How Conductive Diamond Electrodes Are Transforming Advanced Water Treatment: 2025 Market Outlook, Technology Trends, and Growth Opportunities. Discover the Next Wave of Sustainable Water Purification Solutions.

- Executive Summary: Key Findings and 2025 Highlights

- Market Size and Growth Forecast (2025–2030): CAGR, Revenue, and Volume Projections

- Technology Overview: Principles and Advantages of Conductive Diamond Electrodes

- Competitive Landscape: Leading Manufacturers and Innovators (e.g., deNora.com, adamant-namiki.com)

- Application Segments: Municipal, Industrial, and Emerging Uses

- Regulatory Drivers and Environmental Standards (e.g., epa.gov, water.org)

- Recent Innovations: Materials, Coatings, and System Integration

- Challenges and Barriers: Cost, Scalability, and Adoption Hurdles

- Regional Analysis: Key Markets in North America, Europe, and Asia-Pacific

- Future Outlook: Disruptive Trends, Investment Hotspots, and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and 2025 Highlights

The global market for conductive diamond electrodes (CDEs) in advanced water treatment is poised for significant growth in 2025, driven by escalating regulatory demands for contaminant removal, the need for robust and sustainable treatment technologies, and the unique performance advantages of boron-doped diamond (BDD) electrodes. CDEs, particularly BDD variants, are increasingly recognized for their exceptional chemical stability, high overpotential for oxygen evolution, and ability to mineralize persistent organic pollutants, pharmaceuticals, and industrial effluents that challenge conventional treatment methods.

In 2025, several leading manufacturers are scaling up production and deployment of CDEs. Degrenne Technologies (France) continues to expand its portfolio of BDD electrodes, supplying both municipal and industrial water treatment sectors. Neocoat (Switzerland) is advancing the commercialization of high-purity BDD electrodes, with a focus on modular electrochemical reactors for decentralized and on-site water purification. Advent Diamond (USA) is leveraging its expertise in synthetic diamond growth to develop next-generation electrodes with enhanced durability and efficiency, targeting both water reuse and industrial wastewater applications.

Recent pilot projects and commercial installations in Europe and Asia have demonstrated the efficacy of CDEs in degrading recalcitrant contaminants such as per- and polyfluoroalkyl substances (PFAS), pharmaceuticals, and dyes. These successes are prompting utilities and industrial operators to consider CDEs as a viable alternative or complement to advanced oxidation processes (AOPs) and membrane technologies. The ability of BDD electrodes to operate at high current densities with minimal fouling and low maintenance requirements is a key differentiator, especially in challenging water matrices.

Looking ahead, the outlook for 2025 and the following years is marked by continued innovation in electrode fabrication, including the development of larger-area electrodes, improved doping techniques, and integration with renewable energy sources for sustainable operation. Industry collaborations and public-private partnerships are expected to accelerate technology adoption, particularly in regions facing acute water scarcity and stringent discharge regulations. Companies such as Degrenne Technologies and Neocoat are actively engaging with utilities and research institutions to validate performance at scale.

In summary, 2025 is set to be a pivotal year for conductive diamond electrodes in advanced water treatment, with expanding commercial deployments, technological advancements, and growing recognition of their role in addressing emerging contaminants and supporting circular water management strategies.

Market Size and Growth Forecast (2025–2030): CAGR, Revenue, and Volume Projections

The global market for conductive diamond electrodes (CDEs) in advanced water treatment is poised for robust growth between 2025 and 2030, driven by increasing regulatory pressure on water quality, the need for effective treatment of emerging contaminants, and the unique advantages of boron-doped diamond (BDD) electrodes. As of 2025, the market is characterized by a mix of established players and innovative entrants, with a strong focus on scaling up production and reducing costs to enable broader adoption in municipal, industrial, and decentralized water treatment applications.

Current estimates suggest that the CDE market will experience a compound annual growth rate (CAGR) in the range of 12–16% through 2030, with total market revenues projected to surpass USD 500 million by the end of the forecast period. This growth is underpinned by increasing investments in advanced oxidation processes (AOPs) and electrochemical water treatment technologies, where BDD electrodes are recognized for their high oxidation potential, chemical inertness, and long operational lifetimes.

Key manufacturers such as Degrenne Technologies (France), a pioneer in industrial-scale BDD electrode production, and Neocoat (Switzerland), known for its proprietary chemical vapor deposition (CVD) processes, are expanding their manufacturing capacities to meet rising demand. Advent Diamond (USA) is also advancing the commercialization of synthetic diamond materials for electrochemical applications, while Element Six (a De Beers Group company) remains a global leader in synthetic diamond solutions, including electrodes for water treatment.

Volume projections indicate that the number of installed CDE units in municipal and industrial water treatment plants will more than double by 2030, with particularly strong uptake in regions facing water scarcity and stringent effluent regulations, such as Europe, East Asia, and the Middle East. The adoption of CDEs is also expected to accelerate in decentralized and point-of-use systems, supported by ongoing R&D and pilot projects.

Looking ahead, the market outlook remains positive, with further growth anticipated as manufacturing costs decline, electrode lifetimes increase, and regulatory frameworks continue to favor advanced treatment technologies. Strategic partnerships between electrode manufacturers, water technology integrators, and end-users are expected to play a critical role in scaling up deployment and unlocking new market segments.

Technology Overview: Principles and Advantages of Conductive Diamond Electrodes

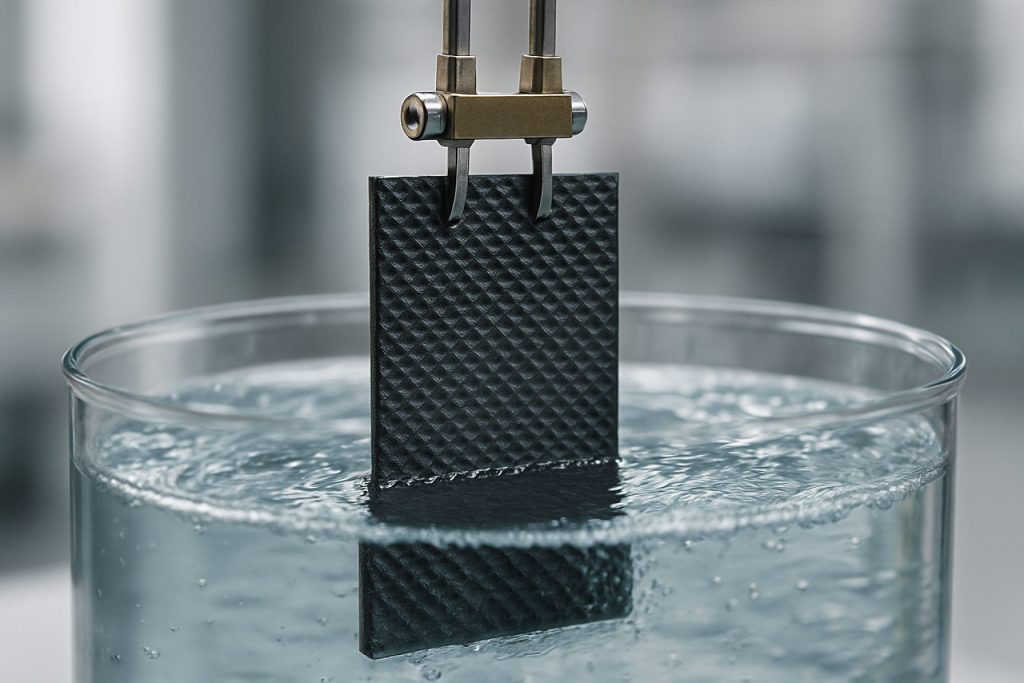

Conductive diamond electrodes, particularly those based on boron-doped diamond (BDD), have emerged as a transformative technology in advanced water treatment. These electrodes are fabricated by doping synthetic diamond films with boron, imparting high electrical conductivity while retaining the exceptional chemical and physical stability of diamond. The unique properties of BDD electrodes—such as wide potential window, low background current, and extreme resistance to corrosion—enable highly efficient and robust electrochemical processes for water purification.

The core principle behind conductive diamond electrodes lies in their ability to generate powerful oxidizing species, notably hydroxyl radicals, directly at the electrode surface during electrolysis. This non-selective oxidation mechanism allows for the breakdown of a wide range of organic pollutants, including persistent pharmaceutical residues, pesticides, and industrial chemicals, which are often resistant to conventional treatment methods. Furthermore, BDD electrodes can facilitate the disinfection of water by inactivating bacteria and viruses without the formation of harmful disinfection byproducts.

Compared to traditional electrode materials such as graphite, platinum, or mixed metal oxides, BDD electrodes offer several key advantages:

- Exceptional Durability: Diamond’s chemical inertness ensures long operational lifetimes, even under harsh conditions and high current densities.

- High Oxidation Power: The wide electrochemical window (up to 3.5 V in aqueous solutions) enables the generation of strong oxidants, leading to complete mineralization of contaminants.

- Low Fouling: The smooth, non-porous diamond surface resists fouling and scaling, reducing maintenance requirements.

- Selective and Safe Operation: Minimal production of secondary pollutants or toxic intermediates, supporting safer water treatment processes.

As of 2025, several companies are actively commercializing BDD electrode technology for water treatment. Degrenne Technologies (France) is a leading manufacturer, offering BDD electrodes for industrial and municipal water treatment systems. Neocoat (Switzerland) specializes in the production of high-quality BDD coatings and electrodes, supplying both research and commercial markets. Advent Diamond (USA) is advancing synthetic diamond technologies, including conductive diamond components for electrochemical applications. These companies are driving the adoption of BDD electrodes in pilot and full-scale installations worldwide.

Looking ahead, the outlook for conductive diamond electrodes in water treatment is highly promising. Ongoing improvements in manufacturing scalability and cost reduction are expected to accelerate deployment in municipal, industrial, and decentralized water treatment systems over the next few years. The technology’s ability to address emerging contaminants and support circular water management aligns with global sustainability goals, positioning BDD electrodes as a cornerstone of next-generation water purification solutions.

Competitive Landscape: Leading Manufacturers and Innovators (e.g., deNora.com, adamant-namiki.com)

The competitive landscape for conductive diamond electrodes in advanced water treatment is characterized by a small but growing group of specialized manufacturers and technology innovators. As of 2025, the market is led by a handful of established companies with proven expertise in synthetic diamond materials, electrochemical systems, and water purification technologies.

One of the most prominent players is Industrie De Nora, an Italian multinational recognized for its pioneering work in electrochemical technologies. De Nora’s Boron Doped Diamond (BDD) electrodes are widely deployed in municipal and industrial water treatment, offering high oxidation power, chemical stability, and long operational lifetimes. The company’s diamond electrode systems are used for the removal of persistent organic pollutants, disinfection, and advanced oxidation processes. De Nora continues to invest in R&D, aiming to improve electrode efficiency and reduce production costs, and has announced new pilot projects in Europe and Asia for 2025.

Another key manufacturer is Adamant Namiki Precision Jewel Co., Ltd., a Japanese company with deep expertise in synthetic diamond growth and precision engineering. Adamant Namiki supplies high-purity BDD electrodes for laboratory, industrial, and environmental applications. Their proprietary chemical vapor deposition (CVD) processes enable the production of electrodes with tailored properties, such as high surface area and controlled doping levels, which are critical for advanced water treatment performance. The company collaborates with academic and industrial partners to develop next-generation electrode materials and has expanded its production capacity in response to rising global demand.

Other notable contributors include Neocoat SA, a Swiss firm specializing in CVD diamond coatings and electrodes, and Element Six, part of the De Beers Group, which is a global leader in synthetic diamond materials. Both companies supply BDD electrodes for water treatment and electrochemical sensing, leveraging their expertise in diamond synthesis and surface engineering. Element Six, in particular, has focused on scaling up production and developing robust, application-specific electrode solutions for industrial clients.

Looking ahead, the competitive landscape is expected to evolve as demand for advanced water treatment grows, driven by stricter regulations and the need to address emerging contaminants. Leading manufacturers are investing in automation, process optimization, and new electrode architectures to enhance performance and cost-effectiveness. Strategic partnerships between technology providers, utilities, and research institutions are likely to accelerate innovation and commercialization over the next few years.

Application Segments: Municipal, Industrial, and Emerging Uses

Conductive diamond electrodes, particularly those based on boron-doped diamond (BDD), are increasingly recognized as transformative materials for advanced water treatment across municipal, industrial, and emerging application segments. Their unique properties—exceptional chemical stability, high overpotential for oxygen evolution, and resistance to fouling—enable highly efficient electrochemical oxidation of persistent organic pollutants, pathogens, and other contaminants.

In the municipal sector, BDD electrodes are being integrated into advanced oxidation processes (AOPs) for the treatment of drinking water and municipal wastewater. These systems are particularly valued for their ability to degrade pharmaceuticals, endocrine-disrupting compounds, and microplastics that are resistant to conventional biological treatment. Companies such as Degrenne and Condias are actively supplying BDD electrode modules for pilot and full-scale municipal installations in Europe and Asia. In 2024 and 2025, several European utilities have initiated demonstration projects to evaluate the long-term operational stability and cost-effectiveness of BDD-based electrochemical treatment, with early results indicating significant reductions in trace organic contaminants and disinfection byproducts.

The industrial segment is witnessing rapid adoption of conductive diamond electrodes for the treatment of complex effluents from sectors such as pharmaceuticals, textiles, and electronics manufacturing. BDD electrodes are particularly effective for the mineralization of recalcitrant organics, cyanides, and perfluorinated compounds (PFAS), which are otherwise challenging to remove. Neocoat, a Swiss manufacturer, has expanded its production capacity in 2024 to meet growing demand from industrial clients in Europe and Asia, while Advent Diamond in the US is developing next-generation BDD electrodes with enhanced surface area and catalytic activity. Industrial users are attracted by the low maintenance requirements and the potential for on-site, chemical-free treatment, which aligns with tightening environmental regulations and sustainability goals.

Emerging uses for conductive diamond electrodes are also gaining momentum. In decentralized and mobile water treatment units, BDD electrodes offer compact, robust solutions for remote communities, disaster relief, and military applications. Additionally, research and pilot projects are exploring their use in the selective recovery of valuable resources from wastewater, such as precious metals and nutrients, and in the treatment of landfill leachate and hospital effluents. The next few years are expected to see further commercialization of these applications, supported by ongoing advances in electrode manufacturing and system integration.

Looking ahead to 2025 and beyond, the outlook for conductive diamond electrodes in advanced water treatment is highly positive. Continued investment by leading manufacturers, such as Element Six (a De Beers Group company), is expected to drive down costs and expand the range of available electrode formats. As regulatory pressures mount and the need for resilient, high-performance water treatment grows, BDD technology is poised to play a central role across municipal, industrial, and emerging application segments.

Regulatory Drivers and Environmental Standards (e.g., epa.gov, water.org)

The regulatory landscape for water treatment technologies is rapidly evolving, with increasing emphasis on advanced oxidation processes (AOPs) and the removal of persistent organic pollutants, pharmaceuticals, and microcontaminants. Conductive diamond electrodes, particularly those based on boron-doped diamond (BDD), are gaining attention due to their ability to generate powerful oxidants (e.g., hydroxyl radicals) and degrade a wide spectrum of contaminants without producing harmful byproducts. In 2025, regulatory drivers are intensifying, as agencies such as the United States Environmental Protection Agency (EPA) and the Water.org organization continue to update standards for drinking water and wastewater effluent quality.

The EPA’s Unregulated Contaminant Monitoring Rule (UCMR 5), effective from 2023 and influencing standards through 2025, mandates monitoring of emerging contaminants such as per- and polyfluoroalkyl substances (PFAS), pharmaceuticals, and endocrine-disrupting compounds. These regulations are pushing utilities and industrial operators to adopt more robust treatment solutions. Conductive diamond electrodes are uniquely positioned to address these challenges, as they can mineralize recalcitrant organics and destroy PFAS, which are otherwise resistant to conventional treatment methods. The EPA’s focus on “forever chemicals” and stricter discharge limits for industrial effluents are expected to accelerate the adoption of advanced electrochemical oxidation technologies.

Globally, the European Union’s Water Framework Directive and the Urban Waste Water Treatment Directive are also being revised to include stricter thresholds for micropollutants and to promote the use of innovative treatment technologies. These regulatory trends are mirrored in Asia, where countries like Japan and South Korea are updating their water quality standards to address pharmaceutical residues and industrial contaminants. The international push for water reuse and zero liquid discharge (ZLD) strategies further incentivizes the deployment of advanced oxidation processes, including those based on conductive diamond electrodes.

Industry leaders such as Degrenne and Condias are actively collaborating with utilities and industrial partners to demonstrate the efficacy of BDD electrode systems in meeting new regulatory requirements. These companies are scaling up pilot projects and commercial installations, focusing on the removal of PFAS, pharmaceuticals, and other priority pollutants. As regulatory agencies continue to tighten standards and expand the list of regulated contaminants, the outlook for conductive diamond electrode technologies in advanced water treatment remains strong for 2025 and the coming years.

Recent Innovations: Materials, Coatings, and System Integration

Recent years have witnessed significant advancements in the development and deployment of conductive diamond electrodes (CDEs) for advanced water treatment applications. These innovations span materials engineering, surface coatings, and system-level integration, positioning CDEs as a promising solution for the removal of persistent organic pollutants, pharmaceuticals, and other contaminants from water streams.

A major breakthrough has been the refinement of boron-doped diamond (BDD) electrodes, which are prized for their exceptional chemical stability, high overpotential for oxygen evolution, and resistance to fouling. Leading manufacturers such as Degrenne Technologies and Neocoat have expanded their production capabilities, offering BDD electrodes with improved uniformity, larger surface areas, and customizable geometries. These enhancements are critical for scaling up from laboratory to industrial-scale water treatment systems.

Material innovations have focused on optimizing the doping process and substrate selection. Recent efforts have shifted towards using niobium and silicon substrates, which offer better mechanical properties and cost-effectiveness compared to traditional titanium bases. Companies like Advent Diamond are exploring advanced chemical vapor deposition (CVD) techniques to produce high-purity, defect-free diamond films, further improving electrode longevity and performance.

Coating technologies have also evolved, with multilayer structures and nanostructured surfaces being developed to enhance electrochemical activity and reduce energy consumption. For instance, the integration of nanodiamond coatings and hybrid materials is being pursued to increase the active surface area and tailor the electrode’s selectivity for specific contaminants. These approaches are expected to be commercialized within the next few years, as pilot projects transition to full-scale operations.

System integration is another area of rapid progress. Modular reactor designs incorporating CDEs are being tested for decentralized and on-site water treatment, enabling flexible deployment in municipal, industrial, and remote settings. Companies such as Condias are at the forefront, offering turnkey electrochemical water treatment systems that leverage the unique properties of diamond electrodes for advanced oxidation processes (AOPs). These systems are being validated for the degradation of recalcitrant compounds, including PFAS and pharmaceutical residues, with promising results in terms of efficiency and operational cost.

Looking ahead to 2025 and beyond, the outlook for conductive diamond electrodes in water treatment is highly positive. Ongoing collaborations between manufacturers, utilities, and research institutions are expected to accelerate the adoption of these technologies, driven by tightening water quality regulations and the need for sustainable treatment solutions. As production costs continue to decrease and system integration becomes more streamlined, CDE-based water treatment is poised for broader commercial deployment in the coming years.

Challenges and Barriers: Cost, Scalability, and Adoption Hurdles

The adoption of conductive diamond electrodes (CDEs) for advanced water treatment is gaining momentum, but several challenges and barriers remain as of 2025. Chief among these are high production costs, scalability limitations, and hurdles to widespread market adoption.

The primary challenge is the cost of manufacturing boron-doped diamond (BDD) electrodes, the most common type of CDE. The synthesis of high-quality diamond films typically relies on chemical vapor deposition (CVD) processes, which require expensive precursors, high energy input, and precise control over doping levels. As a result, the price of BDD electrodes remains significantly higher than that of conventional electrode materials such as graphite, titanium, or mixed metal oxides. For example, leading manufacturers like Neocoat and Advent Diamond continue to focus on optimizing CVD processes and exploring alternative substrates to reduce costs, but as of 2025, BDD electrodes are still considered a premium solution.

Scalability is another major barrier. While laboratory-scale and pilot-scale systems have demonstrated the effectiveness of CDEs in degrading persistent organic pollutants and disinfecting water, scaling up to industrial or municipal levels presents technical and economic challenges. The uniform deposition of diamond films on large or complex electrode geometries is difficult, and maintaining consistent electrochemical performance across large surface areas is a persistent issue. Companies such as Condias and Element Six are actively developing scalable manufacturing techniques and modular reactor designs, but widespread deployment is still limited to niche or high-value applications.

Adoption hurdles also stem from the conservative nature of the water treatment industry, which is risk-averse and subject to stringent regulatory requirements. Utilities and industrial users are hesitant to invest in new technologies without long-term operational data and clear cost-benefit analyses. Furthermore, the integration of CDEs into existing treatment infrastructure often requires significant retrofitting and operator training. Industry organizations and technology providers are working to address these concerns through demonstration projects and partnerships, but market penetration remains slow.

Looking ahead, the outlook for CDEs in water treatment will depend on continued advances in materials science, process engineering, and cost reduction. If manufacturers can achieve significant breakthroughs in electrode longevity, production efficiency, and system integration, CDEs could transition from specialized applications to broader adoption in municipal and industrial water treatment over the next several years.

Regional Analysis: Key Markets in North America, Europe, and Asia-Pacific

The market for conductive diamond electrodes (CDEs) in advanced water treatment is experiencing significant regional differentiation, with North America, Europe, and Asia-Pacific emerging as key markets. Each region demonstrates unique drivers, adoption rates, and industrial focus, shaping the global landscape for CDE deployment in 2025 and the coming years.

North America continues to be a leader in the adoption of advanced water treatment technologies, driven by stringent environmental regulations and the need for effective treatment of industrial and municipal wastewater. The United States, in particular, has seen increased investment in CDE-based systems for the removal of persistent organic pollutants and pharmaceuticals. Companies such as Advent Diamond are actively developing and commercializing boron-doped diamond (BDD) electrodes, targeting both municipal utilities and industrial clients. The region’s robust R&D ecosystem, supported by collaborations between technology developers and water utilities, is expected to accelerate the deployment of CDEs through 2025 and beyond.

Europe is characterized by a strong regulatory framework and ambitious sustainability targets, particularly under the European Green Deal and the Water Framework Directive. Countries such as Germany, Switzerland, and the Netherlands are at the forefront of integrating CDEs into advanced oxidation processes for micropollutant removal. De Beers Group, through its Element Six division, is a prominent supplier of synthetic diamond materials, including BDD electrodes, supporting pilot and full-scale installations across the continent. The European market is also witnessing increased public-private partnerships and EU-funded demonstration projects, which are expected to drive further adoption of CDEs in the next few years.

Asia-Pacific is emerging as a dynamic growth region, propelled by rapid industrialization, urbanization, and escalating concerns over water pollution. China, Japan, and South Korea are investing heavily in advanced water treatment infrastructure, with a focus on technologies capable of addressing recalcitrant contaminants. Companies such as Neocoat (Switzerland, with significant Asia-Pacific partnerships) and Advent Diamond are expanding their presence in the region, supplying CDEs for both research and commercial-scale applications. Local manufacturers in China and Japan are also entering the market, aiming to reduce costs and tailor solutions to regional needs. The Asia-Pacific market is expected to see the fastest growth rate for CDEs through 2025, driven by government initiatives and increasing private sector participation.

Overall, the outlook for conductive diamond electrodes in advanced water treatment is robust across these key regions, with ongoing technological advancements, regulatory support, and cross-border collaborations likely to shape market dynamics in the near future.

Future Outlook: Disruptive Trends, Investment Hotspots, and Strategic Recommendations

The future outlook for conductive diamond electrodes (CDEs) in advanced water treatment is marked by accelerating technological innovation, expanding commercial deployment, and increasing strategic investment. As of 2025, CDEs—primarily based on boron-doped diamond (BDD)—are recognized for their exceptional chemical stability, high overpotential for oxygen evolution, and ability to generate powerful oxidants for the degradation of persistent organic pollutants and pathogens. These properties position CDEs as a disruptive technology in the global push for sustainable and effective water purification solutions.

Key industry players such as Degrenne Technologies (France), a pioneer in industrial-scale BDD electrode manufacturing, and Neocoat (Switzerland), specializing in custom diamond coatings, are expanding their production capacities and diversifying application portfolios. These companies are actively collaborating with water utilities and industrial partners to pilot and scale up CDE-based electrochemical oxidation systems for municipal wastewater, industrial effluents, and decentralized water treatment units.

Recent years have seen a surge in public and private investment targeting the commercialization of CDEs. The European Union’s Green Deal and Horizon Europe programs are channeling funding into projects that integrate diamond electrode technology for micropollutant removal and water reuse, reflecting regulatory drivers for stricter contaminant limits and circular water management. In Asia, Japanese firms such as Kuraray are advancing the integration of diamond electrodes into compact, energy-efficient water treatment modules, aiming to address both industrial and municipal needs.

Disruptive trends shaping the sector include the development of lower-cost, large-area BDD electrodes through improved chemical vapor deposition (CVD) processes, and the emergence of hybrid systems that combine CDEs with complementary technologies such as membrane filtration and advanced oxidation processes. These innovations are expected to reduce capital and operational expenditures, making CDEs more accessible for widespread adoption.

Investment hotspots over the next few years are anticipated in regions facing acute water scarcity and stringent water quality regulations, notably the European Union, Japan, and parts of North America. Strategic recommendations for stakeholders include fostering cross-sector partnerships to accelerate pilot-to-commercial transitions, investing in manufacturing scale-up to drive down costs, and engaging with regulatory bodies to establish performance standards for CDE-based systems.

Overall, the outlook for conductive diamond electrodes in advanced water treatment is highly promising, with 2025 poised as a pivotal year for market expansion, technological breakthroughs, and the establishment of CDEs as a cornerstone of next-generation water purification infrastructure.