Solid-State Laser Diode Systems in 2025: Market Acceleration, Breakthrough Technologies, and Strategic Opportunities. Explore how this sector is set to redefine photonics and industrial applications over the next five years.

- Executive Summary & Key Findings

- Market Overview: Definition, Segmentation, and Scope

- 2025 Market Size & 2025–2030 Growth Forecast (8% CAGR)

- Key Drivers: Industrial, Medical, and Defense Applications

- Emerging Technologies: Efficiency, Miniaturization, and Integration

- Competitive Landscape: Leading Players & Market Share Analysis

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Supply Chain & Manufacturing Trends

- Regulatory Environment & Standards

- Investment, M&A, and Funding Trends

- Challenges & Barriers to Adoption

- Future Outlook: Disruptive Innovations and Strategic Recommendations

- Sources & References

Executive Summary & Key Findings

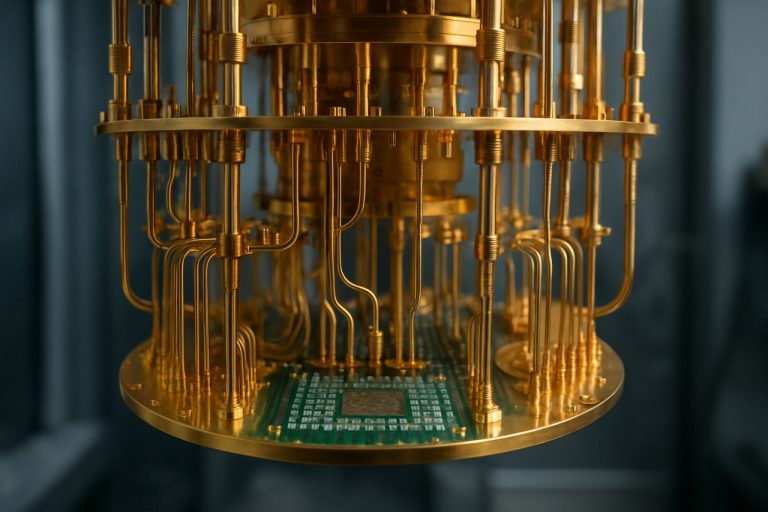

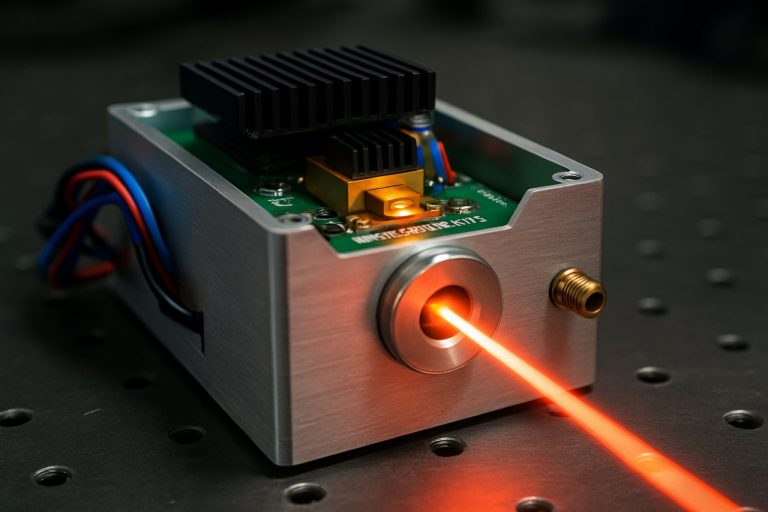

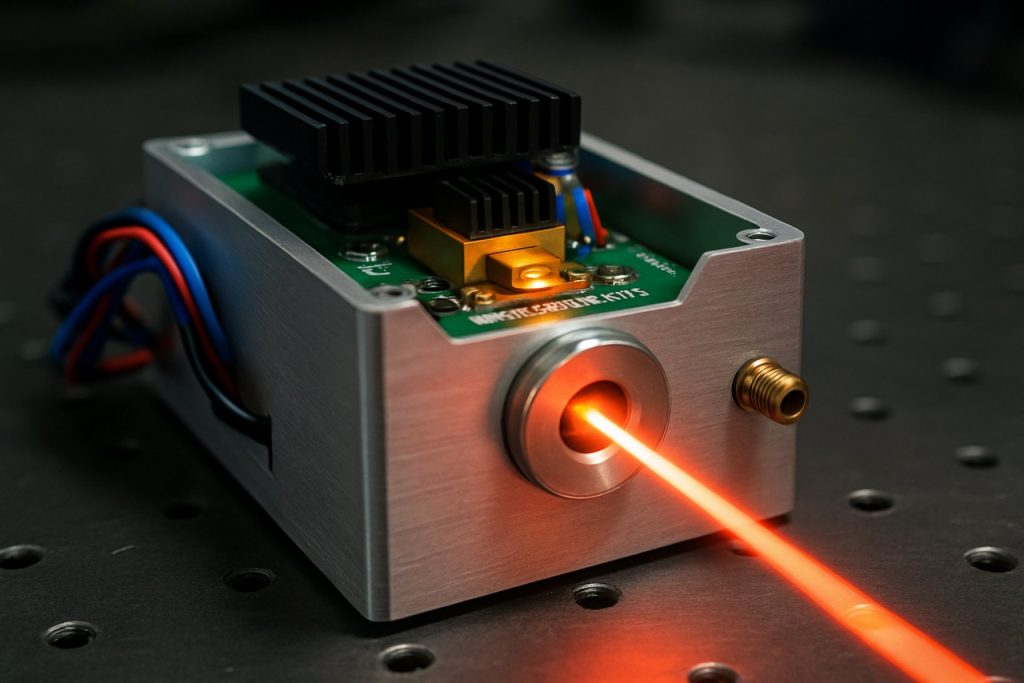

Solid-state laser diode systems are advanced photonic devices that utilize semiconductor diodes to pump solid-state gain media, resulting in highly efficient, compact, and reliable laser sources. These systems are integral to a wide range of applications, including industrial manufacturing, medical procedures, scientific research, and defense technologies. The global market for solid-state laser diode systems is poised for significant growth in 2025, driven by technological advancements, increasing demand for precision manufacturing, and expanding applications in emerging fields such as quantum computing and autonomous vehicles.

Key findings for 2025 indicate that the integration of solid-state laser diodes with fiber and disk laser architectures is enhancing system performance, offering higher output powers, improved beam quality, and greater energy efficiency. Leading manufacturers such as Coherent Corp. and TRUMPF Group are investing in research and development to further miniaturize components and improve thermal management, which is critical for high-duty-cycle industrial applications.

The medical sector continues to be a major adopter, with solid-state laser diode systems enabling minimally invasive surgeries, advanced imaging, and precise phototherapy. Regulatory approvals and clinical adoption are accelerating, particularly in ophthalmology and dermatology, as highlighted by Alcon Inc. and Lumenis Ltd.. In the industrial domain, the automotive and electronics industries are leveraging these systems for micro-machining, welding, and additive manufacturing, benefiting from the lasers’ stability and low maintenance requirements.

Geographically, Asia-Pacific remains the fastest-growing market, fueled by robust manufacturing sectors in China, Japan, and South Korea. Government initiatives supporting advanced manufacturing and photonics research, such as those from New Energy and Industrial Technology Development Organization (NEDO), are further propelling regional growth.

In summary, 2025 will see solid-state laser diode systems at the forefront of photonics innovation, with key trends including system miniaturization, integration with smart manufacturing platforms, and expansion into new medical and industrial applications. Strategic collaborations between manufacturers, research institutions, and end-users are expected to accelerate the commercialization of next-generation systems, solidifying their role as a cornerstone technology in the evolving global laser market.

Market Overview: Definition, Segmentation, and Scope

Solid-state laser diode systems are advanced photonic devices that utilize semiconductor materials to generate coherent light, typically in the visible or infrared spectrum. These systems are distinguished by their compact size, high efficiency, and reliability, making them integral to a wide range of industrial, medical, and scientific applications. The market for solid-state laser diode systems is poised for significant growth in 2025, driven by technological advancements, expanding end-use industries, and increasing demand for precision and miniaturization in optical systems.

The market can be segmented based on several key criteria:

- Type: The primary segmentation is by laser type, including single-mode and multi-mode laser diode systems. Single-mode systems offer high beam quality and are preferred for applications requiring precision, while multi-mode systems provide higher output power for industrial uses.

- Wavelength: Segmentation by wavelength covers ultraviolet, visible, and infrared laser diodes, each tailored for specific applications such as spectroscopy, medical diagnostics, and telecommunications.

- Application: Major application areas include materials processing, medical devices, telecommunications, defense, and consumer electronics. For instance, in the medical sector, solid-state laser diode systems are used in surgical procedures and diagnostic equipment, while in manufacturing, they enable high-precision cutting and welding.

- End-User: The market is further segmented by end-users such as industrial manufacturers, healthcare providers, research institutions, and defense organizations.

- Geography: Regional segmentation highlights key markets in North America, Europe, Asia-Pacific, and the rest of the world, with Asia-Pacific expected to witness the fastest growth due to robust electronics and manufacturing sectors.

The scope of the solid-state laser diode systems market in 2025 encompasses both established and emerging applications. Innovations in semiconductor materials and packaging are enabling higher power outputs, improved thermal management, and greater integration with photonic circuits. Leading manufacturers such as Coherent Corp., Hamamatsu Photonics K.K., and OSRAM GmbH are investing in research and development to expand product portfolios and address evolving customer needs. As industries increasingly adopt automation and digitalization, the demand for solid-state laser diode systems is expected to accelerate, shaping the photonics landscape in 2025 and beyond.

2025 Market Size & 2025–2030 Growth Forecast (8% CAGR)

The global market for solid-state laser diode systems is projected to reach a significant milestone in 2025, with an estimated market size of approximately USD 2.1 billion. This growth is underpinned by increasing adoption across diverse sectors, including industrial manufacturing, medical devices, telecommunications, and defense. The robust demand for high-precision laser systems in applications such as materials processing, additive manufacturing, and advanced medical procedures is a key driver for market expansion.

From 2025 to 2030, the solid-state laser diode systems market is forecasted to grow at a compound annual growth rate (CAGR) of 8%. This sustained growth trajectory is attributed to ongoing technological advancements, such as improvements in beam quality, energy efficiency, and miniaturization. The integration of solid-state laser diodes in next-generation fiber laser systems and their increasing use in LiDAR for autonomous vehicles are expected to further accelerate market expansion.

Geographically, Asia-Pacific is anticipated to maintain its dominance, driven by strong manufacturing bases in countries like China, Japan, and South Korea. North America and Europe are also expected to witness steady growth, supported by investments in research and development and the presence of leading industry players such as Coherent Corp., TRUMPF Group, and Hamamatsu Photonics K.K..

Key end-use industries, including automotive, electronics, and healthcare, are increasingly leveraging solid-state laser diode systems for their reliability, compactness, and ability to deliver high output power with precise control. The medical sector, in particular, is witnessing rapid adoption for surgical procedures, dermatology, and ophthalmology, while the industrial sector continues to utilize these systems for cutting, welding, and marking applications.

Looking ahead, the market is poised for further innovation, with companies focusing on enhancing product lifespans, reducing costs, and expanding the range of wavelengths available. Strategic collaborations and investments in emerging applications, such as quantum computing and advanced sensing, are likely to open new avenues for growth through 2030.

Key Drivers: Industrial, Medical, and Defense Applications

Solid-state laser diode systems are increasingly integral to a range of high-impact sectors, with industrial, medical, and defense applications serving as primary drivers of market growth and technological innovation in 2025. Each sector leverages the unique advantages of solid-state laser diodes—such as compactness, efficiency, and wavelength versatility—to address specific operational demands.

In industrial settings, solid-state laser diode systems are pivotal for precision manufacturing processes, including cutting, welding, and additive manufacturing. Their ability to deliver high power with excellent beam quality enables faster processing speeds and finer detail, which is essential for electronics, automotive, and aerospace manufacturing. The adoption of automation and smart manufacturing further accelerates demand, as laser diodes integrate seamlessly with robotic systems and digital controls. Leading industrial technology providers, such as TRUMPF Group and Coherent Corp., continue to expand their solid-state laser portfolios to meet these evolving requirements.

In the medical field, solid-state laser diode systems are valued for their precision, reliability, and minimally invasive capabilities. They are widely used in surgical procedures, dermatology, ophthalmology, and dental treatments. The ability to target specific tissues with minimal collateral damage is particularly advantageous in delicate surgeries, such as retinal repair or tumor ablation. Medical device manufacturers like Lumenis Ltd. and BIOLASE, Inc. are at the forefront of integrating advanced laser diode technologies into next-generation medical equipment, supporting trends toward outpatient care and personalized medicine.

Defense applications represent another significant driver, with solid-state laser diode systems being deployed in directed energy weapons, range finding, target designation, and secure communications. Their compact form factor and high electrical-to-optical efficiency make them suitable for mobile and airborne platforms. Defense agencies and contractors, including Lockheed Martin Corporation and Northrop Grumman Corporation, are investing in the development of high-power, ruggedized laser diode systems to enhance operational capabilities and address emerging security threats.

Overall, the convergence of industrial automation, advanced medical procedures, and modern defense strategies is propelling the adoption and evolution of solid-state laser diode systems, positioning them as a cornerstone technology across multiple high-value domains in 2025.

Emerging Technologies: Efficiency, Miniaturization, and Integration

Solid-state laser diode systems are at the forefront of photonics innovation, with recent advancements in 2025 focusing on efficiency, miniaturization, and seamless integration into diverse applications. These systems, which utilize semiconductor materials to generate coherent light, are increasingly replacing traditional gas and lamp-based lasers due to their compactness, energy efficiency, and reliability.

A key trend is the dramatic improvement in wall-plug efficiency, driven by advances in materials such as gallium nitride (GaN) and indium gallium arsenide phosphide (InGaAsP). These materials enable higher output powers with lower energy consumption, making solid-state laser diodes ideal for applications ranging from industrial manufacturing to medical diagnostics. For instance, ams OSRAM and Hamamatsu Photonics K.K. have introduced new diode architectures that reduce thermal losses and extend operational lifetimes, further enhancing system efficiency.

Miniaturization is another significant development. The integration of micro-optics and advanced packaging techniques has led to the creation of laser diode modules that are not only smaller but also more robust. This miniaturization allows for the deployment of solid-state laser systems in portable devices, autonomous vehicles, and wearable technologies. Companies like TRUMPF Group are pioneering compact laser modules for industrial and automotive LiDAR, while Coherent Corp. is developing miniaturized solutions for biomedical instrumentation.

Integration with photonic integrated circuits (PICs) is accelerating, enabling solid-state laser diodes to be embedded directly onto silicon chips. This integration supports high-speed data transmission in telecommunications and data centers, as well as advanced sensing in consumer electronics. Intel Corporation and Coherent Corp. are leading efforts to commercialize silicon photonics platforms that incorporate laser diodes for scalable, high-performance optical interconnects.

In summary, the evolution of solid-state laser diode systems in 2025 is characterized by breakthroughs in efficiency, miniaturization, and integration. These advances are expanding the reach of laser technology into new markets and applications, setting the stage for further innovation in the years ahead.

Competitive Landscape: Leading Players & Market Share Analysis

The competitive landscape of the solid-state laser diode systems market in 2025 is characterized by the presence of several established global players, each leveraging technological innovation, strategic partnerships, and robust distribution networks to maintain or expand their market share. Key industry leaders include Coherent Corp., TRUMPF Group, Hamamatsu Photonics K.K., Northrop Grumman Corporation, and IPG Photonics Corporation. These companies are recognized for their extensive product portfolios, which cater to diverse applications such as materials processing, medical devices, defense, and telecommunications.

Market share analysis reveals that Coherent Corp. and TRUMPF Group continue to dominate the high-power segment, particularly in industrial and manufacturing applications, due to their advanced R&D capabilities and global service infrastructure. Hamamatsu Photonics K.K. maintains a strong position in the scientific and medical sectors, benefiting from its expertise in photonics and optoelectronics. IPG Photonics Corporation is a leader in fiber laser technology, which is increasingly integrated with solid-state laser diode systems for enhanced efficiency and performance.

Emerging players and regional manufacturers, particularly from Asia-Pacific, are intensifying competition by offering cost-effective solutions and targeting niche markets. Companies such as Panasonic Corporation and OSRAM GmbH are expanding their presence through innovation in compact and energy-efficient laser diode modules. Strategic collaborations, mergers, and acquisitions are common, as firms seek to broaden their technological capabilities and global reach.

Overall, the market is witnessing a shift towards higher power densities, improved beam quality, and integration with digital manufacturing systems. The ability to offer customized solutions and after-sales support remains a key differentiator among leading players. As demand grows across sectors like automotive, electronics, and healthcare, the competitive dynamics are expected to further intensify, with innovation and scalability as primary drivers of market leadership.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for solid-state laser diode systems in 2025 is characterized by distinct regional trends, shaped by technological advancements, industrial demand, and government initiatives. North America remains a leader, driven by robust investments in defense, medical devices, and advanced manufacturing. The United States, in particular, benefits from strong R&D support and a concentration of key players such as Northrop Grumman Corporation and Coherent Corp., fostering innovation in high-power and precision laser applications.

Europe follows closely, with a focus on industrial automation, automotive manufacturing, and medical technology. Countries like Germany and France are at the forefront, leveraging the expertise of companies such as TRUMPF Group and Lumentum Holdings Inc. (with significant European operations). The European Union’s emphasis on sustainability and energy efficiency also encourages the adoption of solid-state laser diode systems in green manufacturing and renewable energy sectors.

The Asia-Pacific region is experiencing the fastest growth, propelled by expanding electronics manufacturing, telecommunications, and healthcare infrastructure. China, Japan, and South Korea are major contributors, with government-backed initiatives to boost domestic laser technology capabilities. Leading regional manufacturers like Hamamatsu Photonics K.K. and Panasonic Corporation are investing in next-generation solid-state laser diodes for applications ranging from consumer electronics to industrial processing. The region’s cost-competitive manufacturing environment and rapid adoption of automation further accelerate market expansion.

The Rest of the World, including Latin America, the Middle East, and Africa, is gradually increasing its adoption of solid-state laser diode systems. Growth in these regions is primarily driven by investments in telecommunications infrastructure, medical diagnostics, and emerging industrial sectors. While the market share remains smaller compared to other regions, increasing partnerships with global technology providers and local capacity-building initiatives are expected to enhance market penetration in the coming years.

Overall, regional dynamics in 2025 reflect a combination of established industrial bases, government support, and emerging market opportunities, positioning solid-state laser diode systems as a critical technology across diverse sectors worldwide.

Supply Chain & Manufacturing Trends

The supply chain and manufacturing landscape for solid-state laser diode systems is undergoing significant transformation in 2025, driven by technological advancements, evolving end-user demands, and global economic shifts. One of the most notable trends is the increasing integration of automation and digitalization in manufacturing processes. Leading manufacturers are leveraging smart factories and Industry 4.0 principles to enhance production efficiency, reduce defects, and enable real-time monitoring of critical parameters. This shift is particularly evident among major players such as Coherent Corp. and TRUMPF Group, who have invested heavily in automated assembly lines and advanced quality control systems for their laser diode modules.

Another key trend is the diversification and localization of supply chains. The global semiconductor shortage and geopolitical uncertainties have prompted companies to reassess their sourcing strategies. Many are now prioritizing multi-sourcing and establishing regional manufacturing hubs to mitigate risks associated with single-source dependencies and international logistics disruptions. For instance, Hamamatsu Photonics K.K. has expanded its production facilities in Asia and Europe, aiming to ensure a more resilient and responsive supply chain for its solid-state laser components.

Sustainability is also becoming a central focus in the manufacturing of solid-state laser diode systems. Companies are adopting eco-friendly materials, energy-efficient production techniques, and circular economy principles to minimize environmental impact. OSRAM Opto Semiconductors GmbH has implemented green manufacturing initiatives, including the use of renewable energy and recycling of semiconductor materials, aligning with broader industry goals for carbon neutrality.

Furthermore, the demand for customization and rapid prototyping is influencing supply chain strategies. Manufacturers are increasingly offering modular designs and flexible production capabilities to cater to specialized applications in medical, industrial, and communications sectors. This trend is supported by advancements in additive manufacturing and precision engineering, enabling faster turnaround times and lower costs for bespoke laser diode systems.

Overall, the supply chain and manufacturing trends in 2025 reflect a dynamic environment where resilience, sustainability, and technological innovation are paramount. Companies that successfully adapt to these trends are better positioned to meet the growing and diversifying needs of the global solid-state laser diode system market.

Regulatory Environment & Standards

The regulatory environment for solid-state laser diode systems in 2025 is shaped by a combination of international safety standards, national regulations, and industry-specific guidelines. These systems, widely used in telecommunications, medical devices, manufacturing, and defense, are subject to rigorous oversight to ensure both user safety and product reliability.

Globally, the International Electrotechnical Commission (IEC) sets the foundational safety standards for laser products, notably through IEC 60825-1, which classifies lasers based on their potential hazards and prescribes labeling, safety features, and user information requirements. Compliance with IEC standards is often a prerequisite for market access in many regions.

In the United States, the U.S. Food and Drug Administration (FDA) regulates laser products under the Center for Devices and Radiological Health (CDRH). The FDA’s 21 CFR 1040.10 and 1040.11 regulations mandate performance standards, reporting, and product registration for manufacturers of solid-state laser diode systems. The Occupational Safety and Health Administration (OSHA) also provides workplace safety guidelines for laser use, referencing the American National Standards Institute (ANSI) Z136 series for safe laser operation.

In the European Union, the European Commission enforces the Low Voltage Directive (LVD) and the Machinery Directive, both of which apply to laser diode systems. Products must bear the CE mark, demonstrating conformity with essential health and safety requirements. The harmonized EN 60825-1 standard, aligned with the IEC, is commonly used for compliance.

Industry-specific standards further refine requirements. For example, the IEC and International Organization for Standardization (ISO) have developed standards for medical laser equipment (IEC 60601-2-22) and fiber optic communication systems (IEC 60825-2). Defense applications may require additional certifications, such as those from the National Institute of Standards and Technology (NIST) or military-specific standards.

Manufacturers must stay abreast of evolving regulations, as authorities periodically update standards to address technological advances and emerging risks. Active engagement with regulatory bodies and industry associations is essential for compliance and market access in 2025 and beyond.

Investment, M&A, and Funding Trends

The investment landscape for solid-state laser diode systems in 2025 is characterized by robust activity, driven by the expanding applications of these systems in sectors such as telecommunications, medical devices, industrial manufacturing, and defense. Venture capital and private equity firms are increasingly targeting companies that demonstrate innovation in high-power, energy-efficient laser diode technologies, particularly those enabling next-generation fiber-optic communications and advanced manufacturing processes.

Mergers and acquisitions (M&A) are also shaping the competitive dynamics of the industry. Leading photonics and electronics companies are acquiring smaller firms with specialized expertise in solid-state laser diode integration, packaging, and system-level solutions. For example, Hamamatsu Photonics K.K. and Coherent Corp. have both pursued strategic acquisitions to expand their portfolios and strengthen their positions in high-growth markets such as medical imaging and semiconductor manufacturing.

Funding trends indicate a shift toward supporting startups and scale-ups focused on miniaturization, reliability, and wavelength versatility. Government grants and public-private partnerships, especially in the US, Europe, and East Asia, are fostering R&D in solid-state laser diode systems for quantum technologies and autonomous vehicles. Organizations like ams OSRAM and TRUMPF Group are actively investing in collaborative research initiatives to accelerate innovation and commercialization.

Additionally, the rise of Industry 4.0 and the demand for precision manufacturing are prompting established players to increase capital expenditures on production capacity and automation. This is evident in the expansion projects announced by Nichia Corporation and Lumentum Holdings Inc., both of which are scaling up to meet the growing global demand for high-performance laser diode systems.

Overall, the 2025 investment and M&A environment for solid-state laser diode systems is marked by strategic consolidation, increased funding for innovation, and a focus on enabling technologies for emerging applications. These trends are expected to continue as the market matures and new use cases drive further growth and competition.

Challenges & Barriers to Adoption

The adoption of solid-state laser diode systems, while promising for a range of industrial, medical, and scientific applications, faces several significant challenges and barriers as of 2025. One of the primary obstacles is the high initial cost associated with the development and integration of these systems. The manufacturing processes for high-quality solid-state laser diodes require advanced materials and precision engineering, which can drive up costs and limit accessibility for smaller enterprises or research institutions.

Thermal management remains another critical challenge. Solid-state laser diodes generate substantial heat during operation, and inadequate heat dissipation can lead to reduced performance, shorter device lifespans, and even catastrophic failure. Developing efficient, compact, and cost-effective cooling solutions is essential for reliable long-term operation, especially in high-power or continuous-use scenarios.

Reliability and longevity are also concerns, particularly in demanding environments. Factors such as optical degradation, facet damage, and packaging failures can compromise system performance over time. Ensuring robust packaging and protection against environmental factors like humidity, dust, and vibration is crucial for widespread adoption in fields such as telecommunications and manufacturing.

Another barrier is the complexity of system integration. Solid-state laser diode systems often require precise alignment, sophisticated control electronics, and compatibility with existing optical infrastructure. This complexity can increase installation and maintenance costs, as well as the need for specialized technical expertise, which may not be readily available in all markets.

Regulatory and safety considerations also play a role. Laser systems, especially those operating at higher powers, are subject to stringent safety standards and regulations to prevent accidental exposure and ensure safe operation. Compliance with these standards, as set by organizations such as the Occupational Safety and Health Administration and the U.S. Food and Drug Administration, can add complexity and cost to product development and deployment.

Finally, market awareness and education remain barriers. Potential users may lack understanding of the advantages and limitations of solid-state laser diode systems compared to traditional laser technologies. Overcoming these knowledge gaps through targeted outreach and training will be essential for broader adoption across industries.

Future Outlook: Disruptive Innovations and Strategic Recommendations

The future of solid-state laser diode systems is poised for significant transformation, driven by disruptive innovations and evolving market demands. As industries such as telecommunications, medical devices, manufacturing, and defense increasingly rely on high-performance photonics, solid-state laser diodes are expected to play a pivotal role in next-generation applications. Key technological advancements include the integration of novel semiconductor materials, such as gallium nitride (GaN) and indium phosphide (InP), which promise higher efficiency, greater wavelength versatility, and improved thermal management. These materials are being actively developed by industry leaders like OSRAM GmbH and Coherent Corp., who are investing in research to push the boundaries of power output and miniaturization.

Another disruptive trend is the convergence of solid-state laser diodes with photonic integrated circuits (PICs), enabling compact, energy-efficient solutions for data centers and quantum computing. Companies such as Intel Corporation are pioneering this integration, which is expected to reduce costs and enhance scalability for mass-market adoption. Additionally, the emergence of advanced packaging techniques, including wafer-level and chip-scale packaging, is set to improve reliability and reduce manufacturing complexity.

From a strategic perspective, stakeholders should prioritize investment in R&D partnerships with academic institutions and cross-industry collaborations to accelerate innovation cycles. Embracing open standards and interoperability, as advocated by organizations like the Laser Institute of America, will be crucial for fostering a robust ecosystem and ensuring compatibility across diverse applications. Furthermore, companies should monitor regulatory developments and sustainability requirements, as environmental considerations are increasingly influencing procurement decisions in sectors such as automotive and consumer electronics.

In summary, the outlook for solid-state laser diode systems in 2025 and beyond is characterized by rapid technological evolution and expanding application domains. Strategic recommendations for industry players include: investing in next-generation materials and integration technologies, forming collaborative innovation networks, and aligning product development with emerging regulatory and sustainability trends. By adopting these approaches, companies can position themselves at the forefront of a market that is set to redefine the landscape of photonics and optoelectronics.

Sources & References

- Coherent Corp.

- TRUMPF Group

- Alcon Inc.

- Lumenis Ltd.

- New Energy and Industrial Technology Development Organization (NEDO)

- Hamamatsu Photonics K.K.

- OSRAM GmbH

- BIOLASE, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- IPG Photonics Corporation

- Lumentum Holdings Inc.

- European Commission

- International Organization for Standardization (ISO)

- National Institute of Standards and Technology (NIST)

- Nichia Corporation