Flexible Electronics Manufacturing Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Trends, Regional Insights, and Growth Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Flexible Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts 2025–2030: CAGR and Revenue Projections

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

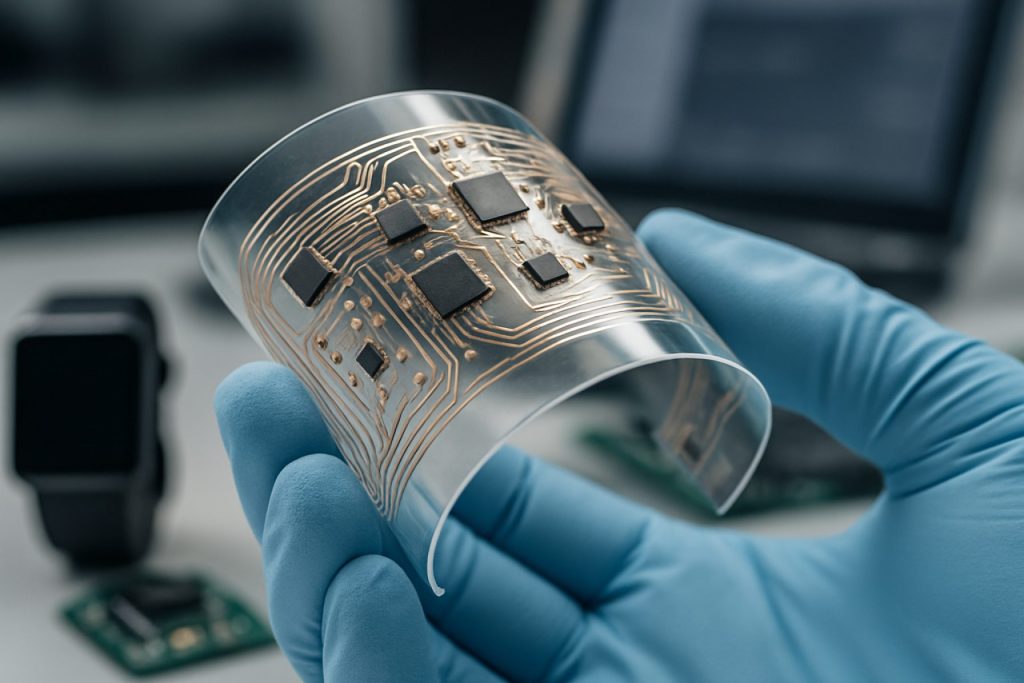

Flexible electronics manufacturing refers to the design and production of electronic circuits and devices built on flexible substrates such as plastic, metal foil, or paper, enabling products that are lightweight, bendable, and adaptable to unconventional form factors. As of 2025, the global flexible electronics market is experiencing robust growth, driven by advancements in materials science, increasing demand for wearable devices, and the proliferation of Internet of Things (IoT) applications.

According to IDTechEx, the flexible electronics market is projected to surpass $50 billion in annual revenue by 2025, with key segments including flexible displays, sensors, photovoltaics, and printed circuits. The adoption of flexible displays in smartphones, tablets, and foldable devices by major manufacturers such as Samsung Electronics and LG Display has accelerated market penetration, while the automotive and healthcare sectors are increasingly integrating flexible sensors and wearable patches for enhanced functionality and user experience.

Manufacturing innovations are central to this market’s expansion. Techniques such as roll-to-roll (R2R) printing, inkjet printing, and advanced photolithography have enabled high-throughput, cost-effective production of flexible circuits and components. Companies like DuPont and 3M are at the forefront, supplying advanced materials and substrates that enhance device durability and performance.

Geographically, Asia-Pacific dominates flexible electronics manufacturing, accounting for over 60% of global production capacity, with China, South Korea, and Japan leading in both innovation and volume output (MarketsandMarkets). North America and Europe are also significant players, particularly in R&D and high-value applications such as medical devices and aerospace.

Looking ahead to 2025, the flexible electronics manufacturing sector is poised for continued expansion, fueled by ongoing investments in R&D, the emergence of new application areas, and the convergence of flexible electronics with AI, 5G, and advanced sensor technologies. However, challenges remain in scaling up production, ensuring long-term reliability, and standardizing manufacturing processes across the industry.

Key Technology Trends in Flexible Electronics

Flexible electronics manufacturing in 2025 is characterized by rapid advancements in materials science, process innovation, and integration techniques, enabling the production of highly adaptable, lightweight, and durable electronic devices. The sector is witnessing a shift from traditional rigid substrates to flexible alternatives such as polyimide, polyethylene terephthalate (PET), and thermoplastic polyurethane (TPU), which offer superior mechanical flexibility and chemical resistance. These materials are foundational for next-generation applications in wearables, foldable displays, medical sensors, and smart packaging.

One of the most significant trends is the adoption of roll-to-roll (R2R) manufacturing processes. R2R enables high-throughput, continuous fabrication of electronic circuits on flexible substrates, drastically reducing production costs and time-to-market. This method is particularly advantageous for large-area electronics, such as flexible solar panels and electronic skins. According to IDTechEx, R2R processing is expected to be a key driver in scaling up flexible electronics production, with increasing investments from both established electronics manufacturers and startups.

Printing technologies, including inkjet, screen, and gravure printing, are also gaining traction for depositing conductive inks and functional materials onto flexible substrates. These additive manufacturing techniques allow for precise patterning, customization, and reduced material waste. The development of advanced conductive inks—such as silver nanowire, graphene, and carbon nanotube formulations—has further enhanced the electrical performance and mechanical reliability of flexible circuits. Frost & Sullivan highlights that innovations in printable materials are expanding the range of possible device architectures and functionalities.

Hybrid integration, combining flexible and rigid components, is another emerging trend. This approach leverages the strengths of both technologies, enabling complex system-in-package (SiP) solutions for applications requiring high performance and flexibility. For instance, flexible hybrid electronics (FHE) are being deployed in medical patches and industrial IoT sensors, where conformability and robust data processing are essential.

Automation and digitalization are further transforming flexible electronics manufacturing. Smart factories equipped with AI-driven quality control, predictive maintenance, and real-time process monitoring are improving yield and consistency. According to Gartner, the adoption of smart manufacturing technologies is expected to accelerate, supporting the scalability and reliability of flexible electronics production in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the flexible electronics manufacturing market in 2025 is characterized by a dynamic mix of established technology conglomerates, specialized material suppliers, and innovative startups. The sector is witnessing rapid advancements in materials science, printing techniques, and integration processes, which are driving both collaboration and competition among key players.

Leading the market are global electronics giants such as Samsung Electronics and LG Electronics, both of which have made significant investments in flexible display technologies for smartphones, wearables, and next-generation consumer devices. These companies leverage their scale, R&D capabilities, and established supply chains to maintain a competitive edge, particularly in the high-volume consumer electronics segment.

Material innovation is a critical differentiator, with companies like DuPont and Kuraray supplying advanced substrates, conductive inks, and encapsulation materials essential for flexible circuit fabrication. Their expertise in polymer chemistry and nanomaterials enables the development of thinner, more durable, and highly conductive components, which are crucial for the performance and reliability of flexible electronics.

In the realm of manufacturing equipment and process technology, firms such as Applied Materials and Lam Research are instrumental. They provide the specialized deposition, patterning, and inspection tools required for roll-to-roll and sheet-to-sheet production methods, which are increasingly adopted for cost-effective, large-scale manufacturing.

Startups and niche players are also shaping the competitive landscape by focusing on emerging applications and novel manufacturing approaches. Companies like Polaris Quantum Biotech and FlexEnable are pioneering flexible sensors, organic transistors, and medical devices, often partnering with larger OEMs to accelerate commercialization. Their agility and focus on innovation allow them to address specialized market needs and push the boundaries of what flexible electronics can achieve.

Strategic alliances, joint ventures, and M&A activity are prevalent as companies seek to expand their technological capabilities and market reach. According to IDTechEx, the market is expected to see intensified collaboration between material suppliers, device manufacturers, and end-user industries, particularly in automotive, healthcare, and IoT sectors. This collaborative environment is fostering rapid innovation and enabling the flexible electronics manufacturing market to address a broader array of applications in 2025 and beyond.

Market Growth Forecasts 2025–2030: CAGR and Revenue Projections

The flexible electronics manufacturing market is poised for robust expansion between 2025 and 2030, driven by surging demand across consumer electronics, automotive, healthcare, and industrial sectors. According to recent projections, the global flexible electronics market is expected to achieve a compound annual growth rate (CAGR) of approximately 15% during this period, with total market revenues anticipated to surpass $60 billion by 2030, up from an estimated $29 billion in 2025 MarketsandMarkets.

This growth trajectory is underpinned by several key factors. The proliferation of wearable devices, foldable smartphones, and advanced medical sensors is fueling demand for flexible displays, circuits, and sensors. Automotive manufacturers are increasingly integrating flexible electronics into dashboards, lighting, and safety systems, further expanding the addressable market. Additionally, the ongoing miniaturization of electronic components and the adoption of new materials such as flexible substrates and conductive inks are enabling more innovative product designs and manufacturing efficiencies IDTechEx.

Regionally, Asia-Pacific is projected to maintain its dominance, accounting for over 45% of global revenues by 2030, led by manufacturing powerhouses such as China, South Korea, and Japan. North America and Europe are also expected to witness significant growth, particularly in high-value applications like medical devices and automotive electronics Grand View Research.

- 2025 Market Size: ~$29 billion

- 2030 Market Size (Projected): >$60 billion

- CAGR (2025–2030): ~15%

- Key Growth Drivers: Wearables, foldable devices, automotive integration, healthcare innovation

- Leading Regions: Asia-Pacific, North America, Europe

In summary, the flexible electronics manufacturing sector is set for accelerated growth through 2030, with technological advancements and cross-industry adoption driving both volume and value. Companies investing in R&D, advanced materials, and scalable manufacturing processes are likely to capture significant market share as the industry matures and diversifies its application base.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global flexible electronics manufacturing market is characterized by significant regional disparities in terms of technological advancement, production capacity, and end-user adoption. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct market dynamics shaped by local industry strengths, investment patterns, and regulatory environments.

North America remains a leader in flexible electronics innovation, driven by robust R&D investments and a strong presence of key players in consumer electronics, healthcare, and automotive sectors. The United States, in particular, benefits from collaborations between academic institutions and industry, fostering rapid prototyping and commercialization of flexible displays, sensors, and wearable devices. The region’s focus on high-value applications and early adoption of emerging technologies is expected to sustain its competitive edge through 2025, with companies like Apple Inc. and 3M at the forefront of integration and product development.

Europe is characterized by a strong emphasis on sustainability and regulatory compliance, which influences material selection and manufacturing processes in flexible electronics. The region’s automotive and healthcare industries are major adopters, leveraging flexible electronics for advanced driver-assistance systems (ADAS), smart packaging, and medical diagnostics. Germany, France, and the UK are leading contributors, supported by EU-funded initiatives and collaborations with research organizations such as Fraunhofer Society. The European market is also witnessing increased investment in organic and printed electronics, with a focus on reducing environmental impact.

Asia-Pacific dominates global flexible electronics manufacturing in terms of volume, owing to its extensive electronics supply chain, cost-effective manufacturing, and government support for innovation. Countries like China, South Korea, and Japan are home to major display and semiconductor manufacturers, including Samsung Electronics and LG Electronics. The region’s rapid adoption of flexible displays in smartphones, wearables, and IoT devices is a key growth driver. Additionally, government initiatives such as China’s “Made in China 2025” and South Korea’s focus on next-generation display technologies are expected to further boost regional output and exports.

Rest of the World (RoW) encompasses emerging markets in Latin America, the Middle East, and Africa, where flexible electronics manufacturing is still nascent. Growth in these regions is primarily driven by increasing demand for consumer electronics and gradual investments in local manufacturing capabilities. However, limited infrastructure and lower R&D spending compared to other regions may constrain rapid market expansion in the near term.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for flexible electronics manufacturing in 2025 is marked by rapid expansion into new application domains and a surge in investment activity targeting both established and emerging hotspots. As the technology matures, its integration into diverse sectors is accelerating, driven by advances in materials science, roll-to-roll processing, and hybrid integration techniques.

Emerging applications are particularly prominent in healthcare, where flexible sensors and wearable devices are enabling continuous patient monitoring, remote diagnostics, and personalized medicine. The global market for wearable medical devices is projected to reach $38.9 billion by 2025, with flexible electronics constituting a significant share of this growth due to their comfort and adaptability for long-term use (MarketsandMarkets). Additionally, the automotive sector is adopting flexible displays and touch sensors for next-generation human-machine interfaces, with major automakers investing in flexible OLED dashboards and smart surfaces.

Consumer electronics remain a core driver, with foldable smartphones, rollable displays, and e-paper devices gaining traction. The global flexible display market alone is forecasted to surpass $20 billion by 2025, propelled by investments from leading display manufacturers and the proliferation of 5G-enabled devices (IDTechEx).

Investment hotspots are shifting geographically and sectorally. Asia-Pacific, led by South Korea, China, and Japan, continues to dominate manufacturing capacity and R&D, with significant government incentives and private capital flowing into flexible electronics startups and scale-ups (Statista). Meanwhile, North America and Europe are seeing increased venture capital activity, particularly in healthcare and industrial IoT applications, as well as strategic partnerships between technology firms and research institutions.

- Healthcare: Wearable biosensors, smart patches, and implantable devices.

- Automotive: Flexible lighting, curved displays, and smart interiors.

- Consumer Electronics: Foldable phones, e-readers, and smart textiles.

- Industrial IoT: Flexible RFID tags, environmental sensors, and asset tracking.

In summary, 2025 will see flexible electronics manufacturing at the forefront of innovation, with robust investment and commercialization across multiple high-growth sectors. The convergence of material breakthroughs, scalable manufacturing, and cross-industry collaboration is expected to unlock new value propositions and sustain long-term market momentum.

Challenges, Risks, and Strategic Opportunities

Flexible electronics manufacturing in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as the sector matures and scales. One of the primary challenges is the integration of novel materials—such as organic semiconductors, conductive polymers, and advanced substrates—into established manufacturing processes. These materials often require specialized handling and deposition techniques, which can increase production costs and complicate quality control. Additionally, ensuring consistent device performance and reliability over time remains a significant hurdle, particularly for applications in wearables, medical devices, and automotive components where durability is critical.

Supply chain risks are also prominent. The flexible electronics value chain is highly globalized, with key materials and components sourced from a limited number of suppliers. Disruptions—whether due to geopolitical tensions, natural disasters, or logistical bottlenecks—can have outsized impacts on production timelines and costs. For example, the ongoing semiconductor supply chain volatility has highlighted vulnerabilities that could similarly affect flexible electronics manufacturing Semiconductor Industry Association.

Another risk is the rapid pace of technological change. As new fabrication techniques such as roll-to-roll printing and additive manufacturing evolve, companies must invest heavily in R&D to stay competitive. This creates financial pressure, especially for smaller firms, and increases the risk of obsolescence if a chosen technology fails to achieve market traction. Intellectual property (IP) protection is also a concern, as the sector’s innovation-driven nature makes it a target for IP theft and patent disputes World Intellectual Property Organization.

Despite these challenges, strategic opportunities abound. The growing demand for flexible, lightweight, and conformable electronics in sectors such as healthcare, consumer electronics, and automotive is driving significant investment. For instance, the adoption of flexible sensors and displays in next-generation medical wearables and foldable smartphones is expected to accelerate market growth IDTechEx. Strategic partnerships between material suppliers, device manufacturers, and end-users are emerging as a key approach to mitigate risks and accelerate commercialization. Furthermore, advances in sustainable manufacturing—such as the use of recyclable substrates and low-energy fabrication processes—offer both cost savings and alignment with global ESG (Environmental, Social, and Governance) trends International Energy Agency.

In summary, while flexible electronics manufacturing in 2025 is challenged by material, supply chain, and technological risks, companies that proactively address these issues and leverage strategic collaborations are well-positioned to capitalize on the sector’s robust growth potential.

Sources & References

- IDTechEx

- LG Display

- DuPont

- MarketsandMarkets

- Frost & Sullivan

- Kuraray

- Polaris Quantum Biotech

- FlexEnable

- Grand View Research

- Apple Inc.

- Fraunhofer Society

- Statista

- Semiconductor Industry Association

- World Intellectual Property Organization

- International Energy Agency