Table of Contents

- Executive Summary: Key Insights & 2025 Outlook

- Market Size & Growth Forecast (2025–2030)

- Technological Innovations Driving the Sector

- Competitive Landscape: Leading Providers & New Entrants

- Application Trends Across Industries

- Regulatory Landscape & Standards (e.g., iaea.org, asn.fr)

- Emerging End-User Demands & Customization

- Investment Trends and Funding Activity

- Challenges, Risks, and Barriers to Adoption

- Future Outlook: Disruptive Trends & Strategic Recommendations

- Sources & References

Executive Summary: Key Insights & 2025 Outlook

Isotopic neutron tomography (INT) services are rapidly advancing as a critical tool for non-destructive analysis in sectors such as aerospace, nuclear energy, materials science, and cultural heritage preservation. The technique leverages the unique penetrative properties of neutrons and their sensitivity to isotopic composition, enabling detailed three-dimensional imaging of internal structures and material distributions. As of 2025, the global landscape for INT services is being shaped by significant investments in neutron source facilities, technological innovation, and growing demand for advanced diagnostic solutions.

Major research institutions and neutron facilities—including Institut Laue-Langevin (ILL), Paul Scherrer Institute (PSI), and Oak Ridge National Laboratory (ORNL)—are expanding their capabilities in neutron imaging and tomography, with increasing emphasis on isotopic analysis for industrial and academic applications. For instance, the Paul Scherrer Institute continues to enhance its neutron imaging beamlines, supporting a growing portfolio of tomography services for both domestic and international partners. These developments are facilitating higher throughput, improved spatial resolution, and the ability to discriminate between isotopes within complex sample matrices.

In the nuclear energy sector, isotopic neutron tomography has become vital for fuel inspection, failure analysis, and life extension programs. Leading nuclear utilities and fuel manufacturers are leveraging service partnerships with facilities such as Oak Ridge National Laboratory to perform detailed inspection of fuel rods and assemblies, identifying isotopic distributions and structural anomalies without destructive sampling. This is particularly relevant as many nuclear plants seek license renewals and safe long-term operation beyond original design life.

The aerospace and advanced materials industries are also expanding their use of INT services for quality assurance and R&D. Companies collaborate with neutron imaging centers to analyze additive-manufactured components, composite structures, and critical hardware, taking advantage of the technique’s sensitivity to light elements and isotopic tracers. For example, Institut Laue-Langevin continues to serve as a hub for industrial tomography projects, supporting innovation in manufacturing and materials development.

Looking to 2025 and beyond, the outlook for isotopic neutron tomography services is robust. Upgrades to neutron source intensities, detector technologies, and data processing pipelines are expected to drive down costs and reduce turnaround times. Growing recognition of INT’s unique value proposition—especially for isotopic mapping and non-destructive evaluation—positions the sector for increased adoption across energy, aerospace, and research markets. Collaboration between public neutron facilities and private industry is likely to accelerate, fostering new service offerings and application-driven research.

Market Size & Growth Forecast (2025–2030)

The isotopic neutron tomography services market is entering a stage of heightened interest and steady growth as industries recognize its unique capabilities for non-destructive analysis, particularly in sectors such as aerospace, nuclear energy, materials science, and advanced manufacturing. As of 2025, the global demand for these services is being propelled by increasing requirements for precise internal imaging of complex assemblies, detection of light elements (notably hydrogen), and the analysis of advanced composites and historical artifacts—all areas where conventional X-ray computed tomography (CT) often falls short.

Current data from leading neutron science facilities, such as those operated by Oak Ridge National Laboratory, highlights a growing throughput of isotopic neutron tomography experiments and user projects in North America and Europe. These facilities have reported year-on-year increases in proposals for neutron imaging, reflecting expanding industrial and academic demand. Similarly, in Europe, institutions like Paul Scherrer Institute are investing in upgrades to their neutron imaging beamlines, suggesting anticipation of further market growth through 2030.

The market size in 2025 is estimated to be in the low-to-mid hundreds of millions USD globally, with a projected compound annual growth rate (CAGR) in the range of 7–10% over the next five years. Key drivers include advancements in neutron source technology—such as more intense spallation sources and compact accelerator-driven systems—and automation of data processing pipelines, which are enabling higher sample throughput and expanding potential market reach. The entry of private sector service providers, complementing national laboratory offerings, is also expected to boost market competitiveness and accessibility.

Geographically, the United States, Germany, Switzerland, and Japan currently lead in service provision and technology development. Ongoing facility expansions, such as those at Japan Atomic Energy Agency and Heinz Maier-Leibnitz Zentrum in Germany, indicate a robust medium-term outlook. Furthermore, collaborative networks like the European Neutron Scattering Association are fostering knowledge exchange and standardization, which may further stimulate market growth and service harmonization across borders.

Looking ahead, the isotopic neutron tomography services market is expected to benefit from the integration of artificial intelligence in image reconstruction and automated defect recognition, as well as new applications in battery research, hydrogen storage, and cultural heritage conservation. These trends, combined with increasing commercialization, suggest a positive growth trajectory through 2030.

Technological Innovations Driving the Sector

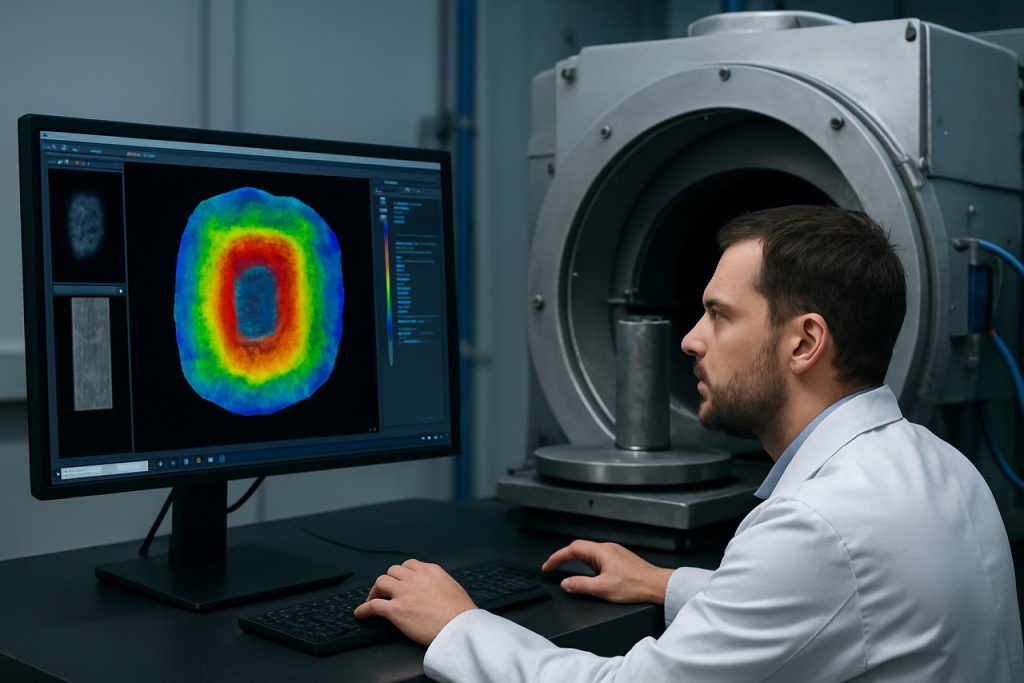

Isotopic neutron tomography services are experiencing a wave of technological innovation, intensifying their value across industrial, archaeological, and scientific applications. As of 2025, cutting-edge developments are primarily centered on enhancing imaging resolution, reducing acquisition times, and expanding the spectrum of isotopic analyses available for complex materials, especially in sectors requiring non-destructive evaluation of dense or heterogeneous objects.

Recent advancements in detector technology are among the most significant drivers. New generations of scintillation and semiconductor-based detectors have improved sensitivity to neutron capture events, directly boosting the spatial and isotopic resolution achievable in tomography scans. Institutions such as Helmholtz Association and Paul Scherrer Institute (PSI) have implemented such detectors in their neutron imaging beamlines, enabling the differentiation between isotopes within objects—critical for industries like nuclear fuel analysis and cultural heritage conservation.

Another major innovation involves the integration of high-flux neutron sources, including compact accelerator-driven systems, which are beginning to supplement traditional research reactors. For example, providers like Institut Laue-Langevin (ILL) and Oak Ridge National Laboratory (ORNL) have demonstrated neutron imaging with unprecedented throughput and lower sample irradiation, supporting rapid, large-scale inspection and in situ monitoring of industrial processes.

Software advancements are also propelling the sector forward. Enhanced reconstruction algorithms utilizing machine learning now allow for real-time tomographic reconstructions from isotopic neutron data, as seen in collaborative projects involving Paul Scherrer Institute (PSI) and international research partners. This reduces time-to-results and facilitates integration with automated quality assurance workflows, especially in the aerospace and energy industries.

Additionally, there is a move towards multimodal imaging, combining neutron tomography with complementary techniques such as X-ray CT and gamma spectroscopy for richer material characterization. Facilities like Helmholtz Association are actively developing platforms for such combined analyses, offering clients the ability to distinguish isotopic composition, elemental distribution, and structural features in a single, streamlined service.

Looking ahead, the sector anticipates broader commercialization of compact neutron sources and further miniaturization of detection systems, enabling mobile or on-site isotopic neutron tomography. These innovations will likely democratize access to advanced non-destructive evaluation, especially for smaller manufacturers or field-based applications. With continued investment from major research centers and expanding industrial collaboration, the next few years are poised to solidify isotopic neutron tomography as a mainstream analytical service.

Competitive Landscape: Leading Providers & New Entrants

The competitive landscape for isotopic neutron tomography (INT) services is evolving rapidly as technological advancements and increased demand for non-destructive testing (NDT) drive market growth in 2025 and beyond. Traditionally, the sector has been dominated by a select group of national laboratories and specialized research facilities, but recent years have seen a growing number of commercial suppliers and new entrants expanding global access to these advanced imaging services.

Among the established leaders, Paul Scherrer Institut in Switzerland and Australian Nuclear Science and Technology Organisation (ANSTO) remain at the forefront, offering state-of-the-art neutron imaging capabilities, including isotopic tomography. Both institutions have invested in modernizing their beamline infrastructure and expanding access to their neutron sources for industrial and scientific clients. For example, ANSTO’s neutron tomography services are increasingly sought after for materials research and quality assurance in the energy and aerospace sectors.

In the United States, Oak Ridge National Laboratory (ORNL) continues to provide advanced neutron imaging, including isotopic neutron tomography, through its High Flux Isotope Reactor and Spallation Neutron Source. ORNL’s facilities support a broad spectrum of applications, from cultural heritage preservation to advanced battery research, and have recently increased throughput to accommodate growing industry demand.

Europe has seen significant investments as well. Helmholtz-Zentrum Berlin and Institut Laue-Langevin (ILL) are both enhancing their service offerings, integrating new detector technologies and data analysis pipelines to improve resolution and efficiency. These developments aim to attract new industrial users, particularly from the automotive and microelectronics sectors.

New entrants are emerging, leveraging compact accelerator-driven neutron sources and digital workflow integration. Companies such as NeutronOptics are developing portable and modular neutron tomography systems to serve niche markets, including on-site inspection and academic research where traditional reactor-based services are impractical. These innovations are expected to democratize access and stimulate further adoption, especially in regions lacking large-scale neutron facilities.

Looking forward, the market is likely to see increased partnerships between established neutron centers and commercial technology providers, fostering innovation in data processing, automation, and remote service delivery. As regulatory frameworks around neutron source deployment evolve, more private-sector participation is anticipated, further diversifying the provider landscape and accelerating technological progress through 2025 and the following years.

Application Trends Across Industries

Isotopic neutron tomography (INT) services are experiencing expanding application trends across a diverse range of industries as organizations seek advanced non-destructive testing (NDT) solutions. In 2025 and the years immediately ahead, key sectors such as energy, aerospace, automotive, cultural heritage, and advanced manufacturing are driving demand for INT, leveraging its unique ability to image light elements (notably hydrogen) within dense or complex structures.

In the energy sector, particularly within nuclear power and renewable technologies, INT is increasingly employed to inspect fuel rods, reactor components, and hydrogen-based storage systems. For instance, International Atomic Energy Agency member states have implemented neutron imaging for verifying the internal integrity of sensitive components, aiming to extend operational lifespans and ensure compliance with safety regulations. Additionally, with the global push toward hydrogen energy, neutron tomography is being adopted for analyzing hydrogen embrittlement in storage tanks and pipelines—a challenge not adequately addressed by conventional X-ray techniques.

The aerospace industry is utilizing INT services for inspection of composite materials, detection of corrosion under insulation, and assessment of water ingress in critical components. Facilities such as those operated by Airbus and its partners are integrating neutron imaging into quality assurance protocols, recognizing its advantages for detecting adhesives, sealants, and moisture—factors vital for aircraft safety and longevity.

Automotive manufacturers are also turning to INT for the analysis of fuel cells, battery systems, and lightweight composite structures. With growing commitments to electric mobility and hydrogen fuel, companies including BMW Group are investing in neutron tomography to optimize design and manufacturing processes, ensuring the reliability and efficiency of next-generation vehicles.

In the field of cultural heritage and archaeology, INT services are instrumental in non-invasively examining ancient artifacts, fossils, and artworks. Institutions like the British Museum collaborate with neutron imaging centers to analyze internal features without damaging priceless objects—supporting both research and conservation.

Manufacturers of specialized neutron imaging systems, such as RI Research Instruments GmbH and Anton Paar, report growing inquiries from research institutes and industrial clients, indicating a continued upward trajectory in service demand. As new compact accelerator-based neutron sources become commercially viable, broader industry adoption is anticipated, with increased availability of services beyond national laboratory infrastructures.

Looking forward, the outlook for INT services remains robust through 2025 and beyond. The convergence of increased industrial digitization, stricter safety standards, and material innovation is expected to further accelerate the deployment of isotopic neutron tomography across both established and emerging applications.

Regulatory Landscape & Standards (e.g., iaea.org, asn.fr)

The regulatory landscape governing Isotopic Neutron Tomography (INT) services is shaped by stringent safety, quality, and operational standards, reflecting the sensitive nature of neutron-based imaging. Globally, regulatory frameworks are established by international agencies, national nuclear safety authorities, and standardization bodies, each playing pivotal roles in ensuring that INT services are conducted safely and effectively.

The International Atomic Energy Agency (IAEA) remains the principal international authority setting safety guidelines and technical standards for neutron-based technologies, including INT, as part of its mission to promote the peaceful and safe use of nuclear techniques. In 2025, the IAEA continues to publish and update safety guides relevant to neutron sources, radiation protection, and transport of radioactive materials. These guidelines form the backbone of regulatory requirements adopted by national agencies and underpin licensing processes for facilities offering INT services.

At the national level, authorities such as the Autorité de Sûreté Nucléaire (ASN) in France and the U.S. Nuclear Regulatory Commission (NRC) oversee compliance with both international and local regulations. For facilities operating neutron tomography equipment, this involves rigorous oversight of source handling, facility shielding, personnel training, and emergency preparedness. In Europe, regulations are often harmonized through bodies like the European Atomic Energy Community (Euratom), ensuring common safety standards across member states.

Industry standards are also developed by organizations such as the International Organization for Standardization (ISO), which publishes protocols for non-destructive testing and radiation protection. ISO standards, like ISO 21482 for neutron radiation warning symbols, are routinely referenced in facility design and operation. These standards are regularly reviewed and updated in line with technological advancements and operational experience, with new editions expected within the next few years to account for evolving INT applications.

Looking ahead, the regulatory outlook for INT services is characterized by ongoing adaptation to new applications in fields such as nuclear industry quality control, cultural heritage, and advanced materials research. As neutron tomography systems become more accessible and commercially available, regulators are expected to refine licensing frameworks, bolster operator training requirements, and enhance cybersecurity protocols for remote operation and data management. International collaboration, especially through the IAEA and ISO, will be critical to harmonize standards and facilitate the safe global expansion of INT services.

Emerging End-User Demands & Customization

In 2025, the landscape of isotopic neutron tomography services is being decisively shaped by emerging end-user demands for greater customization and application-specific solutions. Industries such as aerospace, automotive, energy, and advanced manufacturing are increasingly seeking neutron tomography tailored to their unique inspection and research challenges. Traditionally, neutron tomography has found its stronghold in non-destructive testing, materials science, and cultural heritage investigations. However, as technology evolves and awareness of neutron imaging capabilities rises, new sectors are engaging service providers for highly specialized requirements.

One prominent demand is for improved resolution and sensitivity to differentiate between specific isotopes within complex assemblies. For example, the nuclear energy sector now requests neutron imaging that can non-invasively identify hydrogen distribution in fuel cells or map corrosion in reactor components, which requires precise customization of the neutron source and detector systems. Providers are responding by offering modular service packages, including tailored neutron energies, acquisition geometries, and advanced computational reconstruction algorithms.

Another driver is the need for rapid turnaround and on-site or near-site analysis. End-users in high-value manufacturing and critical infrastructure maintenance are pushing for mobile neutron tomography units or streamlined data-sharing platforms. Leading research institutes and service providers, such as National Institute of Standards and Technology (NIST) and Paul Scherrer Institut, have been developing instruments and services that allow for faster, more flexible deployment, including remote access to tomography setups and real-time data visualization. This trend is expected to accelerate as digitalization and automation further permeate the sector.

Additionally, the customization of neutron tomography for specific end-user workflows is being enabled by partnerships between service providers, instrument manufacturers, and industrial clients. Co-development initiatives, where end-users collaborate directly with neutron imaging centers to adapt hardware and software to their processes, are becoming more common. For instance, Oak Ridge National Laboratory (ORNL) has engaged with automotive and energy companies to refine imaging protocols and expand the analytical capabilities of their neutron tomography services.

Looking ahead, as the user base diversifies and the value of neutron tomography in quality assurance, failure analysis, and R&D becomes more apparent, service providers are expected to continue investing in modular, customizable solutions. These will likely include cloud-based analysis tools, automated feature recognition, and broader support for a variety of sample sizes and compositions. As a result, the sector anticipates a significant increase in both the accessibility and sophistication of neutron tomography services, driven by active engagement with emerging end-user demands.

Investment Trends and Funding Activity

Investment in isotopic neutron tomography services is gaining momentum as industries and research institutions increasingly recognize the technique’s value for non-destructive analysis of complex materials. Over the past year and into 2025, funding activity has reflected a growing demand for cutting-edge neutron imaging capabilities, with particular emphasis on applications in energy, aerospace, automotive, and cultural heritage sectors.

National research facilities and government-backed laboratories remain key drivers of investment. In Europe, substantial funding has been directed toward neutron source upgrades and instrumentation at major centers such as the Institut Laue-Langevin and the Paul Scherrer Institute. Both institutions have reported ongoing investments to expand their neutron tomography services, including the integration of advanced isotopic techniques to improve spatial resolution and contrast for industrial and scientific users.

In North America, the Oak Ridge National Laboratory continues to attract federal and private funding for its neutron imaging beamlines, supporting both fundamental research and proprietary investigations for commercial clients. The laboratory’s neutron facilities, such as the High Flux Isotope Reactor and Spallation Neutron Source, have been focal points for new equipment installations and service expansion, reflecting increased demand from materials science and battery development projects.

Private sector involvement is also growing, with specialized technology companies investing in advanced neutron detectors, imaging software, and portable systems. For example, Thermo Fisher Scientific and Oxford Instruments have both expanded their product portfolios to include instruments and solutions that enable or support neutron tomography workflows, spurred by client interest in high-throughput industrial inspection and research applications.

Looking ahead, the competitive landscape is expected to intensify as emerging facilities in Asia and the Middle East come online. Institutions such as the Japan Proton Accelerator Research Complex are receiving strategic funding to broaden their neutron imaging services, including isotopic tomography, with an eye toward both academic collaboration and commercial contract research.

Overall, 2025 is shaping up as a year of robust investment, with funding flowing from governmental science agencies, multinational industry partnerships, and technology manufacturers. The outlook for the next few years suggests continued financial support for facility upgrades, collaborative R&D, and commercialization initiatives, as the benefits of isotopic neutron tomography become more widely recognized across a spectrum of high-value applications.

Challenges, Risks, and Barriers to Adoption

Isotopic neutron tomography (INT) services, while offering unparalleled capabilities in non-destructive analysis of complex structures and materials, face several challenges and risks that could hinder widespread adoption through 2025 and the near future. One of the primary obstacles remains the limited availability and accessibility of neutron sources. Unlike X-ray tomography, neutron sources are typically confined to large research institutions or specialized reactors, such as those maintained by Oak Ridge National Laboratory and Forschungs-Neutronenquelle Heinz Maier-Leibnitz (FRM II). This restricts commercial and industrial access, resulting in logistical hurdles and high operational costs.

Another significant barrier is the stringent regulatory environment surrounding the handling and operation of neutron sources. Neutron generators and research reactors must comply with national and international nuclear safety and security requirements, as stipulated by authorities like the International Atomic Energy Agency (IAEA). This adds layers of complexity, increases the cost of service provision, and lengthens the time required to launch new facilities or expand existing ones.

Technical challenges also persist. INT demands sophisticated instrumentation, including advanced detector systems and isotopic labeling or contrast agents, which are costly and require specialized expertise to operate and maintain. The expertise needed for neutron imaging is significantly higher compared to more conventional modalities like X-ray CT, which limits the number of qualified personnel and creates a steep learning curve for prospective adopters. Organizations such as Paul Scherrer Institut have emphasized the need for ongoing training and collaboration to foster wider skill development in neutron imaging.

From a market perspective, the cost-benefit ratio remains a concern for many industrial users. While the unique imaging capabilities of INT—such as high sensitivity to light elements and the ability to distinguish isotopes—are invaluable in certain contexts (e.g., energy storage, aerospace, nuclear industry), the high operational costs and limited throughput can deter routine use in sectors where alternative imaging modalities suffice.

Looking ahead, the sector’s outlook depends on several factors: the development of compact, cost-effective neutron sources; advances in detector technologies; and the establishment of new service models, such as remote or distributed tomography. Efforts by organizations including National Institute of Standards and Technology to promote open access and collaborative research may mitigate some barriers, but significant investment and policy support will be required to realize broader adoption of INT services in the coming years.

Future Outlook: Disruptive Trends & Strategic Recommendations

The field of isotopic neutron tomography services is poised for significant advancements through 2025 and the next few years, driven by rapid technological innovation, expanding industrial adoption, and evolving regulatory frameworks. Several disruptive trends are shaping the future outlook for this specialized imaging sector.

One of the primary drivers is the integration of advanced neutron sources with improved detector technologies. Facilities are increasingly deploying high-flux neutron generators and compact accelerator-driven systems, which enable higher resolution and faster scanning times. Leading research centers, such as those operated by Institut Laue-Langevin and Paul Scherrer Institute, are actively upgrading their infrastructure to support industrial-scale tomography services, thereby extending the technique’s reach beyond academic research into commercial applications.

Industrial demand is accelerating, particularly from sectors such as aerospace, automotive, energy, and cultural heritage preservation. Companies are leveraging isotopic neutron tomography for non-destructive evaluation of complex assemblies, detection of internal defects, and analysis of materials that are otherwise impenetrable to X-rays. For example, Siemens AG and General Electric Company have invested in neutron imaging solutions to enhance quality assurance processes in turbine and additive manufacturing components, reflecting a broader industry shift toward advanced non-destructive testing (NDT) modalities.

Another disruptive trend is the convergence of digital technologies with neutron tomography. Artificial intelligence and machine learning algorithms are being developed to automate image reconstruction and defect analysis, significantly reducing turnaround time and human error. Additionally, the proliferation of cloud-based data platforms is facilitating remote access to neutron imaging results, enabling global collaboration and streamlined workflow integration.

The strategic landscape is also influenced by regulatory and supply chain considerations. As isotopic neutron sources are subject to strict safety and licensing requirements, service providers must maintain robust compliance protocols. Partnerships between neutron facility operators, technology suppliers, and end-users are becoming increasingly important for navigating complex regulatory environments and ensuring reliable access to neutron services.

- Strategic Recommendations: Stakeholders should invest in R&D for compact neutron sources and detector systems to improve accessibility and cost-effectiveness.

- Forge partnerships with leading neutron research facilities to gain early access to next-generation tomography capabilities.

- Integrate AI-driven analytics to optimize data interpretation and support predictive maintenance strategies.

- Maintain proactive engagement with regulatory authorities to streamline service deployment and ensure compliance with evolving safety standards.

Overall, isotopic neutron tomography services are set to become more accessible, versatile, and integrated into mainstream industrial workflows, offering substantial opportunities for innovation and value creation through 2025 and beyond.

Sources & References

- Institut Laue-Langevin

- Paul Scherrer Institute

- Oak Ridge National Laboratory

- Japan Atomic Energy Agency

- Heinz Maier-Leibnitz Zentrum

- Helmholtz Association

- Australian Nuclear Science and Technology Organisation

- Oak Ridge National Laboratory

- Helmholtz-Zentrum Berlin

- NeutronOptics

- International Atomic Energy Agency

- Airbus

- RI Research Instruments GmbH

- Anton Paar

- International Atomic Energy Agency

- Autorité de Sûreté Nucléaire

- U.S. Nuclear Regulatory Commission

- International Organization for Standardization

- National Institute of Standards and Technology

- Thermo Fisher Scientific

- Oxford Instruments

- Japan Proton Accelerator Research Complex

- Siemens AG

- General Electric Company