Table of Contents

- Executive Summary: The State of Orthopedic Implant Robotics in 2025

- Market Size & Growth Forecasts Through 2029

- Game-Changing Technologies: Robotics, AI, and Integration

- Key Players and Strategic Partnerships (Stryker, Zimmer Biomet, Smith+Nephew, Medtronic)

- Regulatory Landscape: Approvals, Standards, and Compliance

- Clinical Outcomes: Case Studies and Comparative Effectiveness

- Surgeon Adoption and Training: Barriers and Accelerators

- Global Trends: Regional Hotspots and Expansion Strategies

- Investment Landscape: M&A, Funding Rounds, and Strategic Moves

- Future Outlook: Next-Gen Innovations and Long-Term Impact

- Sources & References

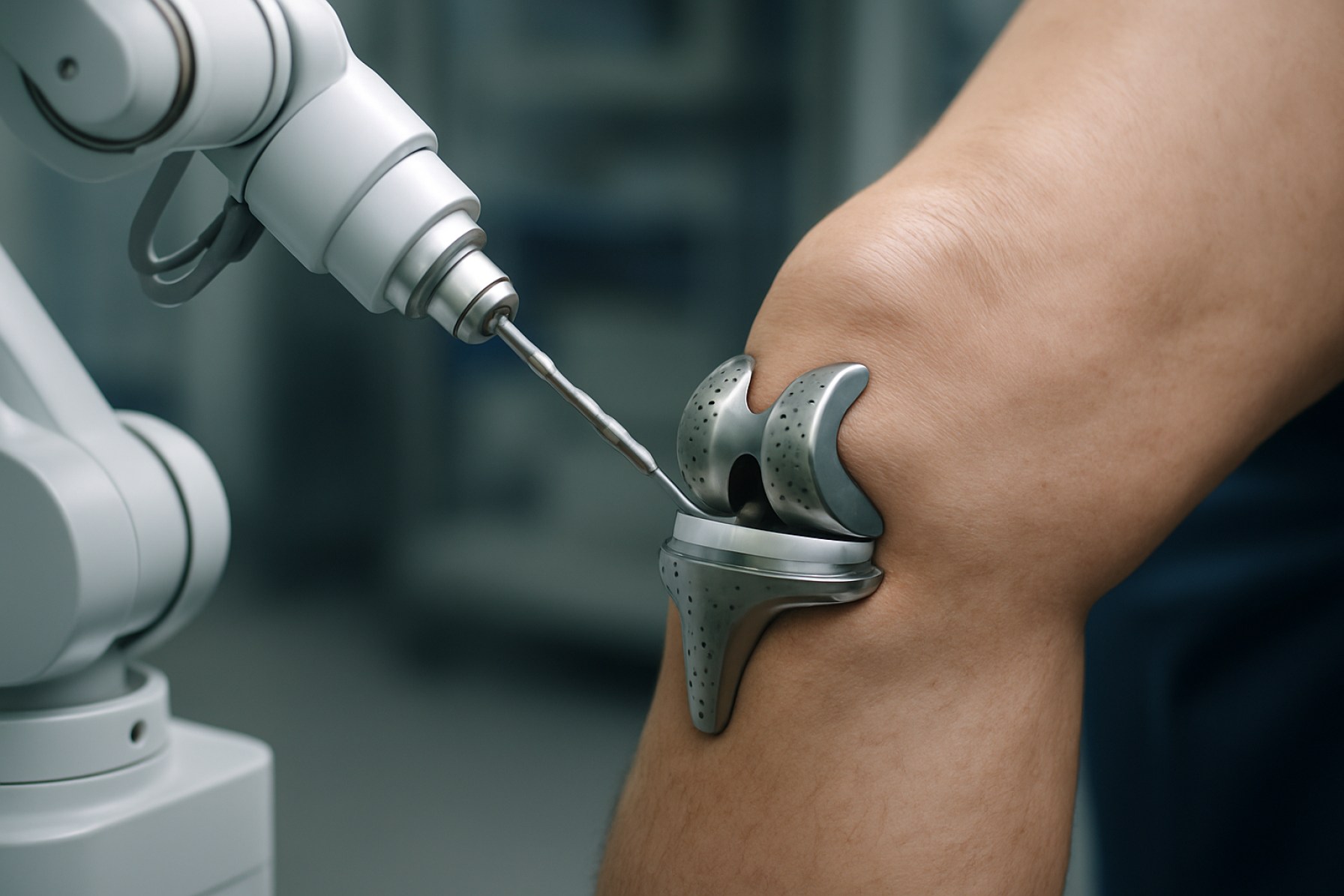

Executive Summary: The State of Orthopedic Implant Robotics in 2025

In 2025, orthopedic implant robotics stands at a transformative juncture, characterized by rapid market expansion, technological innovation, and growing clinical adoption. The sector is propelled by the convergence of advanced robotics, artificial intelligence, and precision navigation systems, all aimed at improving implant placement accuracy, reducing surgical variability, and enhancing patient outcomes. Market leaders and an increasingly diverse array of entrants are accelerating the pace of innovation and competitive differentiation.

A significant portion of the current market is anchored by established platforms such as the Smith+Nephew CORI Surgical System, Stryker’s Mako SmartRobotics, and the ROSA Knee System from Zimmer Biomet. These systems are widely adopted in knee and hip arthroplasty procedures, leveraging real-time 3D imaging, haptic feedback, and AI-powered planning tools to optimize implant alignment and minimize soft tissue disruption. In 2025, the clinical evidence supporting robotic-assisted orthopedic surgery continues to accumulate, with large-scale studies demonstrating reduced revision rates, lower complication incidences, and improved patient satisfaction compared to conventional methods.

The adoption curve is steepening, particularly in North America, Europe, and rapidly in Asia-Pacific, where both public and private healthcare providers are investing in robotic capabilities to meet rising demand for joint replacement procedures. Leading manufacturers are reporting double-digit year-over-year growth in installed base and procedure volumes. For example, Stryker recently announced surpassing the milestone of one million Mako-assisted procedures worldwide, underscoring both the scale and the clinical impact of these systems.

Looking into the next few years, the outlook remains robust. Industry leaders are investing heavily in R&D to expand robotic platforms beyond large joints into areas such as spine, shoulder, and trauma, as evidenced by DePuy Synthes and Globus Medical initiatives. Integration with digital health ecosystems, remote connectivity for intraoperative support, and AI-powered personalization of surgical planning are forecasted to become mainstream features. Furthermore, the drive toward cost efficiency, smaller and more versatile robotic units, and greater compatibility with ambulatory surgical centers is expected to broaden access and accelerate global market penetration.

In summary, orthopedic implant robotics in 2025 is defined by proven clinical value, rapidly expanding adoption, and a dynamic pipeline of next-generation technologies, positioning the sector for sustained growth and deeper integration into the future of orthopedic care.

Market Size & Growth Forecasts Through 2029

The orthopedic implant robotics sector is currently experiencing robust growth, underpinned by increasing demand for precision surgery, aging populations, and rapid technological advancements. As of 2025, the global market value for orthopedic surgical robots is estimated to be in the multi-billion dollar range, with double-digit compound annual growth rates (CAGR) projected through 2029. This growth is driven largely by the adoption of robotic-assisted systems for joint replacement procedures, particularly knee and hip arthroplasties.

Key manufacturers such as Stryker, Zimmer Biomet, and Smith+Nephew report accelerating system installations and procedure volumes. For instance, Stryker’s Mako robotic-arm assisted system has surpassed significant procedural milestones, and the company’s public filings highlight continued double-digit growth in installed bases and related revenue streams, especially in North America and expanding markets in Asia-Pacific. Zimmer Biomet’s ROSA robotic platform also demonstrates strong year-on-year growth in both sales and utilization, reflecting a growing preference among hospitals and ambulatory surgery centers for robotic precision and data-driven planning.

From 2025 through 2029, industry forecasts anticipate that market growth will be further propelled by several factors:

- Continued innovation in implant compatibility and robotic software platforms, enabling broader procedural indications and reducing surgical times.

- Expansion of reimbursement frameworks for robotic-assisted orthopedic surgery in major healthcare markets, increasing accessibility for both providers and patients.

- Rising demand in emerging economies, where surgical infrastructure is rapidly modernizing and healthcare investment is increasing.

- Integration of artificial intelligence and machine learning to enhance intraoperative planning, outcomes tracking, and personalized implant positioning.

Leading firms are investing heavily in R&D and partnerships to capture further market share. For example, Smith+Nephew has expanded its CORI Surgical System’s indications and is actively promoting its adoption in outpatient settings, a segment expected to see significant growth through 2029. Meanwhile, Asian manufacturers are entering the market, with companies like Mindray and others signaling interest in robotic orthopedic solutions, which could accelerate adoption rates in regional markets.

Looking ahead, the orthopedic implant robotics market is poised for sustained expansion, with global procedure volumes and installed robotic platforms expected to grow at strong rates through 2029. The sector’s trajectory will be shaped by ongoing technological advances, regulatory support, and the demonstrated clinical and economic benefits of robotic-assisted orthopedic procedures.

Game-Changing Technologies: Robotics, AI, and Integration

Orthopedic implant robotics is undergoing a transformative evolution in 2025, as the convergence of robotics, artificial intelligence (AI), and digital integration redefines standards of precision and patient outcomes in orthopedic surgery. Robotic-assisted platforms are now widely adopted in knee, hip, and increasingly in spine procedures, with leading manufacturers expanding their product portfolios and integrating advanced AI to enhance intraoperative guidance and surgical planning.

A critical milestone in recent years has been the expansion of robotic systems beyond early adopters, with devices such as the Stryker Mako and Zimmer Biomet ROSA platforms now installed in hundreds of hospitals worldwide. By the beginning of 2025, Stryker reported over 2,500 Mako systems globally, performing hundreds of thousands of procedures annually. Zimmer Biomet, meanwhile, continues to broaden the capabilities of its ROSA Knee and Hip systems, focusing on data-driven personalization and workflow optimization.

AI-powered enhancements are a central focus for industry leaders. Smith+Nephew has incorporated AI algorithms into its CORI Surgical System, enabling real-time ligament balancing and improved implant alignment. DePuy Synthes (Johnson & Johnson MedTech) has accelerated the integration of robotics with its VELYS Robotic-Assisted Solution, leveraging cloud connectivity and machine learning to facilitate more precise planning and execution. These developments are supported by multi-center clinical data demonstrating reduced variability, lower complication rates, and faster patient recovery compared to manual techniques.

Integration with hospital digital ecosystems is becoming a competitive differentiator. Seamless data flow between imaging, planning, and robotics platforms allows for comprehensive preoperative preparation and postoperative analytics. Companies are actively developing platforms that sync with electronic health records, imaging archives, and remote analytics dashboards to support continuous improvement and surgeon education. The push towards interoperable, cloud-based systems is expected to accelerate through 2025 and beyond, as illustrated by strategic partnerships between robotics manufacturers and health IT providers.

Looking ahead, the outlook for orthopedic implant robotics is robust. Industry leaders anticipate significant growth in adoption for hip and knee replacement procedures, with spine and shoulder robotics poised for rapid expansion. The next few years will likely see further miniaturization of robotic hardware, deeper AI integration for predictive analytics, and expanded use of augmented reality for intraoperative visualization. As reimbursement pathways become clearer and clinical evidence mounts, orthopedic robotics is set to become a standard of care in major joint reconstruction, fundamentally reshaping surgical practice and patient experience.

Key Players and Strategic Partnerships (Stryker, Zimmer Biomet, Smith+Nephew, Medtronic)

The orthopedic implant robotics sector is currently shaped by a handful of multinational medical technology companies that have established both leadership and innovation through substantial investments and strategic collaborations. As of 2025, four key players—Stryker, Zimmer Biomet, Smith+Nephew, and Medtronic—dominate the landscape, driving advances in surgical robotics, data integration, and personalized implant design.

- Stryker continues to leverage its flagship MAKO robotic-arm assisted surgery platform, which supports partial and total knee as well as hip procedures. In recent years, Stryker has expanded the MAKO system’s capabilities and global reach, with installations in over 35 countries. The company’s ongoing partnerships with hospitals and research institutions focus on integrating AI-driven planning and real-time analytics, aiming to improve clinical outcomes and operational efficiency.

- Zimmer Biomet has accelerated the deployment of its ROSA Robotics platform, which is central to its ‘digital surgery’ ecosystem. ROSA is used in knee, hip, and brain surgery, and is integrated with Zimmer Biomet’s mymobility app for patient engagement and remote monitoring. The company has established joint ventures with technology providers to enhance data-driven surgical planning and postoperative care, and continues to invest in surgeon training and digital workflow optimization.

- Smith+Nephew has positioned its CORI Surgical System as a portable, efficient solution for robotic-assisted knee surgery, emphasizing its adaptability for both inpatient and outpatient settings. Smith+Nephew’s strategy includes partnerships with ambulatory surgery centers and orthopedic specialty groups to broaden access and utilization. The company is also developing cloud-based data platforms to support surgical planning and outcomes tracking, signaling a shift toward more integrated digital care pathways.

- Medtronic is expanding its influence in orthopedic robotics through its Mazor X Stealth Edition, primarily used for spinal applications but with potential for broader orthopedic procedures. Medtronic’s acquisition and integration strategy is focused on combining navigation, imaging, and robotics with its extensive implant portfolio. Collaborations with academic centers and digital health innovators are expected to enhance procedural accuracy and patient-specific solutions over the next several years.

Looking ahead, these companies are expected to deepen cross-sector partnerships—particularly with artificial intelligence, cloud computing, and imaging technology providers—to further automate and personalize orthopedic procedures. The next few years will likely see new joint ventures, expanded global deployment, and integration of advanced analytics, cementing the role of robotics as the standard of care in orthopedic implant surgery.

Regulatory Landscape: Approvals, Standards, and Compliance

The regulatory landscape for orthopedic implant robotics is rapidly evolving as these systems become increasingly integral to surgical workflows in 2025 and beyond. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other international bodies are adapting their frameworks to address the unique challenges and risks posed by robotic-assisted systems in orthopedic procedures.

In the United States, the FDA classifies most orthopedic surgical robots as Class II or Class III medical devices, requiring premarket notification (510(k)) or premarket approval (PMA), depending on the device’s complexity and intended use. Major manufacturers such as Stryker and Zimmer Biomet have secured clearances for their robotic systems—Mako and ROSA, respectively—after demonstrating substantial equivalence to predicate devices and compliance with recognized standards for safety, efficacy, and cybersecurity.

European Union regulations have also grown stricter since the enforcement of the Medical Device Regulation (MDR) in May 2021, with ongoing updates affecting the certification of robotic systems. The MDR demands robust clinical evaluation and post-market surveillance, compelling companies such as Smith+Nephew and Globus Medical to maintain comprehensive technical documentation and real-world performance data for their platforms. Notified Bodies across Europe are increasingly scrutinizing software validation, interoperability, and human factors engineering for these devices.

International standards such as ISO 13485 (quality management systems for medical devices) and IEC 62304 (medical device software lifecycle processes) remain foundational for compliance, with companies integrating these into their design and manufacturing pipelines. Cybersecurity is a growing regulatory focus, as agencies worldwide require manufacturers to implement proactive risk management and regular vulnerability assessments for network-connected devices.

Looking forward, regulatory agencies are preparing guidance specific to the integration of artificial intelligence (AI) and machine learning in orthopedic robotics, with draft documents expected in the next few years. Collaborative efforts between industry stakeholders and regulators—such as those facilitated by MedTech Europe—are shaping best practices for adaptive algorithms and real-time data utilization.

Overall, compliance burdens are expected to intensify, but ongoing harmonization of global standards and digital documentation processes may streamline international approvals. Manufacturers are investing heavily in regulatory science and real-world evidence generation to maintain market access and support the safe, effective deployment of orthopedic implant robotics worldwide.

Clinical Outcomes: Case Studies and Comparative Effectiveness

The clinical adoption of orthopedic implant robotics has accelerated in recent years, with a growing body of evidence evaluating its impact on patient outcomes. As of 2025, robotic-assisted systems are routinely utilized in joint replacement surgeries, particularly in knee and hip arthroplasty. Several leading manufacturers, including Smith+Nephew, Stryker, and Zimmer Biomet, have reported on the clinical outcomes associated with their robotic platforms.

Case studies published by hospitals and health systems using the Stryker Mako system have demonstrated improved alignment accuracy in total knee arthroplasty (TKA) compared to manual techniques. Data collected from multi-center registries and internal audits suggest a reduction in outlier implant positioning, which is associated with better functional outcomes and potentially lower revision rates. Similarly, early clinical results from the use of Zimmer Biomet‘s ROSA Knee System have indicated enhanced consistency in achieving planned bone resections and ligament balancing.

Comparative studies conducted within the past two years have focused not only on implant placement accuracy but also on short-term patient-reported outcomes and recovery trajectories. For example, reports from orthopedic centers employing Smith+Nephew CORI surgical system have noted trends toward reduced post-operative pain, shorter hospital stays, and earlier return to function, although these advantages are sometimes modest and can vary based on patient selection and surgical protocols.

Prospective randomized trials and registry data expected through 2025 and onward are anticipated to provide more definitive answers regarding long-term survivorship and complication rates. Early signals suggest that robotic-assisted procedures may decrease intraoperative variability and soft tissue trauma, which could translate to lower rates of revision surgery and improved joint longevity over the next decade.

- Robotic platforms have demonstrated statistically significant improvements in implant alignment in multiple peer-reviewed studies sponsored by device manufacturers.

- Some clinical programs report reductions in early complications such as infection and instability, but robust multicenter data are still forthcoming.

- Ongoing multi-year registries, such as those maintained by Zimmer Biomet and Stryker, are poised to clarify the comparative effectiveness and durability of robotic-assisted orthopedic implants.

In summary, while robotic orthopedic implant systems have demonstrated promising early results in terms of accuracy and perioperative outcomes, the orthopedic community is awaiting larger, longer-term studies to confirm whether these translate into meaningful benefits for revision rates and overall patient quality of life. The next few years will be pivotal in shaping practice guidelines and reimbursement frameworks based on this emerging evidence.

Surgeon Adoption and Training: Barriers and Accelerators

The adoption of orthopedic implant robotics among surgeons is accelerating but still faces notable barriers, with 2025 shaping up as a pivotal year for both technological integration and professional development. The sector has seen a marked uptick in interest, primarily driven by the promise of improved precision, reduced complications, and enhanced patient outcomes. However, the transition from traditional to robotic-assisted procedures is shaped by a complex interplay of educational, economic, and institutional factors.

One key barrier remains the learning curve associated with robotic systems. While manufacturers such as Stryker and Zimmer Biomet have made significant advances in intuitive interfaces and workflow integration, many surgeons—especially those mid- or late-career—report apprehension about retraining and temporarily reduced procedure efficiency. Data from recent industry forums indicate that full proficiency with leading platforms like the Mako system or ROSA Knee Robotics typically requires at least 10–20 supervised cases, which can be a deterrent for busy practitioners.

Cost and access to technology also pose challenges. The initial capital outlay for robotic systems, which often exceeds $1 million, remains a significant hurdle for smaller hospitals and ambulatory surgical centers. While companies such as Medtronic and DePuy Synthes are increasing efforts to provide flexible financing models and comprehensive training packages, disparities in access persist, particularly outside major urban centers.

On the accelerator side, there is a growing emphasis on structured training and certification. Industry leaders are investing heavily in simulation-based education, virtual reality modules, and remote proctoring to streamline skill acquisition. For example, Smith+Nephew has expanded its global training centers to facilitate hands-on experience, while Zimmer Biomet collaborates with hospital networks to embed continuous education within clinical workflows. These initiatives are expected to reduce onboarding times and improve surgeon confidence in robotic techniques.

Looking ahead to the next few years, surgeon adoption of orthopedic implant robotics is projected to rise steadily. Professional societies are updating guidelines to include robotic competencies, and more residency and fellowship programs are integrating robotics into their curricula. As clinical data continues to demonstrate improved patient satisfaction and implant longevity, institutional and surgeon-level resistance is likely to diminish. By 2027, it is anticipated that robotic-assisted orthopedic procedures will become standard in high-volume centers, with a corresponding increase in surgeon-led innovation and best practice dissemination.

Global Trends: Regional Hotspots and Expansion Strategies

The landscape of orthopedic implant robotics in 2025 is marked by strong global growth, with particular momentum in North America, Europe, and Asia-Pacific. These regions are not only seeing accelerated adoption of robotic-assisted surgery but are also key battlegrounds for technological innovation, strategic partnerships, and expansion by leading manufacturers.

North America, led by the United States, remains the largest market for orthopedic surgical robots. Major players such as Stryker (with the Mako system) and Zimmer Biomet (Rosa Robotics) continue to drive adoption in joint replacement and spinal procedures by leveraging established hospital networks and robust regulatory pathways. Their expansion strategies include deepening integration with hospital systems and focusing on value-based care models, where robotics can offer measurable improvements in patient outcomes and efficiency.

Europe is also experiencing rapid growth, particularly in Germany, the UK, and France, where orthopedic centers are increasingly investing in robotic platforms. Companies such as Smith+Nephew are strengthening their regional presence by tailoring robotic solutions to local clinical protocols and collaborating with teaching hospitals for training and research. The region’s focus on public healthcare efficiency and advanced surgical standards is fostering wider acceptance of robotic-assisted orthopedic surgeries.

Asia-Pacific represents the fastest expanding region, with China, Japan, and Australia leading the charge. Companies like MicroPort Orthopedics—a key Chinese orthopedic device manufacturer—are investing heavily in robotics R&D and local production facilities. Strategic alliances with domestic hospitals and government support for digital health innovation are accelerating deployments. Similarly, Japanese firms are leveraging the country’s strong robotics ecosystem to introduce next-generation surgical robots for hip and knee replacements.

To capture these regional opportunities, leading manufacturers are employing multifaceted expansion strategies. These include establishing local training centers, developing tailored robotic systems for diverse healthcare settings, and pursuing regulatory approvals across multiple markets in parallel. Partnerships with hospital groups and investment in surgeon education remain central to increasing procedural volumes and broadening the installed base.

Looking ahead, industry leaders anticipate heightened competition as more entrants—particularly from Asia—launch new systems and as existing players expand their portfolios. Interoperability with digital surgical planning and AI-driven analytics are expected to become differentiators, further increasing the global penetration of orthopedic implant robotics over the next several years.

Investment Landscape: M&A, Funding Rounds, and Strategic Moves

The orthopedic implant robotics sector is experiencing dynamic investment activity and strategic consolidation as companies vie for leadership in an expanding market. In 2025 and looking ahead, investment is driven by rising demand for precision in orthopedic procedures, a growing aging population, and advancements in robotic-assisted surgery. The influx of capital and merger and acquisition (M&A) activity underscores the sector’s maturation and future growth potential.

Several major orthopedic device manufacturers have been strengthening their robotic portfolios through strategic acquisitions and partnerships. For example, Smith+Nephew has continued investing in its robotics division following its acquisition of Brainlab’s orthopedic joint reconstruction business, expanding the capabilities of its CORI Surgical System. Similarly, Stryker remains a dominant player, building on its acquisition of Mako Surgical in recent years. The Mako SmartRobotics system continues to be a cornerstone of Stryker’s orthopedic growth strategy, driving further investments in software and hardware enhancements.

In addition to established giants, the sector is witnessing increased funding for innovative startups. Zimmer Biomet has actively invested in robotics through both internal R&D and external collaborations, notably with its ROSA Robotics platform. Recent years have seen Zimmer Biomet make strategic moves to broaden the application of ROSA beyond knee and hip procedures. Meanwhile, Medtronic has accelerated its presence in orthopedics and spine robotics, leveraging its Mazor X Stealth Edition system and pursuing targeted investments to expand its portfolio.

Venture capital and private equity players are also increasingly active. Early-stage companies developing next-generation robotic systems for orthopedic procedures—such as less invasive joint replacement or AI-enabled surgical planning—are attracting multi-million dollar Series A and B rounds. Strategic alliances are also on the rise, with device makers partnering with technology firms to integrate advanced navigation, data analytics, and cloud connectivity into robotic platforms.

Looking ahead to the next few years, consolidation is expected to intensify as major device manufacturers seek to acquire innovative technologies and broaden their reach across global markets. Simultaneously, continued funding for startups and scale-ups will drive rapid innovation, particularly in software, AI, and miniaturized robotics. Regulators are adapting to the pace of robotic adoption, which is expected to further facilitate investment and M&A activity. As the competitive landscape evolves, companies with strong robotic capabilities and integrated digital platforms are likely to secure a leading position in the next phase of orthopedic care.

Future Outlook: Next-Gen Innovations and Long-Term Impact

The field of orthopedic implant robotics is poised for significant advancements in 2025 and the years immediately following, driven by rapid technological innovation, growing clinical adoption, and evolving regulatory landscapes. Several leading medical technology firms have announced next-generation robotic systems, focusing on increased automation, integration with digital planning tools, and enhanced intraoperative feedback to improve precision and patient outcomes. For example, Stryker has indicated continued development of its Mako robotic platform, aiming for wider procedural applicability beyond knee and hip arthroplasty, potentially encompassing spine and trauma implants. Similarly, Zimmer Biomet is leveraging data analytics and artificial intelligence within its ROSA robotics ecosystem to support more personalized implant placement and postoperative care.

Data emerging from ongoing clinical studies and registries in 2025 suggest that robotic-assisted orthopedic procedures are achieving measurable improvements in component positioning accuracy, reduction in variability, and lower rates of early revision when compared to conventional techniques. These trends are encouraging wider adoption among orthopedic centers worldwide, particularly as cost barriers decrease and robotic systems become more compact and interoperable with hospital digital infrastructure.

Looking ahead, integration with artificial intelligence is expected to play a pivotal role in the evolution of orthopedic robotics. Companies such as Smith+Nephew are actively developing robotics platforms that incorporate machine learning and cloud connectivity, enabling real-time intraoperative decision support and remote monitoring of implant performance. In parallel, advances in haptic feedback and augmented reality visualization are anticipated to further enhance surgeon control and confidence, reducing learning curves and expanding the range of procedures suitable for robotic assistance.

Long-term, the impact of these innovations is likely to extend beyond the operating room. The convergence of robotics, AI, and digital health allows for comprehensive data capture throughout the patient journey, supporting evidence-based implant selection, tailored rehabilitation protocols, and predictive maintenance of implant health. As regulatory agencies increasingly recognize the clinical benefits and safety profiles of robotic systems, streamlined approval pathways may expedite the introduction of next-generation devices globally.

In summary, the orthopedic implant robotics sector in 2025 is characterized by accelerating innovation, expanding clinical evidence, and a clear trajectory toward more intelligent, connected, and patient-centric solutions. The coming years will likely see robotics become an integral standard of care in orthopedics, fundamentally reshaping surgical workflows and long-term patient outcomes.