- The AI market, once booming in 2024, faces shifts following DeepSeek’s innovative model announcement.

- DeepSeek’s model slashes training costs for AI, impacting valuations and sparking market volatility.

- “Epigenetic AI” drives transformative possibilities, automating complex tasks across industries.

- US-China geopolitical tensions influence AI advancements, with regulations redirecting Chinese innovation.

- Key companies like Broadcom, ASM International, and Applied Materials emerge as leaders in AI chip development and manufacturing.

- Investors must weigh the balance between risk and opportunity in the AI landscape’s rapid evolution.

- Market fluctuations present both challenges and significant opportunities for future growth and innovation.

In the fast-evolving world of technology, breakthroughs can spark both exhilaration and uncertainty. The recent market tremors, intensified by the emergence of DeepSeek’s cutting-edge model, have sent ripples through the artificial intelligence realm. As the dust settles, investors and tech enthusiasts are keenly observing whether this is a unique opportunity or a potential red flag.

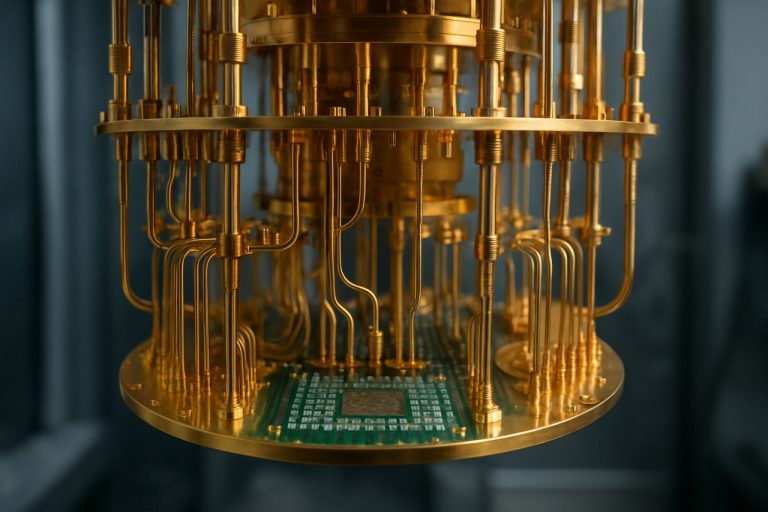

The financial landscape of AI stocks, which experienced an unprecedented surge in 2024, has encountered recent downturns. The catalyst for this shift was DeepSeek’s announcement of its revolutionary AI model, designed to train expansive language computers at a drastically reduced cost. The industry, akin to an intricate web, reacted in unison. Companies that once commanded high valuations saw their worth waver almost overnight. The promise of trimming down hardware expenses and increasing efficiency suddenly made existing market valuations seem inflated.

This disruption spotlighted the sensitivities underlying AI investments. Once glossed over news about data center realignments and decrease in chip orders became harbingers of broader market unease. Investors seemed to grapple with US tariff uncertainties, contributing to a jitteriness that the stock markets often despise. Yet, each fluctuation brings with it a potential doorway: companies at the confluence of AI and innovation remain buzzing with potential.

Leading the charge in transformative AI innovation is “epigenetic AI.” Picture an algorithm not just as a tool but as an entity with an element of independence, one that can shoulder tasks currently reserved for humans. Imagine a future where boarding your flight or managing daily requests becomes second nature for a digital assistant, a reality already being test-driven by tech giants. With potential as vast as autonomously crafting music or pioneering pharmaceutical breakthroughs, the horizon is boundless.

The global stage isn’t just about technology; it’s also about geopolitics. The dance between the US and China, particularly over AI progress, encapsulates today’s tensions. Stricter US regulations, curbing Chinese access to cutting-edge chips and manufacturing equipment, have inadvertently nudged Chinese tech entities like DeepSeek toward innovation through constraint. Their forced evolution, grounded in limited resources, could herald unforeseen advancements.

For investors navigating this dynamic landscape, selecting stalwart stocks is paramount. Broadcom emerges as a key player, addressing the industry’s demand for bespoke chips tailored for tech behemoths, aiming to circumvent the high costs typically associated with Nvidia’s products. ASM International steps into the spotlight as the linchpin for semiconductor innovation. Their patented atomic layer deposition methods stand at the forefront of microchip miniaturization, a critical need for future AI breakthroughs. Meanwhile, Applied Materials, with its monumental footprint in semiconductor equipment manufacturing, is poised to meet the swelling demand for sophisticated foundry tools.

Ultimately, today’s market oscillations are more than mere footholds of uncertainty; they are pavers on the path toward groundbreaking opportunity. As AI evolves, it is imperative to recognize the equilibrium between risk and potential. The pace is set, and the stakes have never been higher. As innovation edges forward, how we harness it will shape tomorrow’s frontier.

Could DeepSeek’s AI Revolutionize the Tech Industry?

Understanding the DeepSeek AI Model

The recent announcement by DeepSeek about its groundbreaking AI model has stirred the tech world. Unlike traditional AI systems that require costly hardware infrastructure, DeepSeek’s model promises a more cost-effective and efficient approach to training expansive language models. This advancement potentially democratizes access to sophisticated AI, allowing for more widespread and varied use cases beyond the tech giants.

Key Features and Potential Implications

– Cost Efficiency: DeepSeek’s model reportedly reduces the hardware and operational costs associated with training large AI models. This could lead to a paradigm shift where smaller companies and startups gain the capability to develop AI applications that were previously financially out of reach.

– Epigenetic AI: This concept of AI mimics biological instincts, potentially creating models that can self-improve and adapt. Such systems could handle tasks autonomously, from customer service interfaces to advanced problem-solving scenarios like healthcare diagnostics and financial modeling.

– Market Disruption: The news has already impacted AI and tech stock valuations. Companies heavily reliant on existing infrastructures must now pivot or face obsolescence, which creates a complex environment for investors.

Geopolitical Impacts on AI Development

The current geopolitical climate, particularly between the US and China, adds another layer of complexity. US restrictions on technology exports have forced Chinese companies like DeepSeek to innovate independently, potentially leading to unexpected advancements through constrained resources.

Investing in AI: Tomorrow’s Opportunities

– Broadcom: By providing bespoke chips, Broadcom remains a prime choice for investors looking for stable growth. This aligns with AI demands and anticipates future technological needs effectively.

– ASM International: Known for its innovation in semiconductor technologies, ASM is crucial in microchip miniaturization, a key component for powering advanced AI systems.

– Applied Materials: Dominating the semiconductor equipment manufacturing space, Applied Materials is poised to support the rising demand from AI developments.

Risks and Considerations

While the prospects are tantalizing, potential investors must tread carefully:

– Regulation and Compliance: With increased scrutiny on AI technologies, regulatory landscapes can shift rapidly, affecting market stability.

– Technological Limitations: Despite advancements, current AI models have limitations in decision-making similar to human reasoning, which can impede practical applications.

– Ethical Concerns: With more powerful AI, ethical considerations regarding privacy and autonomy remain at the forefront of public discourse.

Actionable Recommendations

– Diversify Investments: Spread investments across established companies that have clear AI strategies and emerging firms with innovative capabilities.

– Stay Informed: Engage with industry reports and expert analyses to understand the ever-evolving AI market landscape.

– Embrace Innovation: Be open to new technologies and concepts as they emerge, particularly those that offer efficiency and scalability.

Conclusion

The advent of DeepSeek’s AI model signals exciting potential and significant market recalibration. Investors and tech enthusiasts should watch closely as new opportunities unfold, balancing innovation with caution. For more insights into AI and emerging technologies, visit TechCrunch.