Quantum Epitaxy for Optoelectronic Devices in 2025: Unleashing Next-Gen Performance and Market Expansion. Explore How Advanced Epitaxial Techniques Are Shaping the Future of Photonics and Electronics.

- Executive Summary: Quantum Epitaxy’s 2025 Market Inflection

- Technology Overview: Fundamentals of Quantum Epitaxy in Optoelectronics

- Key Materials and Substrate Innovations

- Major Players and Industry Collaborations (e.g., iqep.com, ams-osram.com, ieee.org)

- Current Market Size and 2025–2030 Growth Forecasts (Estimated CAGR: 18–22%)

- Emerging Applications: Photonic Chips, Quantum Communication, and Sensing

- Manufacturing Challenges and Yield Optimization

- Regulatory, Standards, and Industry Initiatives (e.g., ieee.org, semiconductors.org)

- Investment Trends and Strategic Partnerships

- Future Outlook: Disruptive Potential and Long-Term Opportunities

- Sources & References

Executive Summary: Quantum Epitaxy’s 2025 Market Inflection

Quantum epitaxy, the precise atomic-scale engineering of semiconductor layers, is reaching a pivotal inflection point in 2025 for optoelectronic device markets. This technology underpins the fabrication of advanced lasers, photodetectors, quantum cascade devices, and next-generation LEDs, all of which are critical for applications spanning telecommunications, sensing, automotive LiDAR, and quantum information systems. The surge in demand for high-performance, energy-efficient optoelectronic components is driving rapid adoption and innovation in quantum epitaxial growth techniques, particularly molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD).

Leading manufacturers are scaling up their quantum epitaxy capabilities to meet the requirements of emerging applications. ams OSRAM, a global leader in optoelectronic components, is expanding its epitaxial wafer production for high-brightness LEDs and laser diodes, targeting automotive and industrial markets. IQE plc, a specialist in advanced epitaxial wafers, is investing in new MOCVD and MBE reactors to supply compound semiconductor materials for 5G, photonics, and quantum technologies. Coherent Corp. (formerly II-VI Incorporated) is leveraging its vertically integrated supply chain to deliver quantum-engineered epitaxial structures for infrared lasers and photonic integrated circuits.

In 2025, the market is witnessing a shift toward more complex heterostructures, such as quantum wells, quantum dots, and superlattices, which enable superior device performance and new functionalities. For example, Samsung Electronics and Sony Group Corporation are both advancing quantum dot epitaxy for next-generation image sensors and display technologies. Meanwhile, Infineon Technologies AG is integrating quantum epitaxial layers into its power and RF devices to enhance efficiency and miniaturization.

The outlook for the next few years is marked by continued investment in epitaxial process control, wafer uniformity, and defect reduction, as device manufacturers push for higher yields and lower costs. Strategic partnerships between material suppliers and device makers are accelerating the commercialization of quantum epitaxy-based optoelectronics. As quantum communication and computing move closer to practical deployment, demand for ultra-pure, atomically precise epitaxial layers is expected to intensify, positioning quantum epitaxy as a foundational technology for the optoelectronic industry’s next wave of innovation.

Technology Overview: Fundamentals of Quantum Epitaxy in Optoelectronics

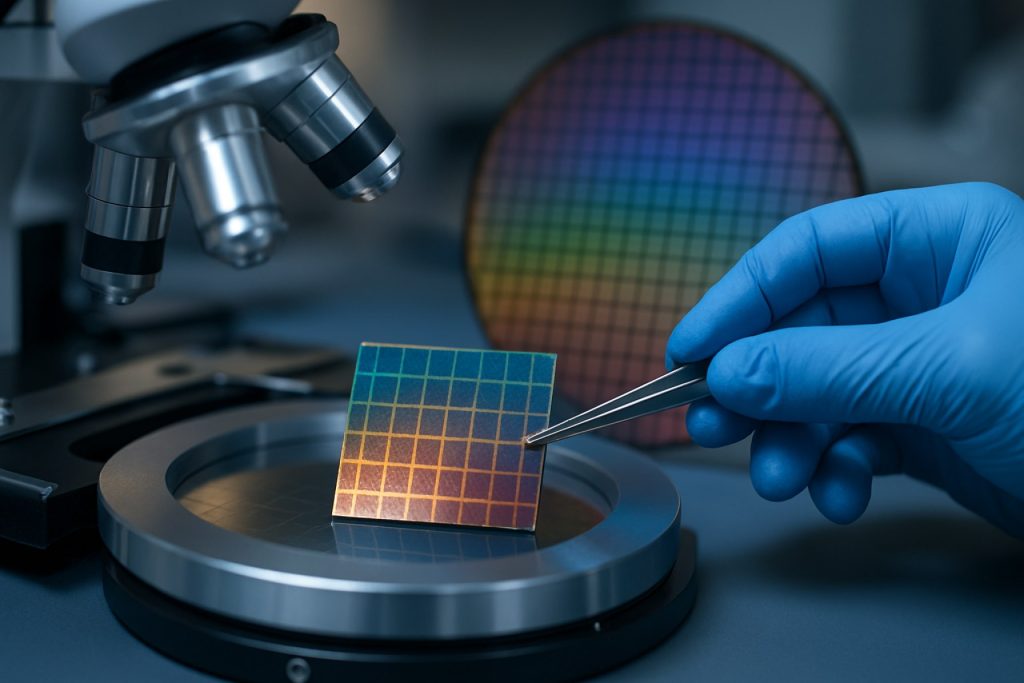

Quantum epitaxy is a cornerstone technology in the fabrication of advanced optoelectronic devices, enabling precise control over material composition and structure at the atomic scale. In 2025, the field is characterized by rapid advancements in both epitaxial growth techniques and their integration into commercial device manufacturing. Quantum epitaxy primarily involves methods such as Molecular Beam Epitaxy (MBE) and Metal-Organic Chemical Vapor Deposition (MOCVD), which are essential for producing high-quality quantum wells, quantum dots, and superlattices used in lasers, photodetectors, and light-emitting diodes (LEDs).

The fundamental principle of quantum epitaxy lies in the layer-by-layer deposition of semiconductor materials with atomic precision, allowing for the engineering of band structures and quantum confinement effects. This precision is critical for tailoring the optical and electronic properties of devices, such as emission wavelength, efficiency, and carrier mobility. For instance, the use of InGaN/GaN quantum wells has become standard in high-brightness blue and green LEDs, while InAs/GaAs quantum dots are pivotal in infrared photodetectors and quantum cascade lasers.

Leading manufacturers and research organizations are at the forefront of quantum epitaxy innovation. ams OSRAM and Lumentum Holdings are notable for their deployment of advanced epitaxial processes in the production of high-performance optoelectronic components, including VCSELs (Vertical-Cavity Surface-Emitting Lasers) and edge-emitting lasers for applications in 3D sensing, automotive LiDAR, and optical communications. Coherent Corp. (formerly II-VI Incorporated) is another key player, leveraging MOCVD and MBE for the fabrication of compound semiconductor devices, with a focus on photonics and quantum technologies.

Recent years have seen significant progress in the scalability and uniformity of quantum epitaxial layers, driven by improvements in reactor design, in-situ monitoring, and automation. These advances are enabling the mass production of devices with tighter performance tolerances and higher yields. In 2025 and beyond, the outlook for quantum epitaxy in optoelectronics is shaped by the growing demand for miniaturized, energy-efficient, and high-speed photonic devices. The integration of quantum epitaxial structures with silicon photonics and heterogeneous platforms is expected to accelerate, opening new avenues for data centers, quantum communication, and next-generation displays.

As the industry continues to push the boundaries of material engineering, collaborations between equipment suppliers, such as Veeco Instruments and American Superconductor Corporation, and device manufacturers are anticipated to further enhance the capabilities and adoption of quantum epitaxy in optoelectronic device fabrication.

Key Materials and Substrate Innovations

Quantum epitaxy, the precise atomic-scale growth of semiconductor layers, is a cornerstone for next-generation optoelectronic devices such as quantum dot lasers, single-photon sources, and advanced photodetectors. In 2025, the field is witnessing rapid innovation in both materials and substrate technologies, driven by the demand for higher efficiency, integration, and scalability in quantum and classical photonic systems.

A major trend is the refinement of III-V compound semiconductors—especially indium gallium arsenide (InGaAs), gallium nitride (GaN), and aluminum gallium arsenide (AlGaAs)—grown on lattice-matched and engineered substrates. These materials are essential for high-performance light emission and detection in the visible and near-infrared spectrum. Companies such as ams OSRAM and Lumentum Holdings are actively advancing epitaxial wafer production for lasers and photonic integrated circuits, focusing on defect reduction and uniformity at the wafer scale.

Substrate innovation is equally critical. The use of silicon (Si) as a platform for integrating III-V quantum structures is gaining momentum, enabling the convergence of photonics and electronics. Intel Corporation and imec are leading efforts to develop direct epitaxial growth of quantum dots and quantum wells on silicon, overcoming challenges of lattice mismatch and thermal expansion. This approach is expected to facilitate mass production of quantum photonic chips compatible with existing CMOS infrastructure.

Another significant development is the adoption of engineered substrates such as silicon carbide (SiC) and sapphire, which offer superior thermal conductivity and lattice compatibility for certain quantum materials. Cree, Inc. (now Wolfspeed) is a prominent supplier of SiC substrates, supporting the growth of GaN-based quantum emitters and detectors with improved reliability and power handling.

In parallel, advances in molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) are enabling atomic-level control over layer thickness, composition, and interface quality. Veeco Instruments Inc. and AIXTRON SE are key equipment providers, supplying reactors and process solutions tailored for quantum epitaxy applications.

Looking ahead, the next few years are expected to bring further breakthroughs in defect engineering, wafer-scale uniformity, and heterogeneous integration. These advances will underpin the commercialization of quantum light sources, detectors, and integrated photonic circuits, accelerating the deployment of quantum communication, sensing, and computing technologies.

Major Players and Industry Collaborations (e.g., iqep.com, ams-osram.com, ieee.org)

The landscape of quantum epitaxy for optoelectronic devices in 2025 is shaped by a dynamic interplay of established industry leaders, innovative startups, and strategic collaborations. Quantum epitaxy, particularly molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD), underpins the fabrication of high-performance quantum wells, quantum dots, and superlattices essential for next-generation lasers, photodetectors, and light-emitting diodes (LEDs).

A central player in this domain is IQE plc, a UK-based global supplier specializing in advanced epitaxial wafers for compound semiconductors. IQE’s portfolio includes materials for photonic and electronic devices, with a strong focus on III-V semiconductors such as GaAs, InP, and GaN. In recent years, IQE has expanded its quantum epitaxy capabilities to support the growing demand for high-efficiency optoelectronic components in 5G, automotive LiDAR, and quantum communication applications. The company’s collaborations with device manufacturers and research institutions are expected to intensify through 2025, as the industry seeks to scale quantum dot and quantum well production for mass-market devices.

Another major force is ams-OSRAM AG, a global leader in optoelectronic components, including LEDs, laser diodes, and sensors. ams-OSRAM leverages advanced epitaxial growth techniques to produce high-brightness and wavelength-stable emitters for automotive, industrial, and consumer electronics. The company’s ongoing investments in quantum dot and micro-LED technologies are closely tied to its epitaxy expertise, with recent announcements highlighting new product lines for augmented reality and advanced display applications. Strategic partnerships with foundries and research consortia are expected to accelerate the commercialization of quantum epitaxy-based devices in the near term.

Industry-wide collaboration is further fostered by organizations such as the IEEE, which provides a platform for standardization, knowledge exchange, and joint research initiatives. IEEE’s conferences and working groups on compound semiconductors and quantum devices facilitate the alignment of technical standards and best practices, supporting interoperability and rapid innovation across the sector.

Looking ahead, the next few years will likely see increased cross-border partnerships, with companies like IQE and ams-OSRAM collaborating with Asian and North American foundries to address supply chain resilience and scale-up challenges. The convergence of quantum epitaxy with silicon photonics and heterogeneous integration is also anticipated, as industry players seek to unlock new functionalities and cost efficiencies for optoelectronic devices in telecommunications, sensing, and quantum information processing.

Current Market Size and 2025–2030 Growth Forecasts (Estimated CAGR: 18–22%)

Quantum epitaxy, the precision-controlled growth of semiconductor layers at the atomic scale, is a foundational technology for advanced optoelectronic devices such as lasers, photodetectors, and quantum light sources. As of 2025, the global market for quantum epitaxy in optoelectronic applications is estimated to be valued in the low single-digit billions USD, with robust growth projected through 2030. The estimated compound annual growth rate (CAGR) for this segment is between 18% and 22%, driven by surging demand for high-performance photonic components in telecommunications, data centers, automotive LiDAR, and quantum information systems.

Key industry players are scaling up their epitaxial wafer production capacities to meet this demand. ams OSRAM, a leader in optoelectronic components, has invested heavily in expanding its epitaxy and wafer processing lines, particularly for high-brightness LEDs and laser diodes. Coherent Corp. (formerly II-VI Incorporated) is another major supplier, providing advanced epitaxial wafers for vertical-cavity surface-emitting lasers (VCSELs) and photonic integrated circuits, with a focus on 3D sensing and datacom markets. IQE plc, a specialist in compound semiconductor epitaxy, has reported strong order books for GaAs and InP-based wafers, citing growth in 5G, automotive, and quantum technology sectors.

The market’s expansion is further supported by strategic partnerships and long-term supply agreements. For example, Samsung Electronics and Sony Group Corporation are both investing in next-generation quantum dot and quantum well technologies for image sensors and display applications, leveraging in-house and external epitaxial wafer suppliers. Vixar Inc., a subsidiary of OSRAM, is advancing VCSEL arrays for automotive and consumer electronics, underpinned by proprietary epitaxial growth processes.

Looking ahead to 2030, the quantum epitaxy market is expected to benefit from the proliferation of quantum communication networks and the integration of quantum light sources into commercial photonic platforms. The adoption of advanced epitaxial techniques—such as molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD)—will be critical for achieving the material quality and scalability required for mass-market optoelectronic and quantum devices. As leading manufacturers continue to invest in R&D and capacity expansion, the sector is poised for sustained double-digit growth, with Asia-Pacific, North America, and Europe all playing significant roles in the global supply chain.

Emerging Applications: Photonic Chips, Quantum Communication, and Sensing

Quantum epitaxy, the precise atomic-scale growth of semiconductor layers, is rapidly advancing the field of optoelectronic devices, particularly as the industry pivots toward quantum-enabled applications. In 2025, the integration of quantum epitaxial techniques is central to the development of photonic chips, quantum communication systems, and quantum sensing platforms. These applications demand materials with exceptional purity, uniformity, and engineered quantum properties, which quantum epitaxy is uniquely positioned to deliver.

A key trend in 2025 is the deployment of quantum dot and quantum well structures grown via molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD). These methods enable the fabrication of single-photon sources and entangled photon emitters, which are foundational for quantum communication and secure data transmission. Companies such as ams OSRAM and IQE plc are at the forefront, supplying epitaxial wafers and custom heterostructures for next-generation photonic integrated circuits (PICs) and quantum light sources. IQE plc, in particular, has expanded its portfolio to include advanced III-V compound semiconductor materials tailored for quantum photonics, supporting both research and commercial device manufacturing.

In quantum communication, the demand for on-chip integration of quantum light sources and detectors is driving collaborations between epitaxial material suppliers and device manufacturers. ams OSRAM is leveraging its expertise in compound semiconductors to develop high-performance epitaxial structures for single-photon avalanche diodes (SPADs) and quantum dot lasers, which are critical for quantum key distribution (QKD) systems. Meanwhile, imec, a leading R&D hub, is working with industry partners to integrate epitaxially grown quantum materials with silicon photonics, aiming to scale quantum photonic chips for commercial deployment.

Quantum sensing is another area witnessing rapid progress, with epitaxial growth enabling the realization of highly sensitive detectors and quantum-enhanced imaging devices. ams OSRAM and IQE plc are both investing in the development of epitaxial platforms for infrared and visible-range quantum sensors, targeting applications in medical diagnostics, environmental monitoring, and autonomous systems.

Looking ahead, the outlook for quantum epitaxy in optoelectronics is robust. The convergence of advanced epitaxial growth, device miniaturization, and quantum engineering is expected to accelerate the commercialization of quantum photonic chips and integrated quantum systems over the next few years. Strategic partnerships between material suppliers, foundries, and system integrators will be crucial in overcoming scalability and yield challenges, paving the way for widespread adoption of quantum-enabled optoelectronic devices.

Manufacturing Challenges and Yield Optimization

Quantum epitaxy, the precise deposition of atomically controlled layers, is foundational for the fabrication of advanced optoelectronic devices such as quantum dot lasers, single-photon sources, and high-efficiency photodetectors. As of 2025, the sector faces significant manufacturing challenges, particularly in scaling up from laboratory-scale molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) processes to high-yield, cost-effective industrial production.

A primary challenge is the stringent requirement for atomic-scale uniformity and defect minimization across large wafer areas. Even minor deviations in layer thickness or composition can drastically affect device performance, especially for quantum well and quantum dot structures. Leading equipment manufacturers such as Veeco Instruments Inc. and American Superconductor Corporation (AMSC) have introduced advanced MBE and MOCVD systems with real-time in-situ monitoring, including reflection high-energy electron diffraction (RHEED) and spectroscopic ellipsometry, to address these issues. These systems enable tighter process control, but maintaining uniformity at 200 mm and larger wafer sizes remains a technical bottleneck.

Yield optimization is further complicated by the sensitivity of quantum structures to contamination and interface roughness. Companies such as AMSC and Veeco Instruments Inc. are investing in ultra-high vacuum environments and advanced precursor delivery systems to reduce unintentional doping and particulate contamination. Additionally, the integration of machine learning algorithms for process optimization is gaining traction, with several manufacturers reporting improved yield and reduced cycle times through predictive maintenance and adaptive process control.

Another critical issue is the reproducibility of quantum dot size and density, which directly impacts the emission wavelength and efficiency of optoelectronic devices. AMSC and Veeco Instruments Inc. are collaborating with leading semiconductor foundries to develop standardized recipes and automated calibration routines, aiming to reduce batch-to-batch variability.

Looking ahead to the next few years, the outlook for quantum epitaxy in optoelectronics is cautiously optimistic. The industry is expected to benefit from continued advances in epitaxial reactor design, in-situ metrology, and data-driven process control. However, the transition to larger wafer formats and the integration of quantum structures with silicon photonics platforms will require further innovation. Industry consortia and partnerships between equipment suppliers, material providers, and device manufacturers are likely to play a pivotal role in overcoming these manufacturing and yield challenges, paving the way for broader commercialization of quantum-enabled optoelectronic devices.

Regulatory, Standards, and Industry Initiatives (e.g., ieee.org, semiconductors.org)

Quantum epitaxy, the precise atomic-scale growth of semiconductor layers, is foundational for next-generation optoelectronic devices such as quantum dot lasers, single-photon sources, and advanced photodetectors. As the field matures, regulatory frameworks, standards, and industry initiatives are evolving to address the unique challenges and opportunities presented by quantum epitaxial technologies.

In 2025, the IEEE continues to play a central role in standardizing measurement techniques, material quality benchmarks, and device characterization protocols for quantum epitaxial structures. The IEEE Photonics Society and the Nanotechnology Council are actively updating standards to reflect advances in molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) processes, which are critical for fabricating quantum wells and dots with atomic precision. These standards are essential for ensuring device interoperability and reliability, especially as quantum-enabled optoelectronics move toward commercial deployment.

The SEMI organization, representing the global electronics manufacturing supply chain, has launched new task forces in 2024–2025 focused on materials purity, wafer uniformity, and contamination control specific to quantum epitaxial growth. These initiatives aim to harmonize best practices across fabs and research institutions, facilitating the scale-up of quantum optoelectronic device production. SEMI’s International Standards program is also working on guidelines for traceability and quality assurance in compound semiconductor substrates, which are vital for quantum dot and quantum well device performance.

On the policy front, the Semiconductor Industry Association (SIA) is advocating for increased federal funding and public-private partnerships to accelerate quantum materials research and workforce development. In 2025, SIA’s Quantum Technology Working Group is collaborating with government agencies to shape export controls and intellectual property frameworks that balance innovation with security concerns, particularly as quantum epitaxial devices become strategically important for communications and sensing.

Industry consortia such as the imec research center in Belgium and the CSEM in Switzerland are spearheading collaborative projects to establish open-access epitaxial growth platforms and shared metrology standards. These efforts are designed to lower barriers for startups and academic labs entering the quantum optoelectronics space, fostering a more robust innovation ecosystem.

Looking ahead, the convergence of regulatory, standards, and industry initiatives is expected to accelerate the commercialization of quantum epitaxial optoelectronic devices. As global supply chains adapt to the stringent requirements of quantum materials, harmonized standards and proactive policy support will be critical in ensuring quality, security, and competitiveness in this rapidly advancing sector.

Investment Trends and Strategic Partnerships

The landscape of investment and strategic partnerships in quantum epitaxy for optoelectronic devices is experiencing significant momentum as of 2025, driven by the surging demand for high-performance photonic and quantum technologies. Quantum epitaxy, particularly molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD), is foundational for fabricating advanced quantum wells, quantum dots, and superlattices used in lasers, detectors, and emerging quantum information systems.

Major semiconductor manufacturers and equipment suppliers are intensifying their investments in epitaxial growth technologies. ams OSRAM, a global leader in optoelectronic components, has announced expanded capital expenditure in 2024–2025 to scale up its epitaxial wafer production, targeting next-generation microLEDs and infrared emitters. Similarly, Coherent Corp. (formerly II-VI Incorporated) continues to invest in MOCVD and MBE capabilities, supporting both in-house device manufacturing and foundry services for external partners in the quantum and photonics sectors.

Strategic partnerships are also shaping the competitive landscape. ams OSRAM has entered into collaborations with leading research institutes and start-ups to accelerate the commercialization of quantum dot and quantum well-based optoelectronic devices. AIT Austrian Institute of Technology and Fraunhofer-Gesellschaft are notable research organizations partnering with industry to develop scalable epitaxial processes for quantum photonic integrated circuits, with pilot projects underway in Europe.

Equipment suppliers are also forging alliances to advance epitaxial technology. Veeco Instruments Inc., a prominent provider of MBE and MOCVD systems, has reported new multi-year supply agreements with both established semiconductor manufacturers and emerging quantum device start-ups. These partnerships are focused on delivering high-uniformity, high-throughput epitaxial reactors tailored for quantum dot lasers and single-photon sources.

Looking ahead, the next few years are expected to see further consolidation and cross-sector collaboration, as quantum epitaxy becomes increasingly central to the optoelectronics value chain. The convergence of photonics, quantum computing, and advanced communications is prompting both established players and new entrants to form joint ventures and co-development agreements. This trend is likely to accelerate as governments in the US, Europe, and Asia expand funding for quantum technology infrastructure, further incentivizing private investment and public-private partnerships in epitaxial manufacturing and device integration.

Future Outlook: Disruptive Potential and Long-Term Opportunities

Quantum epitaxy, the precise atomic-scale engineering of semiconductor layers, is poised to disrupt the optoelectronic device landscape in 2025 and beyond. This technique, which includes methods such as molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD), enables the fabrication of quantum wells, dots, and superlattices with unprecedented control over material properties. As the demand for high-performance photonic and electronic devices accelerates, quantum epitaxy is emerging as a cornerstone for next-generation applications in communications, sensing, and quantum information technologies.

In 2025, leading manufacturers are scaling up quantum epitaxy for mass production of advanced optoelectronic components. For instance, ams OSRAM and Lumentum Holdings are leveraging epitaxial growth to produce high-efficiency laser diodes and photonic integrated circuits for datacom and LiDAR. Coherent Corp. (formerly II-VI Incorporated) is expanding its epitaxial wafer capabilities to support the surging demand for vertical-cavity surface-emitting lasers (VCSELs) in 3D sensing and automotive applications. These companies are investing in advanced MOCVD and MBE reactors to achieve tighter control over layer thickness, composition, and interface quality, which are critical for quantum-confined structures.

The integration of quantum epitaxy with silicon photonics is another disruptive trend. Intel Corporation and GlobalFoundries are actively developing hybrid platforms that combine III-V quantum wells and dots with silicon substrates, aiming to unlock new levels of performance for optical transceivers and quantum light sources. This approach promises to overcome the limitations of traditional silicon photonics by enabling efficient on-chip lasers and single-photon emitters, which are essential for quantum communication and computing.

Looking ahead, the convergence of quantum epitaxy with emerging materials—such as indium phosphide (InP), gallium nitride (GaN), and two-dimensional semiconductors—will open new frontiers in optoelectronics. Companies like ams OSRAM and Coherent Corp. are exploring these materials for applications ranging from micro-LED displays to ultraviolet photodetectors and quantum cascade lasers. The ability to engineer band structures and quantum confinement at the atomic level is expected to yield devices with higher efficiency, lower power consumption, and novel functionalities.

In summary, quantum epitaxy is set to be a disruptive force in optoelectronics through 2025 and the following years. As industry leaders expand their epitaxial manufacturing capabilities and integrate quantum structures with mainstream semiconductor platforms, the technology will unlock long-term opportunities in data communications, sensing, displays, and quantum information science.

Sources & References

- ams OSRAM

- IQE plc

- Infineon Technologies AG

- Lumentum Holdings

- Veeco Instruments

- American Superconductor Corporation

- imec

- Cree, Inc.

- AIXTRON SE

- ams-OSRAM AG

- IEEE

- OSRAM

- Semiconductor Industry Association

- CSEM

- AIT Austrian Institute of Technology

- Fraunhofer-Gesellschaft

- Coherent Corp.