Biodegradable Electronics Development in 2025: Pioneering Eco-Friendly Innovation for a Greener Future. Explore How Next-Gen Devices Are Transforming Sustainability and Market Dynamics.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

- Breakthrough Technologies: Materials and Manufacturing Innovations

- Leading Companies and Industry Initiatives

- Applications: Medical Devices, Consumer Electronics, and Environmental Sensors

- Regulatory Landscape and Industry Standards

- Supply Chain and Raw Material Sourcing

- Challenges: Technical, Economic, and Environmental Barriers

- Investment, Funding, and Partnership Trends

- Future Outlook: Opportunities and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

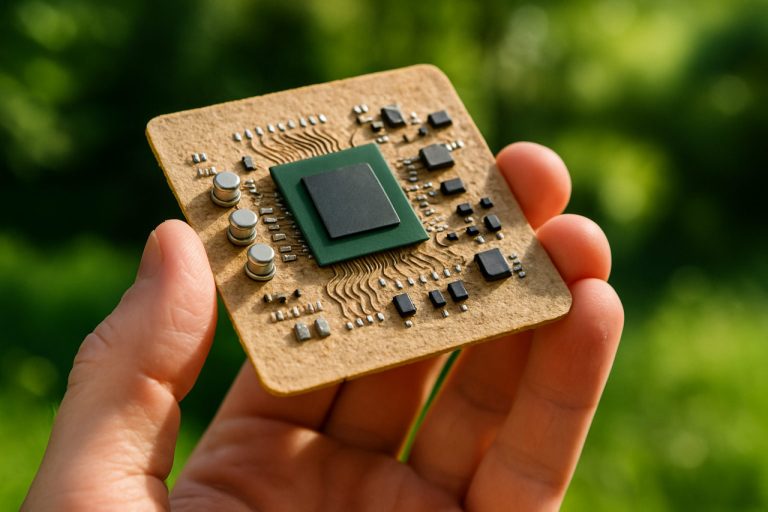

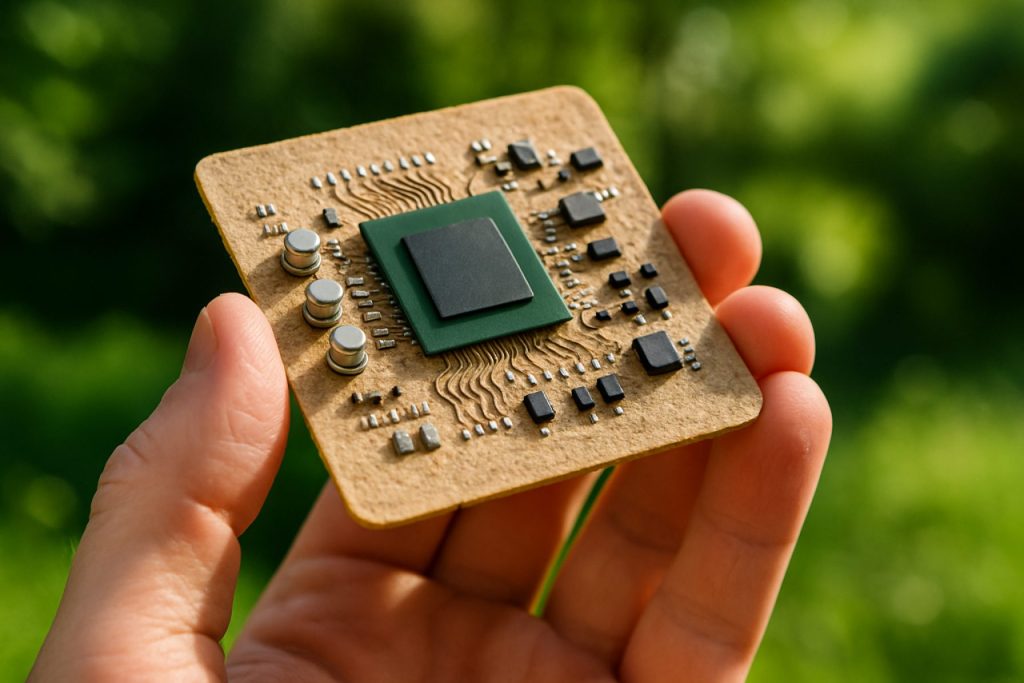

The development of biodegradable electronics is accelerating in 2025, driven by mounting environmental concerns, regulatory pressures, and advances in materials science. The electronics industry faces increasing scrutiny over e-waste, which is projected to reach over 75 million metric tons globally by 2030. In response, manufacturers and research institutions are prioritizing the creation of devices that can safely decompose after use, reducing landfill burden and toxic material leakage.

Key trends in 2025 include the commercialization of transient electronics—devices designed to dissolve or degrade under specific environmental conditions. Major players such as Samsung Electronics and LG Electronics are investing in research partnerships to develop biodegradable substrates and conductive inks, aiming to integrate these materials into consumer products within the next few years. Sony Group Corporation has also announced pilot projects for biodegradable sensors and flexible circuits, targeting applications in medical diagnostics and environmental monitoring.

Material innovation is a central driver. Companies like BASF and DSM are supplying biopolymers and organic semiconductors that form the backbone of new device architectures. These materials enable the fabrication of flexible, lightweight electronics that maintain performance while offering controlled degradation profiles. In parallel, STMicroelectronics is exploring eco-friendly packaging and chip encapsulation methods, aiming to reduce the environmental footprint of integrated circuits.

Regulatory momentum is also shaping the market. The European Union’s Circular Electronics Initiative, effective from 2025, mandates stricter eco-design requirements and extended producer responsibility for electronic goods. This is prompting global manufacturers to accelerate the adoption of biodegradable components to ensure compliance and maintain market access.

Looking ahead, the outlook for biodegradable electronics is robust. Industry forecasts anticipate a surge in demand for single-use medical devices, smart packaging, and environmental sensors that can safely decompose after their functional lifespan. Strategic collaborations between electronics giants, chemical suppliers, and academic institutions are expected to yield commercially viable products by 2027. As the sector matures, the integration of biodegradable electronics into mainstream consumer and industrial applications will be a key differentiator for sustainability-focused brands.

Market Size and Forecast (2025–2030): Growth Projections and CAGR Analysis

The market for biodegradable electronics is poised for significant expansion between 2025 and 2030, driven by increasing regulatory pressure to reduce electronic waste, advances in materials science, and growing demand for sustainable alternatives in consumer and medical electronics. As of 2025, the sector remains in its early commercialization phase, but several key players and consortia are accelerating the transition from laboratory prototypes to scalable manufacturing.

Major electronics manufacturers and materials suppliers are investing in research and pilot production lines for biodegradable substrates, conductors, and encapsulants. Samsung Electronics has publicly committed to exploring eco-friendly materials for future device generations, including biodegradable polymers for flexible displays and circuit boards. Similarly, Panasonic Corporation is developing cellulose-based substrates and organic semiconductors for transient electronics, targeting both consumer and healthcare applications.

In the medical sector, companies such as Medtronic are collaborating with academic partners to develop implantable biodegradable sensors and stimulators, aiming to reduce the need for surgical removal and minimize long-term environmental impact. Meanwhile, materials innovators like BASF are scaling up production of compostable polymers and conductive inks tailored for electronic applications, supporting the supply chain for next-generation devices.

From 2025 onward, the biodegradable electronics market is projected to achieve a compound annual growth rate (CAGR) exceeding 20%, with the total market value expected to surpass several hundred million USD by 2030. Growth will be strongest in regions with stringent e-waste regulations, such as the European Union and parts of East Asia, where government incentives and extended producer responsibility schemes are accelerating adoption.

Key growth segments include single-use medical devices, smart packaging, environmental sensors, and wearable electronics. The convergence of printed electronics and biodegradable materials is enabling the development of ultra-low-cost, disposable devices for logistics, agriculture, and healthcare. Industry consortia and standards bodies, such as the IEEE, are actively working on guidelines to ensure safety, performance, and end-of-life management for biodegradable electronic products.

Looking ahead, the market outlook for 2025–2030 is characterized by rapid innovation, increasing investment from both established electronics giants and specialized startups, and a growing ecosystem of suppliers and integrators. As manufacturing processes mature and economies of scale are realized, biodegradable electronics are expected to transition from niche applications to mainstream adoption across multiple industries.

Breakthrough Technologies: Materials and Manufacturing Innovations

The development of biodegradable electronics is accelerating in 2025, driven by mounting concerns over electronic waste and the need for sustainable alternatives to conventional devices. Recent breakthroughs in materials science and manufacturing processes are enabling the creation of electronic components that can safely decompose after use, reducing environmental impact and opening new possibilities for transient devices in medical, agricultural, and consumer applications.

A key area of innovation is the use of organic and bio-derived materials as substrates, conductors, and semiconductors. Companies such as Samsung Electronics are actively researching flexible, biodegradable substrates made from cellulose nanofibers and silk proteins, which can replace traditional plastics in circuit boards. These materials offer mechanical flexibility and can be processed using existing roll-to-roll manufacturing techniques, facilitating scalable production.

In 2025, STMicroelectronics has announced pilot projects integrating biodegradable polymers into sensor platforms for medical implants. These devices are designed to dissolve harmlessly in the body after their functional lifetime, eliminating the need for surgical removal. The company is collaborating with academic partners to optimize the degradation rates and biocompatibility of these materials, aiming for regulatory approval in the next few years.

Another significant advance comes from TDK Corporation, which is developing biodegradable capacitors and passive components using natural polymers and water-soluble metals. These components are being tested in single-use environmental sensors and smart packaging, where device longevity is limited by design. TDK’s research focuses on balancing electrical performance with controlled degradation, ensuring reliability during use and rapid breakdown afterward.

Manufacturing innovations are also playing a crucial role. Additive manufacturing and inkjet printing techniques are being adapted to deposit biodegradable electronic inks onto flexible substrates, enabling rapid prototyping and customization. Xerox Holdings Corporation is leveraging its expertise in printed electronics to develop eco-friendly inks based on conductive polymers and natural dyes, targeting applications in smart labels and disposable diagnostics.

Looking ahead, the outlook for biodegradable electronics is promising, with industry analysts expecting commercial launches of transient medical devices, smart packaging, and environmental sensors within the next two to three years. Continued collaboration between material suppliers, device manufacturers, and regulatory bodies will be essential to address challenges related to performance, safety, and large-scale production. As these technologies mature, biodegradable electronics are poised to become a key component of the circular economy, reducing e-waste and enabling new classes of sustainable devices.

Leading Companies and Industry Initiatives

The development of biodegradable electronics has accelerated in 2025, driven by mounting concerns over electronic waste and the need for sustainable alternatives in consumer and medical devices. Several leading companies and industry initiatives are shaping the landscape, focusing on materials innovation, scalable manufacturing, and real-world deployment.

One of the most prominent players is Samsung Electronics, which has publicly committed to advancing eco-friendly technologies, including research into biodegradable substrates and packaging for its electronic products. In 2025, Samsung’s R&D division is collaborating with academic partners to develop flexible, compostable circuit boards and sensors, aiming to integrate these into select wearable and medical devices within the next two years.

Another key contributor is STMicroelectronics, a global semiconductor manufacturer. The company has announced pilot projects for biodegradable microchips, leveraging organic materials and water-soluble polymers. These initiatives are part of STMicroelectronics’ broader sustainability roadmap, which includes reducing the environmental impact of its products throughout their lifecycle.

In the medical sector, Medtronic is at the forefront of developing transient bioelectronics—devices designed to safely dissolve in the body after use. In 2025, Medtronic is conducting clinical trials for biodegradable sensors intended for post-surgical monitoring, with the goal of commercial deployment by 2027. These efforts are supported by partnerships with material science startups and university research centers.

On the materials side, BASF, a leading chemical company, is supplying biodegradable polymers and conductive inks tailored for electronic applications. BASF’s collaborations with electronics manufacturers are focused on scaling up production and ensuring the reliability of these new materials in commercial devices.

Industry-wide initiatives are also gaining momentum. The IEEE has established working groups to develop standards for biodegradable electronics, addressing issues such as material safety, performance benchmarks, and end-of-life management. These standards are expected to facilitate broader adoption and regulatory acceptance in the coming years.

Looking ahead, the outlook for biodegradable electronics is promising. With major industry players investing in R&D and pilot production, and with supportive frameworks from organizations like IEEE, the sector is poised for significant growth. By 2027, experts anticipate the first wave of commercial biodegradable electronic products in consumer health, packaging, and environmental monitoring, marking a pivotal shift toward sustainable electronics.

Applications: Medical Devices, Consumer Electronics, and Environmental Sensors

Biodegradable electronics are rapidly transitioning from laboratory prototypes to real-world applications, with 2025 marking a pivotal year for their integration into medical devices, consumer electronics, and environmental sensors. The drive toward sustainability, combined with regulatory and consumer pressure to reduce electronic waste, is accelerating the adoption of these innovative technologies.

In the medical sector, biodegradable electronics are enabling new classes of implantable devices that naturally dissolve after serving their function, eliminating the need for surgical removal. Companies such as Medtronic and Boston Scientific are actively exploring transient bioresorbable sensors and stimulators for post-surgical monitoring and drug delivery. These devices, often based on materials like magnesium, silk fibroin, and polylactic acid, are designed to safely degrade in the body, reducing patient risk and healthcare costs. In 2025, clinical trials are expanding for temporary cardiac monitors and neural interfaces, with regulatory pathways being clarified in major markets.

Consumer electronics are also seeing early-stage adoption of biodegradable components, particularly in single-use or short-lifecycle products. Samsung Electronics has announced research initiatives into biodegradable substrates for flexible displays and wearable sensors, aiming to reduce the environmental impact of disposable devices. Similarly, Panasonic Corporation is developing compostable casings and circuit boards for low-power IoT devices, with pilot programs expected to launch in select markets by late 2025. These efforts are supported by advances in printable organic semiconductors and cellulose-based substrates, which offer both performance and end-of-life degradability.

Environmental monitoring is another area where biodegradable electronics are poised for significant impact. Deployable sensor networks for soil, water, and air quality monitoring often require large numbers of distributed devices, many of which are difficult to retrieve after use. Companies like STMicroelectronics are collaborating with research institutions to develop fully biodegradable sensor nodes that can be left in the environment without contributing to pollution. These sensors, incorporating transient batteries and organic transistors, are being field-tested in agricultural and urban settings throughout 2025, with scalability and cost-effectiveness as key focus areas.

Looking ahead, the next few years are expected to bring further commercialization, as material science breakthroughs and manufacturing scale-up reduce costs and improve device reliability. Industry partnerships and government initiatives are likely to accelerate standards development and regulatory acceptance, paving the way for broader adoption of biodegradable electronics across medical, consumer, and environmental domains.

Regulatory Landscape and Industry Standards

The regulatory landscape for biodegradable electronics is rapidly evolving as governments and industry bodies respond to the dual imperatives of technological innovation and environmental sustainability. In 2025, the sector is witnessing increased attention from regulators, particularly in the European Union, where the European Commission is actively updating directives related to electronic waste (WEEE Directive) and eco-design requirements to include provisions for biodegradable and bio-based materials. These updates are expected to set benchmarks for material safety, end-of-life management, and labeling, influencing global supply chains.

In the United States, the U.S. Environmental Protection Agency (EPA) is engaging with industry stakeholders to develop voluntary guidelines for biodegradable electronics, focusing on lifecycle assessment, toxicity, and compostability standards. While federal regulations specific to biodegradable electronics are still in development, several states are considering their own measures, particularly in California, which has a history of pioneering e-waste legislation.

Industry standards are also emerging through international organizations. The International Organization for Standardization (ISO) is working on new standards for bioplastics and biodegradable materials in electronics, building on existing frameworks such as ISO 17088 for compostable plastics. These standards aim to harmonize definitions, testing protocols, and certification processes, facilitating cross-border trade and compliance.

Major electronics manufacturers and material suppliers are proactively engaging with these regulatory developments. For example, Samsung Electronics has announced pilot projects for biodegradable circuit boards and is participating in industry consortia to shape future standards. Similarly, STMicroelectronics is collaborating with academic and industrial partners to develop biodegradable sensors and is advocating for clear regulatory pathways to accelerate commercialization.

Looking ahead, the next few years are likely to see the introduction of mandatory eco-labeling for biodegradable electronics in several jurisdictions, as well as stricter requirements for end-of-life recovery and recycling. Industry groups such as the IEEE are expected to play a key role in developing technical standards and best practices, ensuring interoperability and safety. As regulatory clarity increases, investment in biodegradable electronics is projected to accelerate, with compliance and certification becoming critical differentiators in the global market.

Supply Chain and Raw Material Sourcing

The supply chain and raw material sourcing for biodegradable electronics are rapidly evolving as the sector moves from laboratory-scale innovation to early commercialization. In 2025, the focus is on securing reliable, scalable sources of biodegradable substrates, conductors, and semiconductors, while ensuring environmental and ethical standards throughout the supply chain.

Key raw materials for biodegradable electronics include cellulose-based substrates, silk fibroin, polylactic acid (PLA), and other biopolymers, as well as organic semiconductors and naturally derived conductive inks. Stora Enso, a global leader in renewable materials, has expanded its production of microfibrillated cellulose and paper-based substrates, which are increasingly used as flexible, compostable circuit boards. Similarly, BASF is scaling up its biopolymer production, including PLA and other compostable plastics, to meet growing demand from electronics manufacturers seeking sustainable alternatives to traditional petroleum-based materials.

On the semiconductor side, companies such as Nitto Denko Corporation are developing organic and biodegradable conductive films, leveraging their expertise in functional materials for flexible electronics. Meanwhile, Samsung Electronics has announced pilot projects exploring the integration of biodegradable substrates and inks into select consumer electronics components, signaling a potential shift in sourcing strategies among major device manufacturers.

Supply chain traceability and certification are becoming increasingly important, with industry bodies such as the IEEE and OEKO-TEX working on standards for biodegradable electronic materials. These standards aim to ensure that raw materials are sourced from renewable, non-toxic, and ethically managed origins, and that end-of-life disposal aligns with circular economy principles.

Looking ahead, the sector faces challenges in scaling up the production of high-purity, electronics-grade biodegradable materials, as well as in establishing robust logistics for global supply. However, with major material suppliers and electronics manufacturers investing in R&D and pilot-scale production, the outlook for 2025 and beyond is positive. The next few years are expected to see increased collaboration between raw material producers, device manufacturers, and certification bodies, driving the maturation of supply chains and enabling broader adoption of biodegradable electronics in consumer, medical, and industrial applications.

Challenges: Technical, Economic, and Environmental Barriers

The development of biodegradable electronics in 2025 faces a complex array of technical, economic, and environmental challenges that continue to shape the sector’s trajectory. Technically, one of the most significant hurdles is achieving reliable device performance while ensuring controlled degradation. Biodegradable substrates and components—often based on materials such as cellulose, silk fibroin, or polylactic acid—tend to have lower electrical conductivity, mechanical strength, and stability compared to conventional silicon-based electronics. This limits their application to low-power, short-lifetime devices such as medical implants, environmental sensors, and transient RFID tags. Companies like Samsung Electronics and Texas Instruments have demonstrated interest in sustainable electronics, but integrating fully biodegradable components into mainstream products remains a technical challenge due to issues with miniaturization, encapsulation, and maintaining device integrity during use.

From an economic perspective, the cost of producing biodegradable electronics is currently higher than that of traditional devices. The specialized materials and manufacturing processes required—such as low-temperature deposition and solvent-free fabrication—are not yet optimized for large-scale production. This results in higher per-unit costs and limits the commercial viability of biodegradable electronics outside of niche markets. For example, STMicroelectronics has explored eco-friendly packaging and materials, but the transition to fully biodegradable systems is hampered by the lack of established supply chains and economies of scale. Additionally, the limited lifespan of biodegradable devices can deter investment, as many applications require longer operational periods than current materials can provide.

Environmental challenges also persist. While biodegradable electronics are designed to reduce e-waste, the degradation products of some materials may still pose ecological risks if not properly managed. Ensuring that all components—including conductors, semiconductors, and encapsulants—break down into non-toxic byproducts is a significant research focus. Organizations such as Flex (formerly Flextronics), which is involved in sustainable electronics manufacturing, are working to address these concerns by developing new material formulations and end-of-life management strategies. However, comprehensive standards and certification processes for biodegradability and environmental safety are still emerging, creating uncertainty for manufacturers and end-users.

Looking ahead to the next few years, overcoming these barriers will require coordinated efforts across the supply chain, increased investment in materials science, and the establishment of clear regulatory frameworks. As industry leaders and research institutions continue to innovate, the sector is expected to make incremental progress, but widespread adoption of biodegradable electronics will likely depend on breakthroughs in both material performance and cost reduction.

Investment, Funding, and Partnership Trends

The landscape of investment, funding, and partnerships in biodegradable electronics is rapidly evolving as the sector matures and sustainability becomes a central concern for the electronics industry. In 2025, significant capital inflows are being observed from both established electronics manufacturers and specialized venture capital funds, reflecting growing confidence in the commercial viability of biodegradable technologies.

Major electronics companies are increasingly allocating resources to research and development of biodegradable components. For instance, Samsung Electronics has publicly committed to advancing eco-friendly materials and has initiated collaborations with academic institutions to explore biodegradable substrates and packaging for consumer electronics. Similarly, Panasonic Corporation has announced investments in startups focused on organic semiconductors and compostable circuit boards, aiming to integrate these innovations into their product lines within the next few years.

Startups specializing in biodegradable electronics have attracted notable venture capital and strategic investments. Companies such as imec, a leading R&D hub in nanoelectronics and digital technologies, have expanded their partnerships with both multinational corporations and government agencies to accelerate the commercialization of biodegradable sensors and flexible devices. In 2025, imec’s collaborative projects with European and Asian partners are expected to yield pilot-scale production of transient electronics for medical and environmental monitoring applications.

On the materials side, suppliers like BASF are investing in the development of biodegradable polymers tailored for electronic applications. BASF’s partnerships with device manufacturers and research consortia are focused on scaling up the production of compostable substrates and encapsulants, with pilot programs underway in both Europe and Asia.

Government funding and public-private partnerships are also playing a pivotal role. The European Union’s Horizon Europe program continues to support collaborative projects involving universities, SMEs, and large industry players to advance biodegradable electronics. In Asia, government-backed initiatives in South Korea and Japan are fostering joint ventures between local electronics giants and material science startups, aiming to establish regional supply chains for sustainable electronics components.

Looking ahead, the next few years are expected to see a surge in cross-sector partnerships, as automotive, healthcare, and consumer electronics companies seek to integrate biodegradable solutions into their products. The convergence of regulatory pressure, consumer demand, and technological breakthroughs is likely to drive further investment and strategic alliances, positioning biodegradable electronics as a key growth area in the global electronics industry.

Future Outlook: Opportunities and Strategic Recommendations

The outlook for biodegradable electronics development in 2025 and the coming years is shaped by accelerating innovation, regulatory momentum, and growing demand for sustainable alternatives to conventional electronic devices. As environmental concerns over electronic waste (e-waste) intensify, the sector is witnessing increased investment and collaboration among material suppliers, device manufacturers, and end-users.

Key industry players are advancing the commercialization of biodegradable components. Samsung Electronics has publicly committed to exploring eco-friendly materials and processes, including research into biodegradable substrates for flexible displays and sensors. Similarly, Panasonic Corporation is developing organic electronic materials and has announced pilot projects for compostable circuit boards. In the United States, DuPont is leveraging its expertise in specialty polymers to supply biodegradable dielectric materials for printed electronics, while BASF is scaling up production of biopolymers suitable for electronic applications.

The European Union’s Circular Economy Action Plan, which includes stricter e-waste directives coming into force by 2025, is expected to drive adoption of biodegradable electronics across consumer and industrial markets. This regulatory push is prompting manufacturers to accelerate R&D and pilot deployments. For example, STMicroelectronics is collaborating with academic partners to develop transient electronics for medical and environmental monitoring, aiming for market introduction within the next two years.

Opportunities abound in sectors where device lifespans are short or environmental impact is critical. Single-use medical sensors, agricultural monitoring tags, and smart packaging are poised for early adoption. Strategic recommendations for stakeholders include:

- Investing in scalable manufacturing processes for biodegradable substrates and inks, leveraging partnerships with chemical suppliers such as Covestro and Evonik Industries.

- Engaging with regulatory bodies and industry consortia to shape standards and certification schemes for biodegradable electronics, ensuring market acceptance and compliance.

- Focusing on end-of-life management solutions, including composting and recycling infrastructure, in collaboration with waste management leaders like Veolia.

- Prioritizing applications with clear environmental and economic benefits, such as medical diagnostics and smart agriculture, to demonstrate value and build consumer trust.

In summary, 2025 marks a pivotal year for biodegradable electronics, with regulatory drivers, technological advances, and strategic partnerships converging to accelerate market entry. Companies that proactively invest in R&D, supply chain integration, and standards development are well positioned to capture emerging opportunities in this rapidly evolving field.

Sources & References

- LG Electronics

- BASF

- DSM

- STMicroelectronics

- Medtronic

- IEEE

- Xerox Holdings Corporation

- Boston Scientific

- European Commission

- International Organization for Standardization

- OEKO-TEX

- Texas Instruments

- Flex

- imec

- DuPont

- Covestro

- Evonik Industries

- Veolia