2025 Submillimeter Astronomy Instrumentation Market Report: In-Depth Analysis of Growth Drivers, Technology Advances, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights for the Next 5 Years.

- Executive Summary and Market Overview

- Key Technology Trends in Submillimeter Astronomy Instrumentation

- Competitive Landscape and Leading Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Market Entry Barriers

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary and Market Overview

Submillimeter astronomy instrumentation refers to the specialized tools and devices designed to observe electromagnetic radiation in the submillimeter wavelength range (approximately 0.1 to 1 millimeter). This segment of the electromagnetic spectrum is crucial for studying cold cosmic phenomena such as molecular clouds, star formation regions, and the cosmic microwave background. The global market for submillimeter astronomy instrumentation is poised for steady growth in 2025, driven by increasing investments in astronomical research, technological advancements, and the expansion of international collaborations.

In 2025, the market is characterized by a robust pipeline of projects and upgrades to existing observatories. Major facilities such as the Atacama Large Millimeter/submillimeter Array (ALMA) and the James Clerk Maxwell Telescope (JCMT) continue to drive demand for advanced receivers, spectrometers, and cryogenic systems. The integration of cutting-edge technologies, including superconducting detectors and digital backends, is enhancing sensitivity and data acquisition rates, further expanding the scientific capabilities of these instruments.

Market growth is also fueled by the increasing participation of emerging economies in large-scale astronomy projects. Countries such as China and India are investing in new submillimeter observatories and contributing to international consortia, thereby broadening the customer base for instrumentation suppliers. Additionally, the proliferation of space-based missions, exemplified by the Herschel Space Observatory and upcoming projects from agencies like NASA and the European Space Agency (ESA), is creating new opportunities for manufacturers specializing in compact, high-reliability submillimeter instruments.

- Key Market Drivers: Rising global research funding, technological innovation, and the need for high-resolution cosmic imaging.

- Challenges: High development costs, technical complexity, and the need for ultra-low temperature operation.

- Competitive Landscape: The market is dominated by a mix of specialized instrumentation firms, research institutions, and collaborative consortia, with notable players including National Radio Astronomy Observatory (NRAO) and Science and Technology Facilities Council (STFC).

Looking ahead, the submillimeter astronomy instrumentation market in 2025 is expected to benefit from sustained public and private sector investment, ongoing technological progress, and the growing importance of multi-wavelength astronomical research. These factors collectively position the sector for continued innovation and expansion.

Key Technology Trends in Submillimeter Astronomy Instrumentation

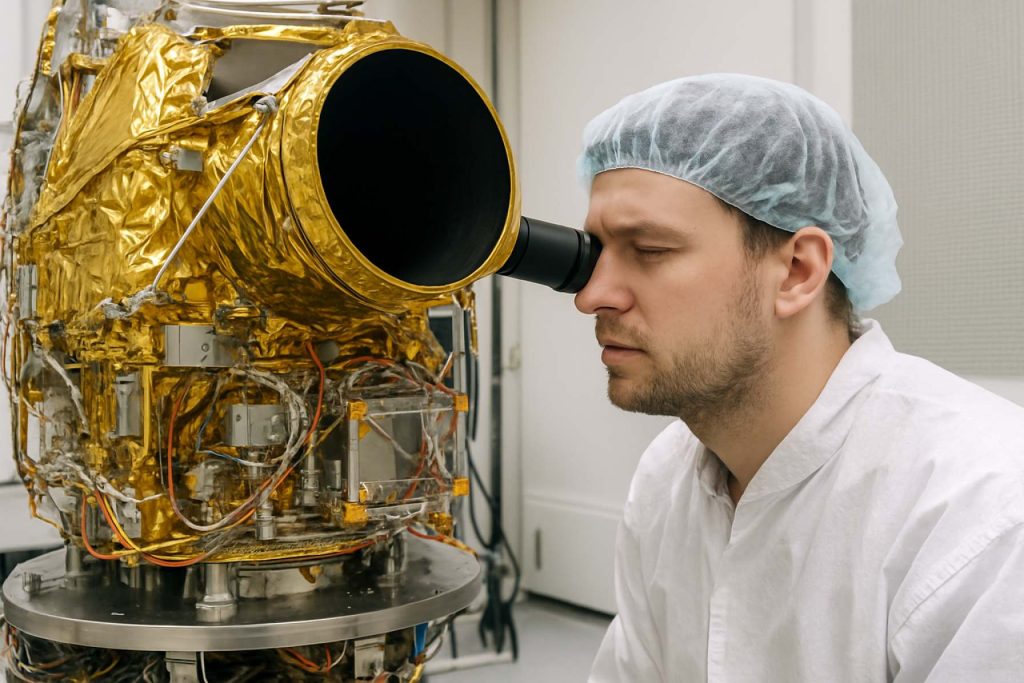

Submillimeter astronomy instrumentation is experiencing rapid technological evolution, driven by the need for higher sensitivity, broader spectral coverage, and improved imaging capabilities. As of 2025, several key technology trends are shaping the landscape of submillimeter astronomy, enabling deeper exploration of the cold universe, including star formation regions, molecular clouds, and the cosmic microwave background.

- Advanced Detector Arrays: The transition from single-pixel detectors to large-format, highly sensitive arrays is a defining trend. Superconducting detectors, such as Transition Edge Sensors (TES) and Kinetic Inductance Detectors (KIDs), are now widely adopted for their low noise and multiplexing capabilities. These arrays, implemented in instruments like those at the European Southern Observatory and the National Radio Astronomy Observatory, allow for faster sky surveys and higher spatial resolution.

- Integrated Photonic Technologies: Photonic circuits are being developed to miniaturize and integrate complex spectrometers and signal processing units. This trend reduces instrument size and power consumption, which is particularly advantageous for space-based and balloon-borne observatories. The Jet Propulsion Laboratory has demonstrated on-chip spectrometers that promise scalable, robust solutions for future missions.

- Improved Cryogenic Systems: Achieving and maintaining sub-Kelvin temperatures is critical for optimal detector performance. Recent advances in closed-cycle cryocoolers and dilution refrigerators, as reported by Cryomech and Bluefors, are enabling longer, more reliable operations with reduced maintenance, supporting both ground-based and space observatories.

- Digital Backends and Real-Time Data Processing: The adoption of high-speed, field-programmable gate array (FPGA)-based digital backends allows for real-time data reduction, flexible signal processing, and adaptive calibration. Facilities like the Atacama Pathfinder Experiment are leveraging these systems to handle the increasing data rates from large detector arrays.

- Adaptive Optics and Active Surface Control: To counteract atmospheric and instrumental distortions, adaptive optics and active surface technologies are being integrated into submillimeter telescopes. The Institut de Radioastronomie Millimétrique has pioneered these systems, resulting in sharper images and improved sensitivity.

These technology trends are collectively enhancing the scientific reach of submillimeter astronomy, enabling discoveries that were previously unattainable and setting the stage for the next generation of observatories and space missions.

Competitive Landscape and Leading Players

The competitive landscape of the submillimeter astronomy instrumentation market in 2025 is characterized by a concentrated group of specialized players, primarily consisting of advanced research institutions, government agencies, and a select number of high-technology companies. The market is driven by the demand for highly sensitive detectors, advanced spectrometers, and large-format bolometer arrays, which are essential for observing cold cosmic phenomena such as star formation, molecular clouds, and the cosmic microwave background.

Key players in this sector include European Space Agency (ESA), which leads several flagship projects such as the Herschel Space Observatory and is actively involved in the development of next-generation submillimeter instruments. The National Aeronautics and Space Administration (NASA) remains a dominant force, with ongoing investments in airborne platforms like SOFIA and future missions targeting the far-infrared and submillimeter spectrum. In Asia, the National Astronomical Observatory of Japan (NAOJ) is a major contributor, particularly through its role in the Atacama Large Millimeter/submillimeter Array (ALMA), which is jointly operated with the European Southern Observatory (ESO) and the National Radio Astronomy Observatory (NRAO).

- ESO and NRAO are at the forefront of ground-based submillimeter instrumentation, with ALMA setting the benchmark for sensitivity and resolution in the field.

- Private sector involvement is limited but growing, with companies like Thales Group and Northrop Grumman providing critical components such as cryogenic systems, mixers, and local oscillators for both spaceborne and terrestrial observatories.

- Emerging players include university-based consortia and startups focusing on superconducting detector technologies and scalable readout electronics, aiming to reduce costs and improve performance for future large-scale surveys.

Strategic collaborations and public-private partnerships are increasingly common, as the complexity and cost of submillimeter instrumentation rise. The competitive edge is often determined by technological innovation, reliability, and the ability to deliver custom solutions for specific scientific missions. As of 2025, the market remains niche but is poised for growth, driven by new scientific objectives and the expansion of international observatory networks.

Market Growth Forecasts and Revenue Projections (2025–2030)

The submillimeter astronomy instrumentation market is poised for robust growth between 2025 and 2030, driven by increasing investments in astronomical research, technological advancements, and expanding international collaborations. According to projections by MarketsandMarkets, the global market for astronomical instrumentation—including submillimeter devices—is expected to grow at a CAGR exceeding 7% during this period, with submillimeter-specific segments outpacing the broader category due to heightened demand for high-resolution cosmic observations.

Revenue for submillimeter astronomy instrumentation is forecasted to reach approximately USD 1.2 billion by 2030, up from an estimated USD 750 million in 2025. This growth is underpinned by several key factors:

- Large-Scale Observatory Projects: Major investments in facilities such as the Atacama Large Millimeter/submillimeter Array (ALMA) and the planned upgrades to the James Clerk Maxwell Telescope (JCMT) are expected to drive procurement of advanced receivers, spectrometers, and detector arrays. The National Radio Astronomy Observatory and European Southern Observatory have both announced multi-year funding plans for instrumentation upgrades through 2030.

- Technological Innovation: The adoption of superconducting detectors, cryogenic systems, and digital backends is accelerating, enabling higher sensitivity and broader bandwidths. Companies such as Thales Group and Northrop Grumman are leading suppliers of these advanced components, with R&D investments expected to increase by 10–15% annually through 2030.

- Government and Academic Funding: National science agencies, including the National Science Foundation and UK Research and Innovation, are expanding grant programs for submillimeter instrumentation, particularly for projects related to cosmic microwave background (CMB) studies and star formation research.

- Emerging Markets: Asia-Pacific countries, notably China and Japan, are ramping up investments in submillimeter observatories, contributing to a projected regional CAGR of over 9% from 2025 to 2030, according to Frost & Sullivan.

Overall, the period from 2025 to 2030 is expected to see sustained revenue growth and market expansion for submillimeter astronomy instrumentation, with innovation and international collaboration serving as primary catalysts.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for submillimeter astronomy instrumentation in 2025 is shaped by varying levels of investment, infrastructure, and scientific collaboration across North America, Europe, Asia-Pacific, and the Rest of the World. Each region demonstrates unique strengths and challenges in advancing submillimeter observational capabilities.

- North America: The United States and Canada remain at the forefront, driven by robust funding from agencies such as NASA and the National Science Foundation. Facilities like the Submillimeter Array (SMA) in Hawaii and participation in the Atacama Large Millimeter/submillimeter Array (ALMA) underscore the region’s leadership. The focus is on upgrading receiver sensitivity, expanding bandwidth, and developing next-generation spectrometers. North America also benefits from strong university-industry partnerships, fostering innovation in detector and cryogenic technologies.

- Europe: European countries, led by the European Space Agency (ESA) and national research councils, invest heavily in both ground-based and spaceborne submillimeter instrumentation. The Atacama Pathfinder Experiment (APEX) and the Herschel Space Observatory (legacy) have established Europe as a key player. Current efforts focus on collaborative projects, such as the Joint Institute for VLBI ERIC (JIVE), and the development of advanced bolometer arrays and heterodyne receivers. The region’s regulatory environment and funding mechanisms support long-term, multinational projects.

- Asia-Pacific: The Asia-Pacific region, particularly Japan, China, and South Korea, is rapidly expanding its submillimeter astronomy capabilities. Japan’s National Astronomical Observatory is a major ALMA partner and operates the Nobeyama Radio Observatory. China is investing in new facilities and indigenous instrumentation, exemplified by the National Space Science Center’s initiatives. Regional priorities include developing large-format detector arrays and enhancing data processing infrastructure to support growing observational demands.

- Rest of World: While contributions from Latin America, Africa, and the Middle East are more limited, strategic partnerships are emerging. Chile’s role as host to ALMA and APEX is critical, providing geographic advantages for high-altitude observatories. Efforts in South Africa and Australia focus on leveraging existing radio astronomy infrastructure for submillimeter applications, often in collaboration with international consortia.

Overall, the global submillimeter astronomy instrumentation market in 2025 is characterized by regional specialization, cross-border collaboration, and a shared emphasis on technological advancement to enable deeper cosmic exploration.

Challenges, Risks, and Market Entry Barriers

The submillimeter astronomy instrumentation market in 2025 faces a complex landscape of challenges, risks, and entry barriers that shape its competitive dynamics and innovation trajectory. One of the primary challenges is the high cost and technical complexity associated with developing and manufacturing submillimeter detectors, receivers, and associated cryogenic systems. These instruments require advanced materials, precision engineering, and often custom fabrication, leading to significant capital expenditure and long development cycles. As a result, only a handful of specialized firms and research institutions possess the necessary expertise and infrastructure, creating a high barrier to entry for new market participants.

Another significant risk is the dependency on government and institutional funding. The majority of submillimeter astronomy projects are driven by large-scale observatories and space agencies, such as the European Southern Observatory and NASA, which allocate budgets based on shifting scientific priorities and political considerations. Fluctuations in funding can delay or cancel projects, impacting the demand for new instrumentation and creating uncertainty for suppliers. Additionally, the long lead times for project approval and instrument deployment—often spanning several years—expose manufacturers to financial and operational risks.

- Technological Obsolescence: Rapid advancements in detector sensitivity, data processing, and cooling technologies mean that existing products can quickly become outdated. Companies must invest heavily in R&D to remain competitive, which can be prohibitive for smaller entrants.

- Regulatory and Export Controls: Submillimeter instrumentation often incorporates components subject to export restrictions, particularly in the U.S. and Europe. Compliance with regulations such as ITAR and EAR can complicate international sales and collaborations (U.S. Bureau of Industry and Security).

- Supply Chain Vulnerabilities: The market relies on a limited number of suppliers for critical components like superconducting materials and ultra-low-noise amplifiers. Disruptions in the supply chain, as seen during the COVID-19 pandemic, can delay production and increase costs (McKinsey & Company).

- Skilled Workforce Shortage: There is a global shortage of engineers and scientists with expertise in submillimeter technology, further constraining the pace of innovation and market expansion (National Science Foundation).

Collectively, these factors create a high-risk, high-investment environment that favors established players and collaborative consortia, while posing significant hurdles for new entrants seeking to penetrate the submillimeter astronomy instrumentation market in 2025.

Opportunities and Strategic Recommendations

The submillimeter astronomy instrumentation market in 2025 presents a range of opportunities driven by technological advancements, expanding scientific objectives, and increased international collaboration. As the demand for higher sensitivity and resolution in astronomical observations grows, there is a significant opportunity for manufacturers and research institutions to develop next-generation detectors, spectrometers, and cryogenic systems. The integration of superconducting technologies, such as Transition Edge Sensors (TES) and Kinetic Inductance Detectors (KID), is expected to enhance instrument performance, opening new avenues for both ground-based and space-borne observatories.

Strategically, stakeholders should focus on partnerships with leading research organizations and observatories, such as the European Southern Observatory and the National Radio Astronomy Observatory, to co-develop and test innovative instrumentation. The upcoming deployment of facilities like the Origins Space Telescope and upgrades to the Atacama Large Millimeter/submillimeter Array (ALMA) are expected to drive procurement of advanced submillimeter components, creating a robust market for specialized suppliers.

Emerging markets in Asia, particularly China and Japan, are increasing investments in submillimeter astronomy, as evidenced by projects like the National Astronomical Observatories of China and the National Astronomical Observatory of Japan. Companies should consider establishing local partnerships or joint ventures to access these rapidly growing markets and to participate in government-funded initiatives.

Another strategic recommendation is to invest in modular, scalable instrumentation platforms that can be adapted for multiple observatories and scientific missions. This approach reduces development costs and shortens time-to-market, while also appealing to a broader customer base. Additionally, leveraging artificial intelligence and machine learning for instrument calibration and data analysis can provide a competitive edge, as observatories seek to maximize the scientific return from increasingly complex datasets.

- Collaborate with leading observatories for co-development and early adoption.

- Target emerging Asian markets through local partnerships.

- Invest in modular, upgradable instrumentation platforms.

- Integrate AI-driven solutions for data processing and instrument optimization.

In summary, the 2025 landscape for submillimeter astronomy instrumentation is shaped by technological innovation, international collaboration, and the expansion of scientific frontiers. Companies that align their strategies with these trends are well-positioned to capture new market opportunities and drive the next wave of astronomical discovery.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the future of submillimeter astronomy instrumentation is shaped by both technological innovation and strategic investment, with several emerging applications and geographic hotspots poised to drive market growth. The submillimeter wavelength range (roughly 0.1–1 mm) is critical for probing cold cosmic phenomena, such as star formation, molecular clouds, and the cosmic microwave background. As demand for higher sensitivity and resolution grows, next-generation instruments are being developed to address these scientific frontiers.

Emerging applications are increasingly interdisciplinary. For instance, the integration of submillimeter detectors with machine learning algorithms is enabling real-time data analysis and anomaly detection, which is crucial for large-scale sky surveys. Additionally, the synergy between submillimeter astronomy and planetary science is expanding, with instruments now being designed to study planetary atmospheres and surface compositions in our solar system and beyond. The development of compact, cryogenically cooled receiver arrays is also facilitating the deployment of submillimeter instruments on small satellites and high-altitude balloon missions, broadening access to this wavelength regime.

Investment hotspots are shifting in response to both governmental priorities and private sector interest. East Asia, particularly China and Japan, is ramping up funding for submillimeter observatories and instrumentation, exemplified by projects like the National Astronomical Observatory of Japan’s upgrades to the Atacama Submillimeter Telescope Experiment (ASTE) and China’s plans for new submillimeter facilities. In Europe, the European Southern Observatory continues to invest in advanced receivers for the Atacama Large Millimeter/submillimeter Array (ALMA), while the European Space Agency is supporting next-generation space-based submillimeter missions. In North America, the National Science Foundation and NASA are prioritizing submillimeter instrumentation in their decadal surveys, with funding directed toward both ground-based and orbital platforms.

- Key emerging applications: real-time sky surveys, planetary science, and compact satellite payloads.

- Investment hotspots: East Asia (China, Japan), Europe (ESO, ESA), and North America (NSF, NASA).

- Technological focus: cryogenic detectors, large-format arrays, and AI-driven data processing.

Overall, 2025 is expected to see accelerated growth in submillimeter astronomy instrumentation, driven by both scientific demand and strategic investments, with a strong emphasis on international collaboration and cross-disciplinary innovation.

Sources & References

- Atacama Large Millimeter/submillimeter Array (ALMA)

- Herschel Space Observatory

- NASA

- National Radio Astronomy Observatory (NRAO)

- Cryomech

- Bluefors

- Institut de Radioastronomie Millimétrique

- National Astronomical Observatory of Japan (NAOJ)

- Thales Group

- Northrop Grumman

- MarketsandMarkets

- National Science Foundation

- Frost & Sullivan

- Submillimeter Array (SMA)

- Atacama Large Millimeter/submillimeter Array (ALMA)

- Joint Institute for VLBI ERIC (JIVE)

- Nobeyama Radio Observatory

- U.S. Bureau of Industry and Security

- McKinsey & Company

- Origins Space Telescope

- National Astronomical Observatories of China