerly Fluidigm), Dolomite Microfluidics, and Berthold Technologies are at the forefront, each offering platforms that enable single-cell encapsulation, sorting, and downstream molecular profiling. For instance, droplet microfluidics, which compartmentalizes cells and reagents in picoliter-scale droplets, has become the foundation for several single-cell omics workflows, reducing reagent costs and increasing throughput. These systems are now routinely capable of handling tens of thousands of individual cells per run, with improved recovery rates and processing speeds.

The integration of optical, electrical, and acoustic manipulation modalities is another notable trend. Companies like CYTENA and Menarini Diagnostics offer microfluidic platforms that combine gentle cell sorting with real-time monitoring, minimizing cell stress and preserving viability for downstream culture or analysis. In parallel, digital microfluidics—wherein discrete droplets are actuated using electric fields—has seen increased adoption for automating complex multi-step assays, offering flexibility for both research and diagnostic settings.

Emerging applications in 2025 include rare cell isolation (e.g., circulating tumor cells, stem cells), immune profiling, and synthetic biology, supported by customizable chip designs and improved integration with downstream analytical tools. Several companies, including Bio-Rad Laboratories and 10x Genomics, continue to innovate in single-cell partitioning and barcoding, with new products announced to support larger cell numbers and more comprehensive multi-omics studies.

Looking ahead, the next few years are expected to bring further miniaturization, higher parallelization, and smarter automation, lowering barriers for adoption in both translational research and clinical diagnostics. The focus is shifting toward seamless integration of microfluidic cell manipulation with downstream sequencing, imaging, and computational analysis, promising unprecedented insights into cellular heterogeneity and function.

Applications in Drug Discovery, Diagnostics, and Regenerative Medicine

Microfluidic cell manipulation technologies have rapidly expanded their impact across drug discovery, diagnostics, and regenerative medicine, with 2025 marking a year of notable advancements and commercialization. These platforms use micron-scale fluid channels and precise control systems to isolate, sort, and analyze single cells or cell populations, enabling high-throughput, low-volume, and cost-effective experimentation that is transforming biomedical workflows.

In drug discovery, microfluidic systems are increasingly integral for high-content screening and phenotypic assays. Companies such as Dolomite Microfluidics and Sphere Fluidics have developed platforms that allow researchers to encapsulate cells in picoliter droplets, enabling parallelized screening of drug candidates on single-cell resolution. This approach reduces reagent consumption and accelerates hit identification, crucial for pharmaceutical innovation timelines. Moreover, microfluidic-enabled organ-on-a-chip devices from firms like Emulate are being adopted by major pharmaceutical companies to model complex tissue responses and predict human toxicity, enhancing preclinical validation.

Diagnostics is witnessing a surge in point-of-care (POC) applications powered by microfluidic manipulation. Technologies from Standard BioTools (formerly Fluidigm) and Bio-Rad Laboratories are facilitating robust single-cell analysis, liquid biopsy, and rapid infectious disease testing. In 2025, microfluidic PCR and digital droplet platforms are increasingly deployed in decentralized settings, supporting faster and more accurate detection of pathogens and genetic markers. This trend is being reinforced by regulatory approvals and collaborations with healthcare providers to integrate microfluidic diagnostics into routine clinical workflows.

In regenerative medicine, microfluidic cell manipulation is pivotal for cell therapy manufacturing and tissue engineering. Automated microfluidic bioreactors from Berkeley Lights enable precise control over cell culture microenvironments, improving the consistency and scalability of stem cell-derived therapies. Meanwhile, 3D cell printing and tissue-on-chip models are being commercialized by companies like Organovo, offering new avenues for developing patient-specific grafts and preclinical testing of biomaterials.

Looking forward, the next few years are expected to bring even greater integration of microfluidic cell manipulation with AI-driven analytics, further miniaturization, and broader regulatory acceptance. As these technologies become more accessible and standardized, their application in drug discovery, diagnostics, and regenerative medicine will continue to expand, driving personalized medicine and accelerating clinical translation.

Integration with AI and Lab-on-a-Chip Systems: Next-Gen Workflows

The integration of microfluidic cell manipulation technologies with artificial intelligence (AI) and lab-on-a-chip (LoC) systems is rapidly shaping next-generation workflows in biomedicine and life sciences. As of 2025, these combined platforms are driving automation, throughput, and analytical power, enabling transformative advances in research and clinical practice.

Key industry leaders are developing microfluidic LoC devices capable of precise single-cell manipulation, isolation, and analysis. Companies such as Dolomite Microfluidics and Standard BioTools (formerly Fluidigm) are commercializing platforms that integrate complex fluid handling, cell sorting, and molecular profiling onto miniaturized chips. These systems routinely leverage AI-powered image analysis and decision-making algorithms to enhance accuracy in cell identification, sorting, and downstream analytics. For example, in single-cell genomics and phenotyping, AI-driven pattern recognition is becoming essential for real-time data interpretation and adaptive experimental control.

Recent demonstrations highlight the trend: In 2024, Dolomite Microfluidics released updated microfluidic chips tailored for high-throughput cell encapsulation and droplet generation, with integrated sensors and interfaces compatible with AI-driven controllers. Similarly, Standard BioTools has expanded its LoC portfolio with devices designed for automated single-cell capture and analysis, directly supporting machine learning workflows for cell classification and rare cell detection.

Another major player, Berkeley Lights, continues to advance its optofluidic platforms, which combine precise cell manipulation with AI-guided decision-making. Their systems enable multiplexed cell screening and functional assays—critical for antibody discovery, cell therapy development, and synthetic biology—by integrating microfluidics, optics, and software intelligence.

Looking ahead to the next few years, the convergence of microfluidics, AI, and LoC technologies is poised to accelerate. Anticipated developments include tighter integration of machine learning models into chip firmware, real-time feedback loops for adaptive experimental protocols, and expanded cloud-based analytical tools. Industry alliances and partnerships between microfluidics manufacturers and AI software providers are expected to spur innovation and adoption, particularly in personalized medicine, point-of-care diagnostics, and automated drug screening.

- Microfluidic-AI integration is rapidly moving from research to clinical and industrial workflows.

- AI enhances decision-making in cell manipulation, enabling higher throughput and precision.

- Lab-on-a-chip platforms are increasingly modular, supporting plug-and-play AI/ML capabilities.

- Next-gen systems will emphasize interoperability, real-time analytics, and distributed data sharing, further democratizing access to advanced cell-based assays.

Regulatory Landscape and Standardization Efforts (e.g., ieee.org, iso.org)

The regulatory landscape and standardization efforts for microfluidic cell manipulation technologies are rapidly evolving as these systems gain traction in biomedical research, diagnostics, and therapeutic applications. In 2025, the increasing sophistication and adoption of microfluidics have prompted both international and national regulatory bodies to address their unique characteristics, particularly concerning device reliability, safety, and reproducibility.

Several standards organizations are actively shaping the guidelines for microfluidic devices. The International Organization for Standardization (ISO) has developed and continues to refine ISO 22916, which lays out general requirements for microfluidic devices, including materials, design, and testing. This standard is gaining broader industry acceptance, helping manufacturers and end-users align on quality benchmarks. Additionally, ISO collaborates with other stakeholders to address biocompatibility issues and data interoperability, both critical as cell-based assays and therapies become more prevalent.

The Institute of Electrical and Electronics Engineers (IEEE) is also contributing to the standardization of microfluidic technology. Through its Engineering in Medicine and Biology Society, IEEE is focusing on technical standards that cover aspects such as device communication, data formats, and integration with electronic health records. Efforts like the IEEE P2791 draft standard for bioinformatics—initially focused on biocompute objects—are being extended to accommodate microfluidic-generated data, ensuring traceability and reproducibility in clinical and research settings.

From a regulatory perspective, agencies such as the U.S. Food and Drug Administration and the European Medicines Agency are actively engaging with industry leaders to clarify the classification and approval pathways for microfluidic cell manipulation products. In 2024 and 2025, regulatory guidance documents have been updated to streamline submissions for lab-on-a-chip devices, especially those used in in vitro diagnostics and cell therapy manufacturing. Industry consortia and working groups are collaborating with regulators to develop consensus standards, which are expected to further harmonize requirements globally over the next few years.

Looking ahead, harmonization of standards and regulatory frameworks remains a top priority. Industry stakeholders anticipate that by 2027, clearer international standards will facilitate faster market access and broader adoption of microfluidic technologies in both clinical and research environments. Continued collaboration among standards bodies, regulators, and industry will be essential to address emerging challenges, such as integration with artificial intelligence and automation, further cementing the role of microfluidic cell manipulation technologies in the biomedical landscape.

Regional Opportunities: North America, Europe, Asia-Pacific Insights

Microfluidic cell manipulation technologies are experiencing significant regional momentum, with distinct opportunities and growth trajectories across North America, Europe, and Asia-Pacific as of 2025. These regions are leveraging their unique strengths to foster innovation, commercialization, and adoption in sectors such as biomedical research, diagnostics, cell therapy, and biopharmaceutical manufacturing.

North America continues to lead in microfluidic innovation, propelled by robust academic research, strong venture capital investment, and strategic partnerships between leading universities and biotechnology firms. The United States, in particular, is home to key players advancing microfluidic platforms for single-cell analysis, cell sorting, and automated cell culture. Companies such as Fluxion Biosciences and Thermo Fisher Scientific have expanded their offerings in microfluidic-based cell manipulation, catering to both research and clinical markets. The trend towards integration with artificial intelligence and automation is especially prominent, with several startups launching platforms that combine microfluidics with machine learning for high-throughput cell screening and phenotyping.

Europe is characterized by a strong focus on regulatory compliance and translational research, with the European Union supporting standardization and cross-border collaboration. Countries like Germany, the United Kingdom, and the Netherlands are notable for their emphasis on microfluidic systems tailored for regenerative medicine and drug discovery. Firms such as Dolomite Microfluidics and ANGLE plc are at the forefront, offering microfluidic tools for circulating tumor cell (CTC) isolation and organ-on-chip applications. The region benefits from a dense network of biotech clusters and public-private partnerships, accelerating technology transfer from lab to market. With expected tightening of regulations around cell-based therapeutics, precision microfluidic manipulation is anticipated to play a critical role in quality control and GMP-compliant manufacturing by 2026.

Asia-Pacific is emerging as both a manufacturing powerhouse and an innovation hub in microfluidics. China, Japan, South Korea, and Singapore are investing heavily in microfluidic R&D, driven by government initiatives and the rapid expansion of biotechnology sectors. Chinese companies are scaling up production of microfluidic chips and consumables, with firms such as Zolix Instruments expanding their capabilities in life science instrumentation. Meanwhile, Japan’s established electronics industry is translating its microfabrication expertise into next-generation cell manipulation devices, supporting applications from point-of-care diagnostics to live cell imaging. Asia-Pacific’s large and diverse patient populations present a significant opportunity for localized solutions in personalized medicine, with regional players expected to increase their global footprint over the next few years.

Across all regions, the next several years will likely see increased collaboration, regulatory harmonization, and a focus on scalable, user-friendly microfluidic platforms as the demand for precise, efficient cell manipulation intensifies globally.

Challenges: Scalability, Reproducibility, and Commercialization Hurdles

Microfluidic cell manipulation technologies have demonstrated significant potential in biomedical applications such as single-cell analysis, cell sorting, and therapeutic cell manufacturing. However, as the field advances toward clinical and industrial relevance in 2025 and the coming years, several critical challenges persist—primarily in scalability, reproducibility, and commercialization.

Scalability remains a formidable hurdle. While microfluidic devices excel at precise manipulation on a small scale, transitioning to industrial-scale throughput is non-trivial. Current commercial platforms, such as those offered by Fluidigm Corporation and Dolomite Microfluidics, typically handle moderate sample volumes and cell numbers suitable for research or early-phase clinical studies, but scaling up to process the vast quantities required for biomanufacturing or large diagnostics labs poses engineering and cost challenges. New efforts are underway to develop parallelization strategies, modular device arrays, and robust integration with upstream and downstream processes, but widespread industrial adoption is still emerging.

Reproducibility is another concern, particularly given the sensitivity of microfluidic systems to fabrication variations, material inconsistencies, and subtle environmental changes. Organizations such as Dolomite Microfluidics and Sphere Fluidics are deploying standardized chip manufacturing techniques and improved quality control protocols to minimize device-to-device variability. Nevertheless, achieving consistent performance across batches and between manufacturing sites is an ongoing challenge. This is especially critical for regulatory approval in clinical settings, where stringent validation is required.

On the commercialization front, microfluidic cell manipulation technologies face barriers related to regulatory pathways, end-user adoption, and cost-effectiveness. Despite the growing number of products entering the market, including automated cell sorters and droplet generators from companies like Fluidigm Corporation and Sphere Fluidics, widespread clinical and manufacturing adoption is hindered by complex user interfaces, integration difficulties with existing laboratory infrastructure, and the need for specialized training. Furthermore, regulatory agencies require robust evidence of reproducibility, reliability, and biocompatibility, which can delay time-to-market.

Looking ahead, industry leaders are addressing these challenges by investing in automation, advanced materials, and standardized protocols. Collaborations with pharmaceutical companies and contract manufacturing organizations are accelerating the validation and deployment of scalable microfluidic platforms. As the sector evolves, further progress in automation, quality standards, and regulatory alignment will be crucial for these technologies to realize their full commercial and clinical potential within the next few years.

Future Outlook: Strategic Roadmap and Investment Hotspots for 2025–2030

The period from 2025 to 2030 is poised to be transformative for microfluidic cell manipulation technologies, underpinned by rapid advancements in device miniaturization, integration of artificial intelligence (AI), and expanding applications in biomedical research and therapeutics. The strategic roadmap for this sector is being shaped by a confluence of trends: the demand for single-cell analysis, precision medicine, cell-based manufacturing, and decentralized diagnostics. Major industry players and research-driven organizations are aligning investments to capitalize on these opportunities, accelerating innovation cycles and commercialization.

A primary hotspot for investment is the development of next-generation microfluidic platforms capable of high-throughput, automated cell sorting and manipulation. Companies such as Dolomite Microfluidics and Standard BioTools Inc. are advancing systems that enable precise control of individual cells and particles, targeting applications in single-cell genomics, rare cell isolation, and immunotherapy manufacturing. Integration of real-time analytics and AI-driven decision algorithms is expected to further enhance the performance and reproducibility of these platforms, providing actionable insights for both research and clinical contexts.

Another key area of focus is the incorporation of microfluidic cell manipulation into point-of-care (POC) diagnostics and organ-on-chip models. Companies like CN Bio and Emulate, Inc. are investing in microengineered systems that simulate physiological microenvironments, enabling predictive drug testing and toxicity screening. These organ-on-chip platforms are anticipated to become central in pharmaceutical R&D pipelines, offering a scalable alternative to animal testing and expediting time-to-market for new therapeutics.

Strategic collaborations between microfluidics manufacturers, biopharma, and healthcare providers are also expected to intensify. For example, partnerships involving Sphere Fluidics are driving innovations in droplet-based cell encapsulation and single-cell analysis, fueling new product pipelines for antibody discovery and cell therapy. Concurrently, regulatory agencies are providing clearer guidance frameworks, further de-risking investments and accelerating clinical translation.

- Investment Hotspots (2025–2030):

- High-throughput, AI-integrated single-cell manipulation systems

- Organ-on-chip and advanced tissue models for pharma and biotech

- Point-of-care diagnostics leveraging microfluidic cell sorting

- Automated, closed-system cell manufacturing for cell and gene therapy

In summary, the outlook for microfluidic cell manipulation technologies through 2030 is marked by robust growth, with strategic investments converging on automation, integration, and translation to clinical and manufacturing settings. Market leaders and innovative startups alike are well positioned to capitalize on this trajectory, setting the stage for a new era in precision medicine and biotechnology.

Sources & References

- Dolomite Microfluidics

- Sartorius

- Pistoia Alliance

- BioRep Technologies

- Miltenyi Biotec

- Berthold Technologies

- Menarini Diagnostics

- 10x Genomics

- Sphere Fluidics

- Emulate

- Berkeley Lights

- Organovo

- Standard BioTools

- International Organization for Standardization (ISO)

- Institute of Electrical and Electronics Engineers (IEEE)

- Thermo Fisher Scientific