Nanorobotics for Biomedical Oncology in 2025: How Precision Micro-Machines Are Transforming Cancer Diagnosis and Therapy. Explore the Breakthroughs, Market Trajectory, and Future Impact of Nanorobots in Oncology Care.

- Executive Summary: The State of Nanorobotics in Oncology (2025)

- Market Size, Growth Forecasts, and Investment Trends (2025–2030)

- Key Nanorobotic Technologies and Engineering Advances

- Leading Companies and Industry Collaborations

- Clinical Applications: Diagnostics, Drug Delivery, and Tumor Targeting

- Regulatory Landscape and Standards (FDA, EMA, IEEE)

- Challenges: Biocompatibility, Manufacturing, and Scalability

- Case Studies: Pioneering Trials and Real-World Deployments

- Competitive Landscape and Strategic Partnerships

- Future Outlook: Disruptive Innovations and Long-Term Impact on Oncology

- Sources & References

Executive Summary: The State of Nanorobotics in Oncology (2025)

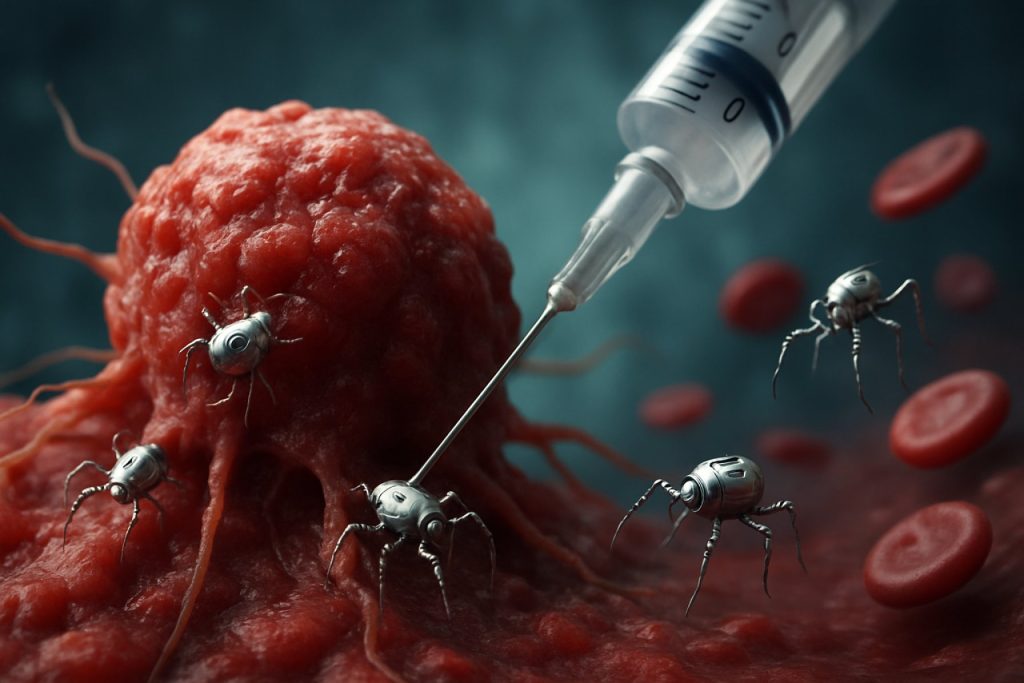

Nanorobotics is rapidly emerging as a transformative technology in biomedical oncology, with 2025 marking a pivotal year for both research progress and early-stage clinical translation. Nanorobots—engineered devices at the nanometer scale—are being developed to perform highly targeted tasks such as drug delivery, tumor imaging, and minimally invasive interventions. The convergence of nanotechnology, robotics, and biotechnology is enabling unprecedented precision in cancer diagnosis and therapy, with several key players and research institutions advancing the field.

In 2025, the focus remains on leveraging nanorobots for targeted drug delivery, aiming to maximize therapeutic efficacy while minimizing systemic toxicity. Companies such as Nanobots Medical and Nanorobotics are at the forefront, developing nanorobotic platforms capable of navigating the bloodstream, recognizing cancerous tissues, and releasing chemotherapeutic agents directly at tumor sites. These platforms utilize a combination of magnetic guidance, molecular recognition, and responsive materials to achieve site-specific action, a significant advancement over conventional drug delivery systems.

Recent preclinical studies and early-phase clinical trials have demonstrated the potential of nanorobots to improve drug bioavailability and reduce adverse effects. For example, magnetic nanorobots developed by Nanobots Medical have shown promising results in targeting solid tumors in animal models, with ongoing efforts to initiate first-in-human trials by late 2025. Meanwhile, Nanorobotics is collaborating with leading oncology centers to refine their autonomous navigation algorithms and biocompatible coatings, addressing key challenges such as immune evasion and real-time tracking.

The regulatory landscape is also evolving, with agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) engaging with industry stakeholders to establish safety and efficacy standards for nanorobotic devices. Industry consortia and standards bodies, including the International Organization for Standardization (ISO), are working to define protocols for manufacturing, quality control, and clinical evaluation.

Looking ahead, the next few years are expected to see a transition from proof-of-concept studies to larger-scale clinical trials, particularly for nanorobotic drug delivery systems targeting hard-to-treat cancers such as glioblastoma and pancreatic cancer. Strategic partnerships between technology developers, pharmaceutical companies, and academic medical centers will be crucial in accelerating commercialization and adoption. As the field matures, nanorobotics is poised to become an integral component of precision oncology, offering new hope for improved patient outcomes and personalized cancer care.

Market Size, Growth Forecasts, and Investment Trends (2025–2030)

The nanorobotics sector within biomedical oncology is poised for significant expansion between 2025 and 2030, driven by advances in nanotechnology, targeted drug delivery, and minimally invasive cancer therapies. As of 2025, the global market for nanorobotics in oncology is still in its nascent stage, but it is rapidly gaining traction due to increasing clinical validation, regulatory interest, and strategic investments from both established medical device manufacturers and innovative startups.

Key players in the nanorobotics landscape include Philips, which has a strong presence in medical imaging and minimally invasive interventions, and Siemens Healthineers, known for integrating nanotechnology into diagnostic and therapeutic platforms. Both companies are investing in research collaborations and pilot programs to explore the integration of nanorobots for precision oncology applications. Additionally, ABB, a leader in robotics and automation, is exploring the miniaturization of robotic systems for medical use, including potential applications in targeted cancer therapies.

Startups and specialized firms are also shaping the market. For example, Nanobots Medical is developing nanorobotic systems for targeted drug delivery and tumor ablation, with preclinical trials underway as of 2025. Similarly, Magnetics Insight is advancing magnetic navigation technologies that could enable precise control of nanorobots within the human body, a critical capability for oncology applications.

Investment trends indicate a surge in venture capital and strategic partnerships, particularly in North America, Europe, and parts of Asia-Pacific. Major pharmaceutical companies are increasingly collaborating with nanorobotics firms to co-develop targeted therapies, aiming to reduce systemic toxicity and improve patient outcomes. Public funding agencies and innovation programs in the EU and US are also supporting translational research and early-stage commercialization efforts.

Market growth forecasts for 2025–2030 suggest a compound annual growth rate (CAGR) in the double digits, with the oncology segment expected to outpace other biomedical applications due to the high unmet need for precision cancer treatments. The outlook is further bolstered by ongoing regulatory engagement, with agencies such as the FDA and EMA initiating frameworks for the evaluation and approval of nanorobotic medical devices.

In summary, the period from 2025 to 2030 is expected to witness accelerated market expansion, increased investment, and the emergence of clinically validated nanorobotic solutions for oncology. The convergence of robotics, nanotechnology, and oncology is set to transform cancer care, with leading industry players and innovative startups driving the sector forward.

Key Nanorobotic Technologies and Engineering Advances

The field of nanorobotics for biomedical oncology is experiencing rapid technological maturation, with 2025 marking a pivotal year for both preclinical and early clinical applications. Nanorobotic systems—engineered at the molecular or nanoscale—are being designed to navigate complex biological environments, enabling targeted cancer diagnostics, drug delivery, and minimally invasive interventions.

A central engineering advance is the development of programmable nanorobots capable of precise tumor targeting. These devices often utilize biocompatible materials such as DNA origami, gold nanoparticles, or polymeric nanostructures, which can be functionalized with ligands or antibodies for selective binding to cancer cell markers. For example, DNA-based nanorobots have demonstrated the ability to deliver thrombin directly to tumor vasculature, inducing selective blood clotting and tumor necrosis in preclinical models. Such programmable systems are being refined for enhanced stability and controlled release, with several academic-industry collaborations underway to transition these platforms toward clinical-grade manufacturing.

Magnetically actuated nanorobots represent another key technology, leveraging external magnetic fields for navigation and activation. Companies like Industrial Magnetics, Inc. and Ferrotec Corporation are advancing the production of high-precision magnetic materials and components, which are integral to the fabrication of these nanorobotic systems. These devices can be guided through the vascular system to tumor sites, where they may release chemotherapeutic payloads or generate localized hyperthermia to ablate malignant cells.

Ultrasound-propelled and light-activated nanorobots are also gaining traction, with research groups collaborating with manufacturers such as Olympus Corporation for the integration of advanced imaging and actuation technologies. These nanorobots can be externally controlled to penetrate tumor tissue, offering real-time feedback and precision in drug delivery or biopsy procedures.

In parallel, the integration of artificial intelligence (AI) and machine learning is enhancing the autonomous navigation and decision-making capabilities of nanorobots. Companies like Intel Corporation are providing high-performance computing platforms that support the real-time processing of complex biological data, enabling adaptive responses to dynamic tumor microenvironments.

Looking ahead, the next few years are expected to see the first-in-human trials of multifunctional nanorobotic systems, with regulatory pathways being actively explored in collaboration with industry bodies such as the International Organization for Standardization (ISO) for safety and efficacy standards. The convergence of materials science, robotics, and AI is poised to accelerate the translation of nanorobotic oncology from experimental models to clinical reality, with the potential to revolutionize cancer treatment paradigms by 2030.

Leading Companies and Industry Collaborations

The field of nanorobotics for biomedical oncology is rapidly advancing, with several leading companies and industry collaborations shaping the landscape as of 2025. These organizations are leveraging nanotechnology to develop targeted cancer therapies, precision diagnostics, and minimally invasive treatment modalities. The sector is characterized by a blend of established medical device manufacturers, innovative nanotechnology startups, and strategic partnerships with academic institutions and pharmaceutical companies.

One of the most prominent players is Abbott Laboratories, which has expanded its research into nanoscale drug delivery systems for oncology applications. Abbott’s focus includes the development of nanorobotic platforms capable of delivering chemotherapeutic agents directly to tumor sites, thereby minimizing systemic toxicity and improving patient outcomes. The company’s collaborations with leading cancer research centers have accelerated the translation of nanorobotic concepts into clinical trials.

Another key contributor is Siemens Healthineers, which is integrating nanorobotics with advanced imaging technologies. Their initiatives aim to enhance the precision of tumor localization and real-time monitoring of nanorobotic agents within the body. Siemens Healthineers’ partnerships with biotechnology firms and academic consortia are fostering the development of multifunctional nanorobots that combine diagnostic and therapeutic capabilities.

In the startup ecosystem, Nanobots Medical has emerged as a pioneer in the design and fabrication of autonomous nanorobots for targeted cancer therapy. The company’s proprietary technology enables the navigation of nanorobots through complex biological environments, with ongoing preclinical studies demonstrating promising results in selective tumor ablation. Nanobots Medical is actively collaborating with pharmaceutical companies to integrate its platforms with novel anticancer agents.

Industry collaborations are also central to progress in this sector. For example, Thermo Fisher Scientific is working with multiple nanotechnology startups and oncology research groups to develop standardized protocols for the manufacturing and quality control of nanorobotic devices. These efforts are crucial for meeting regulatory requirements and ensuring the scalability of nanorobotic solutions for clinical use.

Looking ahead, the next few years are expected to witness increased cross-sector partnerships, with major pharmaceutical companies such as Roche and Pfizer exploring collaborations with nanorobotics firms to co-develop personalized cancer therapies. The convergence of nanorobotics, artificial intelligence, and precision medicine is anticipated to drive significant breakthroughs, positioning these companies at the forefront of oncology innovation.

Clinical Applications: Diagnostics, Drug Delivery, and Tumor Targeting

Nanorobotics is rapidly emerging as a transformative technology in biomedical oncology, with clinical applications spanning diagnostics, drug delivery, and tumor targeting. As of 2025, the field is witnessing a transition from preclinical research to early-stage clinical trials, driven by advances in nanoscale engineering, biocompatible materials, and precision medicine.

In diagnostics, nanorobots are being developed to enhance the sensitivity and specificity of cancer detection. These devices can navigate the bloodstream, identify tumor biomarkers, and relay real-time data, enabling earlier and more accurate diagnosis. For example, companies like Nanobots Medical are working on nanorobotic platforms capable of detecting circulating tumor cells and molecular signatures associated with various cancers. Such technologies promise to outperform conventional imaging and biopsy techniques by providing minimally invasive, high-resolution insights at the cellular and molecular levels.

Drug delivery is another area where nanorobotics is making significant strides. Traditional chemotherapy often suffers from systemic toxicity and limited tumor specificity. Nanorobots, engineered to carry therapeutic payloads, can be programmed to home in on tumor sites, release drugs in a controlled manner, and minimize off-target effects. Nanorobotics Ltd. and Nano-Therapies Inc. are among the companies developing such targeted delivery systems. Their nanorobots utilize surface ligands that recognize tumor-specific antigens, ensuring that cytotoxic agents are released only in the tumor microenvironment. Early clinical data suggest improved drug accumulation at tumor sites and reduced adverse effects compared to conventional therapies.

Tumor targeting is further enhanced by the integration of smart navigation and actuation mechanisms. Magnetic, acoustic, and chemical guidance systems allow nanorobots to traverse complex biological environments and reach deep-seated tumors. Magnetic Science Corporation is pioneering magnetically guided nanorobots, which can be steered with external magnetic fields to precise anatomical locations. This approach is being evaluated in clinical studies for its potential to treat hard-to-reach malignancies, such as glioblastoma and pancreatic cancer.

Looking ahead, the next few years are expected to see the expansion of clinical trials, regulatory engagement, and the first commercial deployments of nanorobotic systems in oncology. Collaborations between technology developers, academic medical centers, and regulatory agencies are accelerating the translation of nanorobotics from bench to bedside. As manufacturing scalability and safety profiles improve, nanorobotics is poised to become a cornerstone of personalized cancer care, offering unprecedented precision in diagnosis, therapy, and monitoring.

Regulatory Landscape and Standards (FDA, EMA, IEEE)

The regulatory landscape for nanorobotics in biomedical oncology is rapidly evolving as these technologies transition from experimental stages to clinical applications. In 2025, both the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are intensifying their focus on the unique challenges posed by nanorobotic systems, particularly regarding safety, efficacy, and manufacturing standards.

The FDA has established the Nanotechnology Regulatory Science Research Plan to address the complexities of nanoscale materials and devices, including nanorobots intended for cancer diagnosis and therapy. The agency is actively engaging with developers to clarify requirements for Investigational New Drug (IND) applications and premarket submissions, emphasizing the need for robust characterization, biocompatibility, and long-term safety data. In 2024 and 2025, the FDA has hosted several workshops and public meetings to gather stakeholder input and refine its guidance for nanotechnology-enabled medical products, with a particular focus on oncology applications (U.S. Food and Drug Administration).

In Europe, the EMA is similarly updating its regulatory frameworks to accommodate the novel properties of nanorobotic systems. The agency’s Committee for Medicinal Products for Human Use (CHMP) and the Nanomedicines Working Party are collaborating to develop harmonized guidelines for the assessment of nanorobotics in cancer therapy. These efforts include defining standards for preclinical evaluation, clinical trial design, and post-market surveillance, with a strong emphasis on risk-benefit analysis and patient safety (European Medicines Agency).

On the standards front, the IEEE is playing a pivotal role in establishing technical and safety benchmarks for medical nanorobotics. The IEEE Nanotechnology Council and the IEEE Standards Association are working on new standards for the design, interoperability, and ethical deployment of nanorobots in clinical settings. In 2025, draft standards are under review, focusing on aspects such as communication protocols, power management, and fail-safe mechanisms for nanorobots used in oncology. These standards are expected to facilitate regulatory approval and foster industry-wide best practices.

Looking ahead, the next few years will likely see increased collaboration between regulatory agencies, standards bodies, and industry leaders to streamline approval pathways for nanorobotic oncology therapies. Companies such as Nanobots Medical and Nanorobotics are actively participating in regulatory consultations and pilot programs, aiming to bring the first wave of clinically approved nanorobotic cancer treatments to market. As regulatory clarity improves and standards mature, the sector is poised for accelerated innovation and broader clinical adoption.

Challenges: Biocompatibility, Manufacturing, and Scalability

The translation of nanorobotics from laboratory research to clinical oncology faces significant challenges, particularly in the areas of biocompatibility, manufacturing, and scalability. As of 2025, these hurdles remain central to the field’s progress, with both academic and industrial stakeholders intensifying efforts to address them.

Biocompatibility is a primary concern, as nanorobots must interact safely with complex biological systems. The immune response to foreign nanomaterials can lead to rapid clearance, inflammation, or toxicity, undermining therapeutic efficacy. Companies such as Nanobots Medical and Nanorobotics are developing surface modification techniques—such as PEGylation and biomimetic coatings—to reduce immunogenicity and prolong circulation time. However, long-term studies on the fate and potential accumulation of nanorobots in organs are still limited, and regulatory agencies are demanding more comprehensive safety data before approving clinical trials.

Manufacturing nanorobots at the precision and consistency required for medical use is another formidable challenge. The intricate architectures—often involving multi-material assemblies at the nanoscale—necessitate advanced fabrication methods. Companies like Oxford Instruments are supplying high-resolution electron beam lithography and atomic layer deposition systems to research institutions and startups, enabling the production of prototype nanorobots with precise geometries. Despite these advances, scaling up from laboratory batches to clinical-grade, reproducible manufacturing remains a bottleneck. Quality control at the nanoscale is particularly demanding, as even minor deviations can alter biological interactions and therapeutic outcomes.

Scalability is closely tied to manufacturing but also encompasses supply chain and cost considerations. The current cost of producing functional nanorobots is high, limiting their accessibility for widespread clinical trials. Efforts are underway to automate assembly processes and integrate microfluidic platforms for high-throughput synthesis. Thermo Fisher Scientific and Bruker are providing instrumentation for nanoparticle characterization and quality assurance, which are essential for regulatory compliance and batch-to-batch consistency. However, the field still lacks standardized protocols for large-scale production, and the regulatory landscape is evolving to keep pace with these novel technologies.

Looking ahead, the next few years are expected to see incremental progress as industry and academia collaborate to develop robust, scalable, and safe nanorobotic systems for oncology. The establishment of industry standards and regulatory frameworks, alongside technological advances in nanofabrication and biocompatibility, will be critical for the successful clinical translation of nanorobotics in cancer therapy.

Case Studies: Pioneering Trials and Real-World Deployments

The field of nanorobotics for biomedical oncology has transitioned from theoretical promise to tangible clinical exploration, with several pioneering trials and early-stage real-world deployments underway as of 2025. These case studies highlight the progress and challenges in leveraging nanorobots for targeted cancer diagnostics and therapeutics.

One of the most prominent examples is the ongoing collaboration between DNA Script and leading oncology research centers, focusing on DNA-based nanorobots engineered to deliver chemotherapeutic agents directly to tumor cells. In 2024, preclinical studies demonstrated that these nanorobots could recognize specific cancer cell markers and release their payload with high precision, minimizing off-target toxicity. Early-phase human trials initiated in late 2024 are now monitoring safety, biodistribution, and initial efficacy in patients with refractory solid tumors.

Another notable case is the work by Nanobots Medical, which has developed magnetically guided nanorobots for localized drug delivery in glioblastoma patients. Their first-in-human pilot study, launched in early 2025, utilizes external magnetic fields to steer nanorobots across the blood-brain barrier, a major obstacle in neuro-oncology. Interim results suggest improved drug penetration and reduced systemic side effects, with full data expected by late 2025.

In Asia, Nanospectra Biosciences has advanced its AuroShell nanorobot platform, which employs gold-silica nanoparticles for photothermal ablation of prostate tumors. After successful phase I/II trials in the United States, the technology is now being deployed in select hospitals in Japan and South Korea under expanded access programs. Early real-world data indicate favorable safety profiles and promising tumor control rates, supporting further regulatory submissions.

Meanwhile, Abbott Laboratories has entered the nanorobotics oncology space through strategic partnerships, focusing on integrating nanoscale biosensors into implantable devices for real-time tumor monitoring and adaptive therapy. Their pilot deployments in European cancer centers are being closely watched for their potential to personalize treatment regimens based on continuous molecular feedback.

Looking ahead, these case studies underscore a trend toward multi-institutional collaborations and regulatory engagement, with the U.S. Food and Drug Administration and European Medicines Agency providing guidance on nanorobotic device trials. As more data emerge from ongoing studies, the next few years are expected to see a gradual expansion of nanorobotic oncology applications from controlled trials to broader clinical practice, contingent on demonstrated safety, efficacy, and manufacturability.

Competitive Landscape and Strategic Partnerships

The competitive landscape for nanorobotics in biomedical oncology is rapidly evolving as the field transitions from foundational research to early-stage clinical and commercial activity. As of 2025, the sector is characterized by a mix of established technology conglomerates, specialized nanotechnology firms, and emerging biotech startups, all vying to develop and commercialize nanorobotic solutions for cancer diagnosis, targeted drug delivery, and minimally invasive interventions.

Among the most prominent players, ABB has leveraged its expertise in robotics and automation to explore precision micro- and nanorobotic systems, with ongoing collaborations in medical device miniaturization. Thermo Fisher Scientific is actively involved in the development of nanoscale tools and platforms for oncology research, including nanoparticle-based delivery systems and analytical instrumentation that underpin nanorobotic applications. Carl Zeiss AG continues to advance high-resolution imaging and manipulation technologies, which are critical for the real-time guidance and control of nanorobots in clinical settings.

Strategic partnerships are a defining feature of this landscape. In 2024 and 2025, several collaborations have emerged between nanorobotics developers and major pharmaceutical companies, aiming to accelerate the translation of laboratory breakthroughs into clinical oncology solutions. For example, Philips has entered into joint development agreements with nanotechnology startups to integrate nanorobotic drug delivery with advanced imaging modalities, enhancing the precision of tumor targeting and monitoring. Similarly, Siemens Healthineers is investing in partnerships to combine its diagnostic imaging platforms with nanorobotic agents for early cancer detection and therapy monitoring.

Startups and university spin-offs are also making significant strides. Companies such as Nanobots Medical (if confirmed operational) and others in the US, Europe, and Asia are developing proprietary nanorobotic platforms designed for site-specific drug delivery and micro-surgical interventions. These firms often collaborate with academic medical centers and cancer research institutes to conduct preclinical and early-phase clinical trials, leveraging public-private funding mechanisms and government innovation grants.

Looking ahead, the next few years are expected to see increased consolidation as larger medical device and pharmaceutical companies seek to acquire or partner with innovative nanorobotics firms to expand their oncology portfolios. Regulatory pathways are also being clarified, with agencies such as the FDA and EMA engaging with industry consortia to establish safety and efficacy standards for nanorobotic devices. As these partnerships mature and clinical data accumulates, the competitive landscape will likely shift toward integrated solutions that combine nanorobotics, imaging, and personalized oncology therapeutics.

Future Outlook: Disruptive Innovations and Long-Term Impact on Oncology

As the field of nanorobotics rapidly advances, its application in biomedical oncology is poised to become one of the most disruptive innovations in cancer diagnosis and therapy over the next several years. By 2025, the convergence of nanotechnology, robotics, and biotechnology is expected to yield tangible progress in the development and clinical translation of nanorobots designed for targeted cancer intervention.

Several leading organizations are actively developing nanorobotic platforms for oncology. For instance, Abbott Laboratories has invested in nanoscale drug delivery systems, leveraging their expertise in medical devices and diagnostics to explore programmable nanorobots capable of delivering chemotherapeutic agents directly to tumor sites. Similarly, Thermo Fisher Scientific is advancing nanoparticle-based technologies that could serve as foundational components for future nanorobotic systems, focusing on precision targeting and real-time monitoring of cancer cells.

In 2025, the most immediate impact of nanorobotics in oncology is anticipated in the realm of targeted drug delivery and minimally invasive diagnostics. Early-stage clinical trials are underway for nanorobots engineered to navigate the bloodstream, identify malignant cells via surface biomarkers, and release therapeutic payloads with high specificity. This approach aims to minimize systemic toxicity and improve patient outcomes compared to conventional chemotherapy. Companies such as Siemens Healthineers are also exploring the integration of nanorobotic agents with advanced imaging modalities, enabling real-time visualization and tracking of therapeutic interventions at the cellular level.

Looking ahead, the next few years are expected to witness the emergence of multifunctional nanorobots capable of performing complex tasks, such as in situ biopsy, micro-surgery, and even immune modulation within the tumor microenvironment. The integration of artificial intelligence and machine learning algorithms will further enhance the autonomy and decision-making capabilities of these nanorobots, allowing for adaptive responses to dynamic tumor biology. Regulatory agencies, including the U.S. Food and Drug Administration, are actively engaging with industry leaders to establish safety and efficacy standards for clinical deployment.

While significant technical and regulatory challenges remain, the long-term impact of nanorobotics in oncology could be transformative. By enabling ultra-precise, personalized interventions, nanorobots have the potential to shift the paradigm from reactive to proactive cancer care, reducing recurrence rates and improving survival. As investment and collaboration between industry and academia intensify, the coming years are likely to see nanorobotics move from experimental to mainstream clinical practice, fundamentally altering the landscape of cancer treatment.

Sources & References

- International Organization for Standardization

- Philips

- Siemens Healthineers

- ABB

- Industrial Magnetics, Inc.

- Ferrotec Corporation

- Olympus Corporation

- Thermo Fisher Scientific

- Roche

- European Medicines Agency

- IEEE

- Oxford Instruments

- Nanospectra Biosciences

- Carl Zeiss AG

- Siemens Healthineers