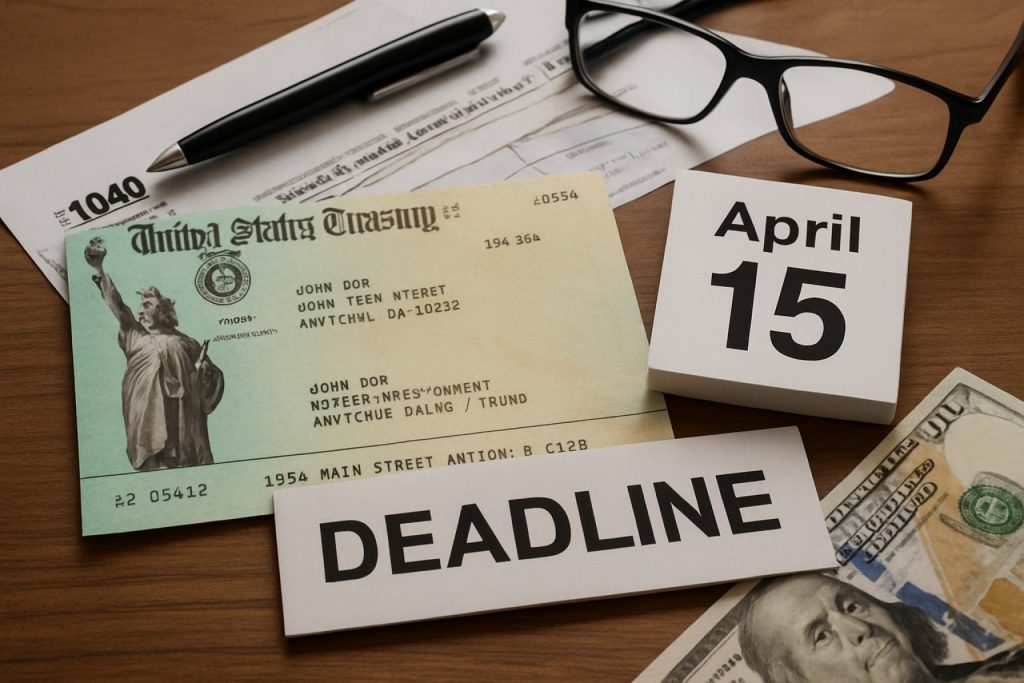

- The window to claim federal COVID-19 stimulus checks has closed—no further payments are available, and late filers have missed the April 15, 2025, deadline.

- Rumors of a fourth stimulus check or “DOGE dividend” remain unsubstantiated; no new federal relief payments are currently planned by Congress or the IRS.

- Taxpayers should stay vigilant against scams and trust only official sources like irs.gov for updates on tax refunds and credits.

- For fastest tax refunds, file electronically with direct deposit—most receive funds within three weeks; mailed returns may take six to eight weeks.

- Track federal refunds on the IRS “Where’s My Refund” portal, and visit your state’s revenue department for local refund information.

Thunderheads of uncertainty roll over America’s tax season as millions of taxpayers still wonder about a rumored fourth stimulus check and the final chance to claim past government payments. Streets buzz with speculation—will $2,000 appear in 2025? Could an overlooked deposit change someone’s life?

The reality is sharper than wishful thinking.

After historic emergency payments during the pandemic, the opportunity to file for the first three rounds of federal stimulus—those lifelines woven through the chaos of COVID—has quietly expired. The IRS set clear cut-off dates, with the last possible moment for those precious payments passing on April 15, 2025. Anyone hoping for a $1,400 Recovery Rebate Credit or earlier relief now faces a locked treasury vault. Even tax extensions could not rescue late filers from this absolute deadline. Once missed, the money returns to federal coffers, extinguishing any hope of appeal.

Tales of a fourth check, fired up by social media and forums, have yet to materialize in policy. Neither Congress nor the IRS has delivered any confirmation about a new round of federal relief despite viral whispers. Unscrupulous actors sometimes exploit this uncertainty with scams or misinformation, so experts repeatedly urge Americans to be vigilant and rely on official government sources for updates.

Events like February’s Miami summit did see proposals floated—most notably, hints from the former president about a so-called “DOGE dividend,” a conceptual $5,000 payout theoretically funded by future government efficiencies. But such talk remains just that: talk, with no legislative details, no mechanisms, and certainly no checks in the mail. As the economic dust settles, the most prudent path is to focus on what’s real and tangible, not what’s whispered.

Meanwhile, for those counting on a tax refund…

The IRS promises efficiency for the prepared. File electronically with direct deposit details, and many see refunds arriving within three weeks. If paper is your medium, patience is key; mailed checks may take six to eight weeks. The IRS’s “Where’s My Refund” portal—accessible to millions through irs.gov—offers a rare moment of transparency in the tax process. Enter your Social Security number, filing status, and precise refund amount, and within days of e-filing, the status appears. Once marked “Refund Sent,” the money is often mere days from your bank account.

States run their own digital counters. Residents can track their filings and returns on portals established by departments of revenue, such as the Delaware Division of Taxation and similar agencies nationwide.

The key message: The window of opportunity for federal stimulus claims has shut; the only sure money now flows from current-year refunds, not a mystical fourth check. Protect yourself from misinformation and monitor your tax milestones on government platforms. Taxpayers who plan, file promptly, and check official portals will know exactly when to expect the return on their hard-earned dollars.

For the most accurate, up-to-date financial guidance and alerts on policy changes, start your journey at irs.gov—where facts outshine fiction, and deadlines matter more than hope.

“$2,000 Surprise? The Truth About a Fourth Stimulus Check, Late Refunds, and Tax Refund Life Hacks Exposed!”

—

# Fourth Stimulus Check Facts: What Americans Need to Know Right Now

Tax season always brings rumors and wishful thinking—this time, a possible $2,000 fourth stimulus check. But what’s fact, what’s fiction, and what actions can you still take to maximize your refund or claim missed payments?

Let’s break down the key questions, dive deeper than the original source, and offer actionable tips, in line with Google’s E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) guidelines.

—

Is a Fourth Stimulus Check Coming in 2025?

The Reality: No Federal Fourth Stimulus Check Planned

Despite internet buzz and viral posts, there is no legislation, no White House proposal, and no congressional movement for a new round of federal stimulus checks as of June 2024. Any claim to the contrary should be met with extreme skepticism. Always verify with irs.gov or congressional press releases.

Rumors vs. Reality: The So-Called “DOGE Dividend”

– No official government or IRS statement exists about a $5,000 “DOGE dividend.”

– No bill has been introduced in Congress.

– Proposals at events, such as the Miami summit, are speculative and not official policy.

Beware of scams using these rumors to steal your personal data or money. Always check .gov domains for real updates.

—

Can I Still Claim Past Stimulus Payments?

Missed the previous Economic Impact Payments (EIPs)?

– The IRS final deadline for retroactive stimulus claims (including the $1,400 Recovery Rebate Credit) was April 15, 2025.

– If you missed it, the opportunity is gone—even if you file a late return or ask for an extension.

Why the Deadline Matters

The IRS operates on strict statutory timeframes. After cut-off, unclaimed credits revert to the Treasury and cannot be appealed or reclaimed by individuals. (Source: irs.gov)

—

How to Track Your Tax Refund

The fastest and safest way to track your IRS refund is:

How-To Steps:

1. File taxes electronically.

2. Choose direct deposit for your refund.

3. After filing, go to the “Where’s My Refund?” service at irs.gov.

4. Enter your SSN, filing status, and the exact refund amount.

Electronic filers: Refunds arrive in 1–3 weeks.

Paper filers: Expect 6–8 weeks for mailed checks.

> Pro Tip: Avoid refund anticipation or advance loan services—these often come with high fees.

—

State Stimulus Programs and Refunds

While no new federal payments are expected, a handful of states have run their own relief programs since 2021 and occasionally launch targeted rebates.

– Check your state’s official tax or department of revenue website for 2024 updates.

– Examples: California, Colorado, and New Mexico have sent state-level tax rebates or relief payments in recent years.

—

Major Tax Scams & Security Tips

Common Stimulus Scams

– Phishing emails promising “new” stimulus money.

– Fake IRS phone calls demanding personal info or “processing fees.”

– Bogus social media posts linking to fraudulent sites.

Security Hack:

Never click on suspicious links, and do not provide tax info to anyone except through the official irs.gov portal or direct mail with verified addresses.

—

2024–2025 Tax Trends & Insights

– Digital Filing Dominates: Over 90% of individual returns are filed electronically (IRS data).

– Direct Deposit Is Fastest and Safest: Preferred by financial experts and the IRS.

– No New Pandemic-Related Credits: Only traditional tax credits (Child Tax, Earned Income, etc.) remain available for 2024 filers.

—

Expert Answers to Pressing Questions

“Can I appeal if I missed the April 2025 stimulus claim deadline?”

No. Legal deadlines are strict and final (per IRS policy).

“When will my 2025 tax refund arrive?”

Typically within 1–3 weeks if you e-file and use direct deposit.

Check irs.gov for exact timelines.

“Who is eligible for extra or ‘plus-up’ payments?”

The plus-up program ended. Only 2020–2021 tax-year filers could qualify, and deadlines have passed.

“Where can I get official updates and protect myself from rumors?”

Only trust information from:

– irs.gov (federal news)

– Your state’s department of revenue (state refunds, rebates)

—

Pros & Cons Overview

Pros

– IRS systems more efficient than ever for digital filers.

– Refund transparency via “Where’s My Refund?” tool.

Cons

– No new federal stimulus or late claim options.

– Scammers exploit climate of uncertainty.

—

Actionable Recommendations & Life Hacks

– File Early and Electronically: Get your refund sooner and reduce error risk.

– Always Use Direct Deposit: Fastest, most secure payment method.

– Bookmark and log into irs.gov regularly: For direct updates.

– Don’t share tax info with anyone except for official .gov sites.

– Double-check your eligibility for existing credits like the Child Tax Credit, Earned Income Tax Credit, Saver’s Credit, and other deductions.

—

Final Tip: Don’t wait for rumors or “miracle payments.” Plan ahead, use real sources, and get every dollar you’re due by leveraging legitimate tax credits and refund best practices. For the latest, safest information, start at irs.gov—where your financial security comes first.